Zaner Daily Precious Metals Commentary

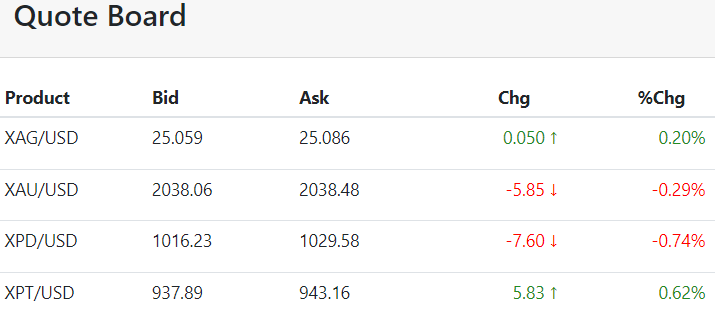

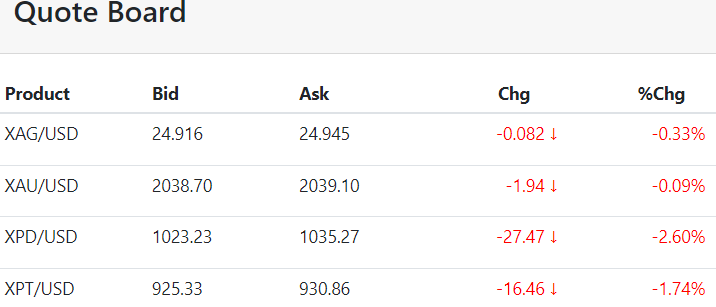

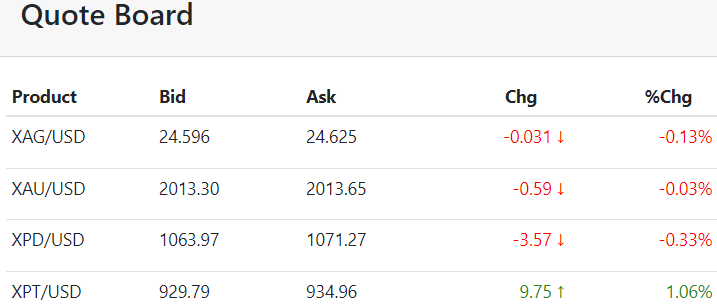

Thursday, November 30, 2023As goes the dollar, so goes gold in the opposite direction! In fact, with yesterday's dollar reversal and today's upside $ extension gold is facing a critical junction and perhaps a failure of key support following today's early US scheduled data.

However, the jury is out on the impact of today's PCE and initial claims readings, with soft PCE and higher initial claims data still capable of resurrecting the bull case in gold and silver.

Therefore, further evidence of a US Fed pivot early next year to lower rates has been heavily factored with the November low-to-high rally of $127 and it now needs fresh bullish fuel...[MORE]

Please subscribe to receive the full report via email by clicking here.