Zaner Daily Precious Metals Commentary

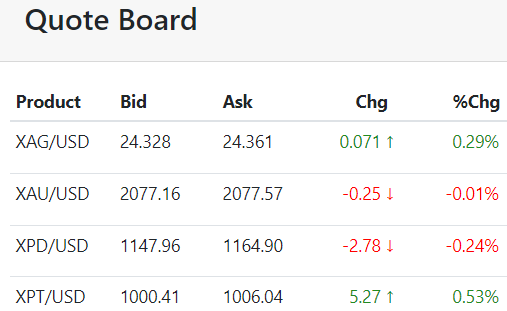

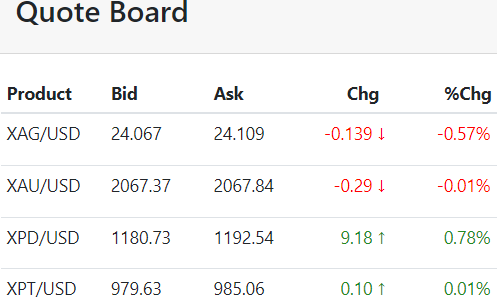

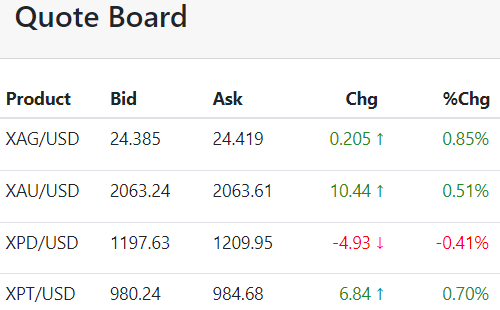

Thursday, December 28, 2023The early corrective action in gold and silver this morning is very surprising, especially with the dollar breaking out and posting the lowest trade since the second half of July.

Certainly, a slight uptick in implied treasury yields suggests the rate-cut mentality is at least temporarily overplayed.

On the other hand, today's US initial and ongoing claims data will likely revive the rate cut watch with the probability of Fed easing rising incrementally with each soft US data point...[MORE]

Please subscribe to receive the full report via email by clicking here.