Zaner Daily Precious Metals Commentary

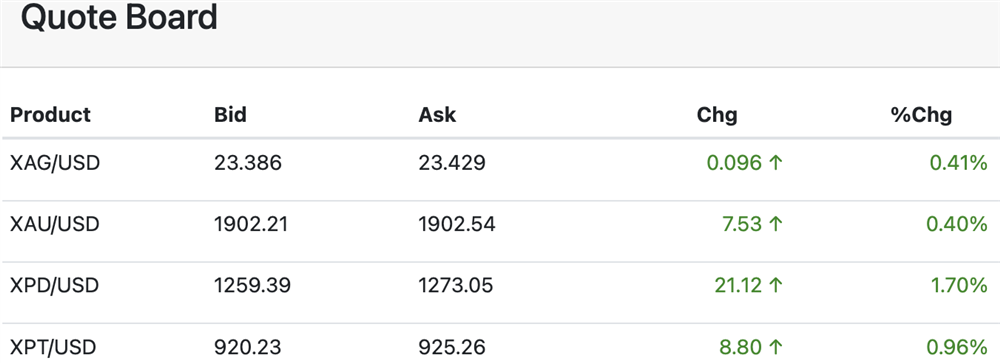

Tuesday, August 22, 2023Not surprisingly, with the #dollar posting a 4-day low overnight, the #gold market has extended the reversal and forged a 3-day high in the early trade today.

Adding to the slight improvement in outside market conditions is a slight dip in treasury yields, which have been applying significant pressure to gold, especially with yesterday's treasury yields reaching the highest levels in 16 years.

Traders should expect little reaction in gold to US scheduled data today and instead expect an avalanche of Fed speeches from Jackson Hole to provide the beginning of a narrative for the Fed's September policy decision...[MORE]

Please subscribe to receive the full report via email by clicking here.