Zaner Daily Precious Metals Commentary

Monday, September 30, 20249/30/2024

Gold and silver remain corrective ahead of month-end and quarter-end

OUTSIDE MARKET DEVELOPMENTS: China's CSI 300 stock index surged 8.5% on Monday, its biggest gain since 2008, as markets continued to digest last week's bazooka stimulus. Hong Kong's Hang Seng Index posted a 2.4% gain and is now up 24% YTD.

The easing of home-buying restrictions in three major Chinese cities provided additional lift to shares and its troubled real estate sector. Steel and iron ore prices surged. Copper reached a 4-month high of $4.7382 before retreating somewhat.

Bejing is pulling out all the stops to get growth back to its 5% target. There's a growing sense that if additional stimulus is needed to achieve that goal, it will be forthcoming. That provides a considerable market tailwind.

Iran has vowed retaliation for recent Israeli attacks that have effectively decapitated Hezbollah. The Wall Street Journal is reporting that Israeli special forces have been conducting targeted raids within southern Lebanon, possibly paving the way for a broader IDF ground incursion.

ECB President Christine Lagarde is worried that the EU "recovery is facing headwinds." That acknowledgment may boost the prospects for an October ECB rate cut, but European bonds and shares were under pressure today.

German HICP inflation fell to 1.8% y/y in September, versus 2.0% in August. Italian HICP inflation fell to 0.8% y/y in September from 1.2% in August. These readings below the ECB target of 2.0% may provide clearance for more easing, but Lagarde sees scope for a Q4 inflation rebound driven by energy prices.

Chicago PMI rose to 46.6 in September, above expectations of 45.9, versus 46.1 in August. While comfortably above the May low of 35.5, the barometer has been in contractionary territory for 24 of the past 25 months. Troubles at Boeing continue to pose a headwind.

The Dallas Fed Index improved to -9.0 in September, inside expectations of -10.7, versus -9.7 in August. "Moderate upward pressure on prices and wages continued in September," according to the Dallas Fed. The comments section highlights how political uncertainty ahead of the November election has weighed on sentiment.

Fed President Powell will speak at the NABE conference later today.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$6.68 (-0.25%)

5-Day Change: +$5.07 (+0.19%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +42.86

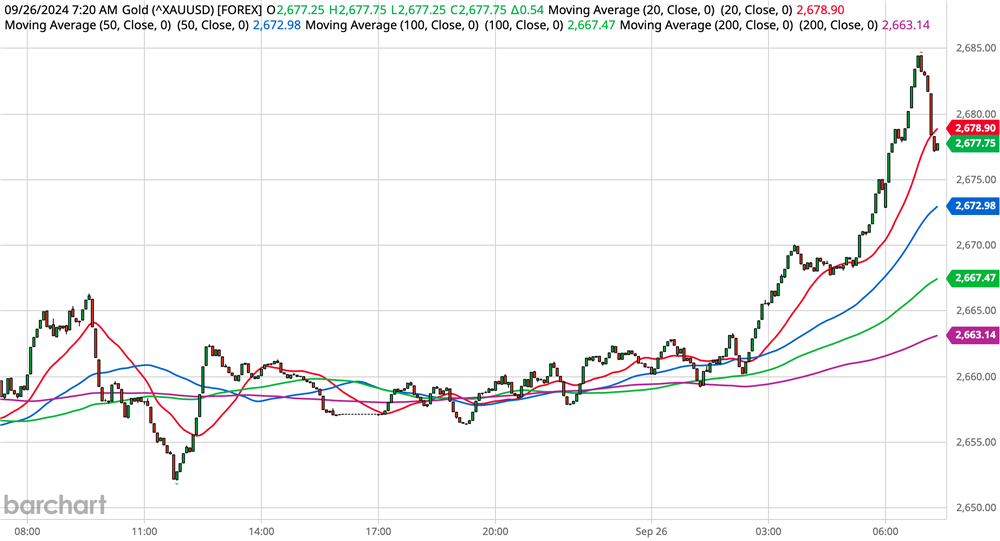

Gold is maintaining a corrective tone to start the new week as traders ring up profits for month-end and quarter-end. The yellow metal is lower for a second session after setting a record high of $2,684.45 on Thursday.

Despite the recent setback, gold is poised to notch an eighth consecutive monthly rise and a fourth straight quarterly gain. The quarterly gain should be the best since Q1'16.

The trend remains decisively bullish. Consequently, pullbacks are likely to be viewed as buying opportunities. The $2,700.00/$2,709.14 objective remains valid, with intervening barriers noted at $2,665.36, $2,673.67, and $2,684.45.

Supports at $2,624.58 and $2,614.86 protect the $2,600 zone. The rising 20-day moving average, which provided good support earlier in the rally, comes in at $2,575.17 today.

The COT report showed net speculative long positioning increased 5.3k contracts to 315.4k last week. That's the highest spec long positioning in more than four years.

CFTC Gold speculative net positions

I'm anticipating that gold ETFs saw good inflows last week as well, although my source for that information has not been updated yet. I'll cover ETFs tomorrow.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -0.485 (-1.53%)

5-Day Change: +$0.544 (+1.77%)

YTD Range: $21.945 - $32.657

52-Week Range: $20.704 - $32.657

Weighted Alpha: +43.32

Silver has corrected to the $31 zone on position squaring on this, the last trading day of September and Q3. However, last week's move to fresh 12-year highs has swung the technical picture decisively back in favor of the bull trend off the COVID-era low at $11.703.

I suspect the housing market reforms in China will ultimately have a positive impact on silver, as they have for steel and copper today. Silver has become an increasingly important component in home construction.

The net speculative long position in silver futures jumped 3.9k to 62.2k contracts according to the latest COT report. That's the biggest net-long position since late February 2020 and may be contributing to the recent corrective pressure.

CFTC Silver speculative net positions

While additional downticks toward the $30 zone can not be ruled out, market focus is likely to remain on buying strategies in anticipation of further tests above $32.

On the upside, I have a Fibonacci projection at $33.972. Intervening barriers are found at $31.829, $32.227, and $32.657. Further out, a key retracement level is highlighted at $35.217 (61.8% retracement of the entire decline from $49.752 to $11.703).

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.