Grant on Gold – September 25, 2023

Monday, September 25, 2023Gold continues to consolidate in the bearish channel that dominated throughout the summer. The 100-day MA successfully contained the upside last week, leaving the downside vulnerable to further tests.

Last week the Fed held steady on rates, as was widely expected. However, Chairman Powell noted strength in the economy and his desire to see “convincing evidence” that inflation is moderating.

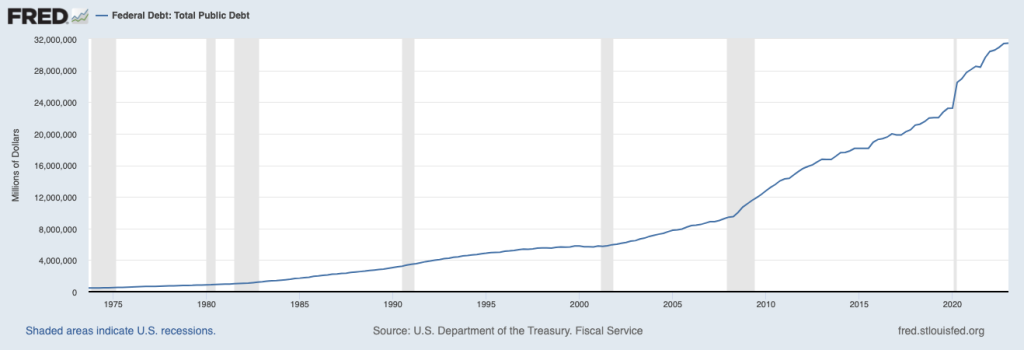

The dot plot suggested that at least one more rate hike could be seen this year. Perhaps more importantly, the dots reinforced the ‘higher for longer’ scenario with the first rate cut now forecast for June 2024.

The 10-year yield moved more convincingly above 4% on Monday, reaching levels not seen since 2007. Higher yields are buoying the greenback. The dollar index extended on Monday to reach 10-month highs.

Higher yields and a higher dollar will continue to pose a considerable headwind for gold. Mounting global growth risks apply additional weight.

It is believed that the Eurozone economy contracted in Q3, even as inflation remains elevated. September CPI is forecast to be 4.5%. While that’s down from 5.2% in August, the inflation rate remains well above target.

Earlier in the month, the ECB hiked rates for a 10th consecutive meeting, pushing the deposit rate to a record high of 4%. Analysts now believe the ECB is on hold, probably into next summer.

However, the ECB also will want to see some convincing evidence to confirm that inflation has been squelched in the EU. Until that happens, at least one more rate hike can’t be ruled out.

Of course, worries about the Chinese economy persist as well. This could have grim implications for the global economy.

Chinese demand for imports has contracted in nine of the last 10 months. If China slips into recession, there are concerns that demand for commodities will suffer further. While that may help tamp inflation, the demand destruction will be the greater concern in the medium term.

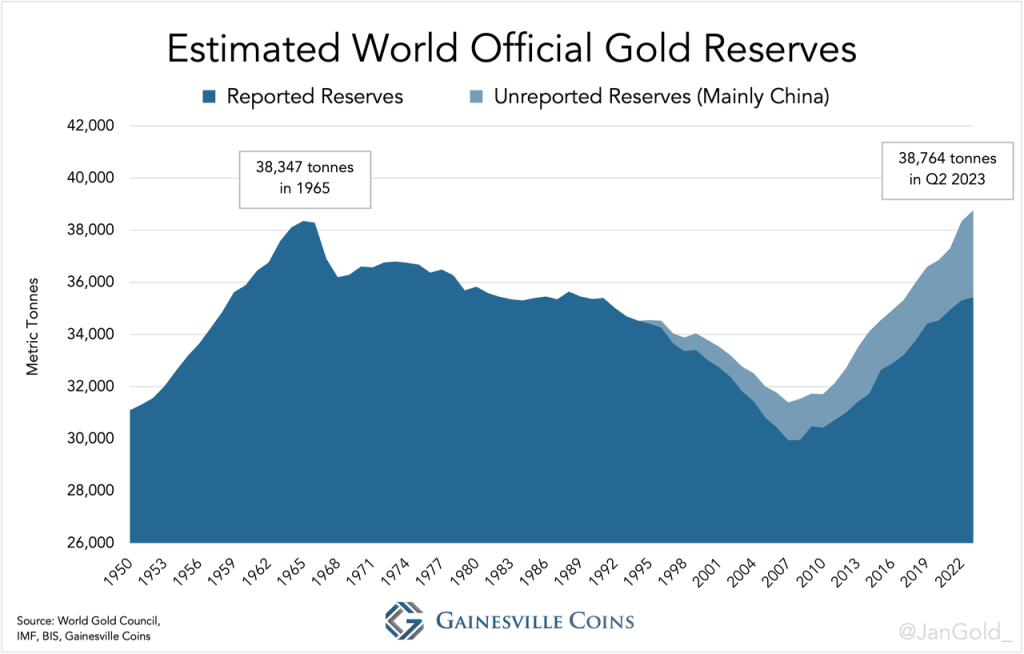

The ongoing expansion of official gold reserves remains a bright spot for the yellow metal. Central banks continue to seek diversification, mainly out of dollars and into gold.

While central bank gold demand slowed in Q2, the record purchases in Q1 led to record H1 demand of 387 tonnes. Turkey was a big seller in April and May before resuming purchases in June.

The World Gold Council believes the Turkish sales were “tactical rather than strategic” amid internal economic and political strife. Interestingly, as the TCMB was selling, demand for bars, coins, and gold jewelry surged in the country as citizens sought to protect their wealth against a devaluing lira.

Taking into consideration estimates of China’s unreported gold reserves, analyst Jan Nieuwenhuijs of Gainesville Coins believes world reserves reached an all-time high of 38,764 tonnes in Q2. If that’s an accurate assessment, it exceeds the previous record of 39,347 tonnes from 1965.

Nieuwenhuijs points out that gold as a percentage of total global reserves currently stands at 17%, while the long-term historical average is 58%. That suggests there remains considerable potential for further central bank gold buying.

If gold were once again to make up the majority of global reserves, one of Jan’s models projects a price in excess of $8,000 over the next 10 years.

Silver

Silver continues to trade in a choppy manner within the confines of a large symmetrical triangle pattern. The white metal rose more than 2% last week, but most of those gains were given back on Monday.

The silver market is facing some of the same headwinds as the gold market. Perhaps most notably, sluggish demand for electronics in China is likely to adversely impact demand for silver.

The Chinese auto sector returned to growth in August, after contracting in June and July. Sales surged 8.5% m/m and 2.2% y/y with electric vehicles such as Teslas increasingly popular. However, the sustainability of these gains is in doubt as China’s real estate crisis threatens to sap consumer demand.

Real estate is the biggest contributor to Chinese GDP, so the crisis has the potential to drag the middle kingdom into recession. Growth risks in the world’s second-largest economy pose considerable risks to the global economy as a whole.

That being said, the global trend toward electrification keeps the long-term supply/demand fundamentals undeniably positive. Therefore, retreats into the range that has emerged this year are still likely to be viewed as buying opportunities.

Initial support is well-defined by the series of lows at $22.30, $22.22, and $22.11. This zone should keep the low for the year at $19.90 (10-Mar) at bay.

Last week’s high at $23.78 is now seen as the trigger for a retest of the upper reaches of the triangle pattern, which comes in around $24.50.

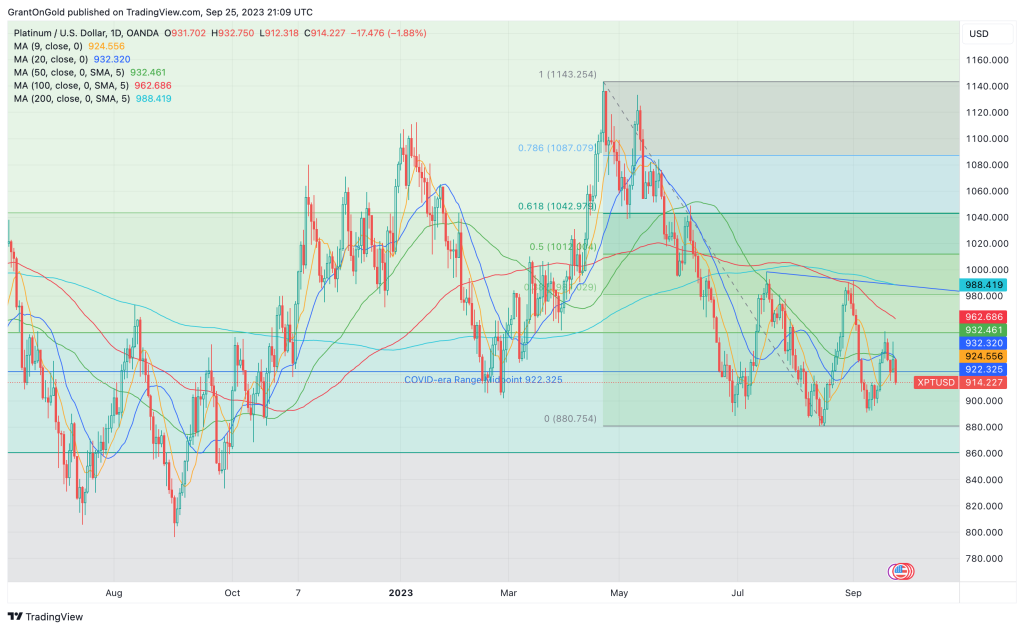

PGMs

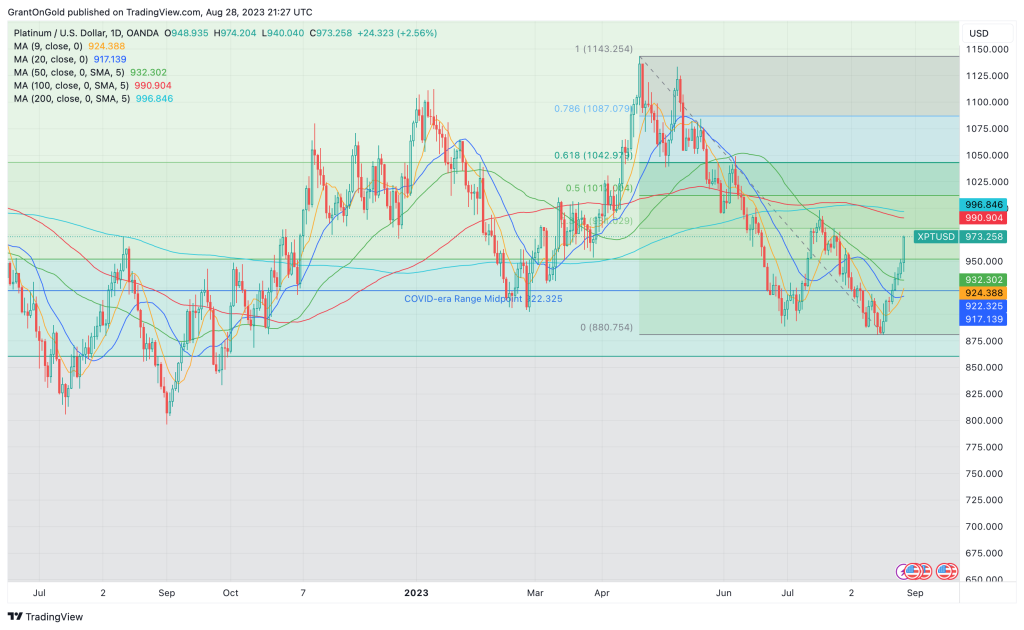

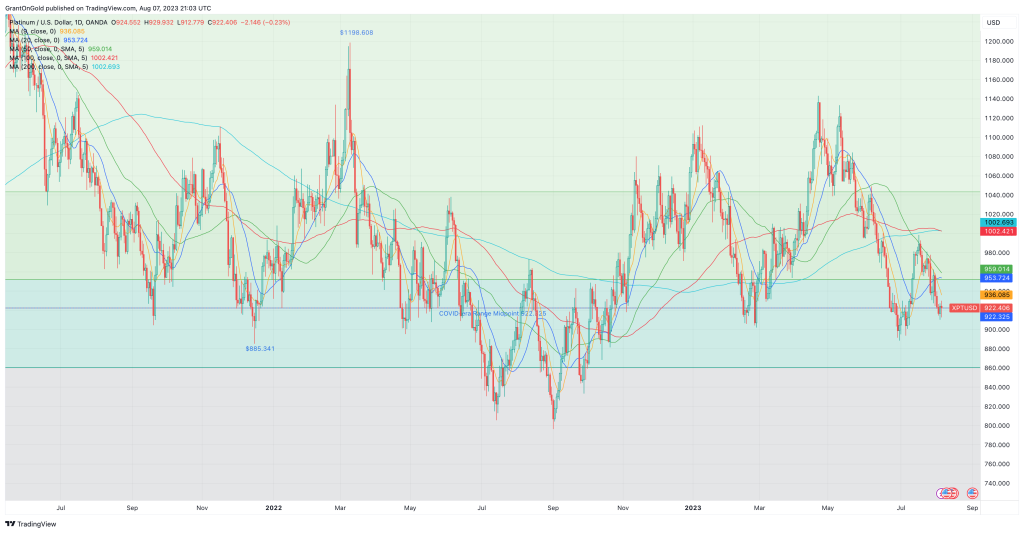

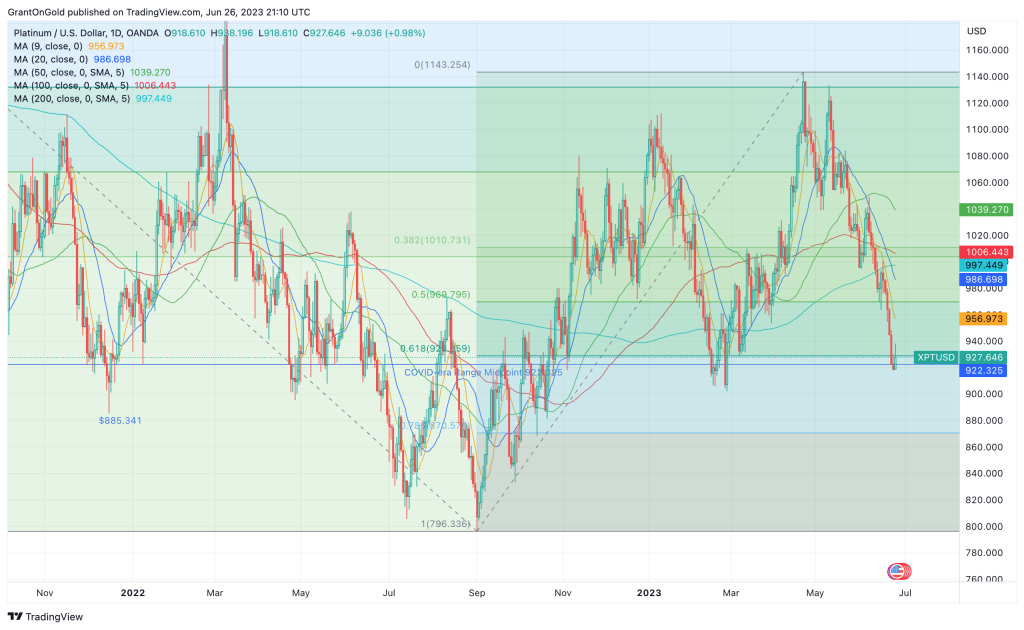

Platinum continues to struggle on upticks. The market rose modestly last week, notching a second consecutive higher weekly close. However, renewed selling pressure surfaced on Monday.

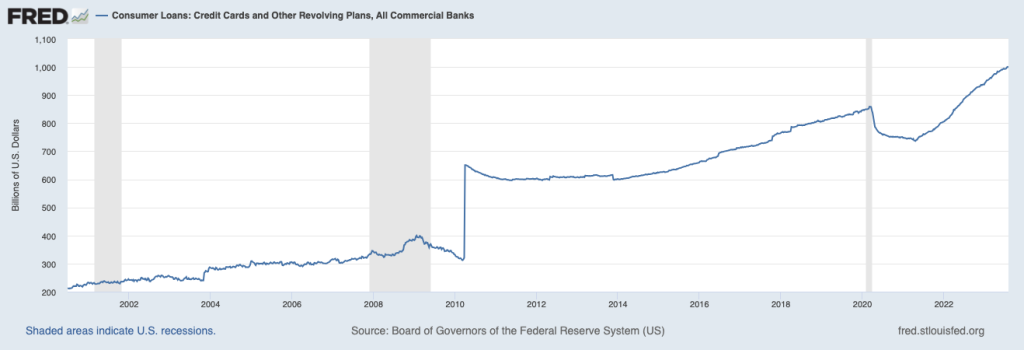

While U.S. auto sales were robust in August, global growth concerns continue to percolate below the surface. Rising interest rates also threaten to undermine consumer purchasing power.

Late-summer sales were helped by better supply, but if the expanding UAW strike persists the supply of new cars will tighten.

Palladium remains defensive at the low end of the multi-year range.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.