Morning Metals Call

Monday, December 30, 2024Good morning. The precious metals are lower in early U.S. trading.

U.S. calendar features Chicago PMI, Pending Home Sales Index, Dallas Fed Index.

Good morning. The precious metals are lower in early U.S. trading.

U.S. calendar features Chicago PMI, Pending Home Sales Index, Dallas Fed Index.

12/26/2024

Gold and silver firm in thin holiday trade on heightened geopolitical risks

OUTSIDE MARKET DEVELOPMENTS: Geopolitical tensions have escalated amid speculation that Russia is responsible for the downing of the Azerbaijan Airlines passenger plane on Wednesday. Some reports suggest that Russian air defenses were engaging Ukrainian drones and the commercial flight was struck inadvertently.

Most European and Canadian markets remain closed for the holidays. Thin trading conditions.are expected to prevail until after the new year.

Once 2025 has begun, the market's focus will shift to the inauguration of President Trump, his initial raft of executive orders, and political priorities associated with trade, immigration, taxes, and fiscal policies.

Initial Jobless Claims fell 1k to 219k in the week ended 21-Dec, below expectations of 222k, versus 220k in the previous week. Continuing jobless claims surged 46k to a three-year high of 1,910k in the 14-Dec week, versus a revised 1,864k in the previous week.

M2 will be released this afternoon.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$11.82 (+0.45%)

5-Day Change: +$41.43 (+1.60%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +25.03

Gold jumped more than 1% in thin holiday trading to set new highs for the week. Reports that Russian air defenses may be responsible for the downing of the Azerbaijan Airlines passenger plane have increased geopolitical tensions. The Kremlin has warned against such speculation until they have conducted a full investigation.

The yellow metal remains confined to the lower half of the well-defined $2,789.68/$2,541.42 range. The midpoint of the range at $2,665.55 corresponds closely with the 50-day moving average and should remain protected for the remainder of this week. The 20-day MA at $2,642.71 provides an intervening barrier.

A move into the upper half of the range in the week ahead would bode well for tests back above $2700 with potential back to the record high at $2,789.68. An eventual resumption of the dominant uptrend is favored in 2025. The next significant upside objective beyond the all-time high is $3,000.

A minor chart point at $2,622.93 now protects the low for this week at $2,608.94. More important support is marked by last week's low at $2,585.51, which stands in front of the range low at $2,541.42.

Silver is engaged in a test of Monday's high at $29.868, bolstered by safe-haven flows into gold. While last week's range breakout and drop below the 200-day moving average leaves the short-term tone bearish, the downside is likely to be limited as long as gold's range is intact.

The white metal has been stymied by global growth concerns and yet silver is poised to end the year with a 25% gain, similar to that of gold. If gold's uptrend resumes in 2025, so too should silver's.

It would take improved global growth prospects to set silver up to outperform in the year ahead. While the U.S. economy remains resilient, concerns about China and Europe are likely to persist and provide headwinds for silver and other commodities.

It would take a sustained rebound above $30 to shift back to a more neutral tone. The $32 level must be exceeded to set a more favorable tone within the old range. That seems unlikely given another holiday week ahead of us.

A breach of last week's low at $28.783 would clear the way for a challenge of the $28.306 Fibonacci level (78.6% retrace of the rally from $26.524 to $34.853). Below that, the September low at $27.732 would be the likely attraction.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

Good morning. The precious metals are mixed in early holiday-thinned U.S. trading.

UK and Canadian markets closed for Boxing Day.

U.S. calendar features Initial Jobless Claims, M2.

12/19/2024

Gold remains defensive after the post-Fed plunge, but the range is intact

OUTSIDE MARKET DEVELOPMENTS: Yesterday's FOMC decision was widely anticipated to be a 25 bps 'hawkish cut," but the forward guidance was more hawkish than expected. Members halved their projections for additional easing in 2025 from 100 bps to just 50 bps.

"From here, it's a new phase and we're going to be cautious about further cuts," said Fed Chairman Powell. Fed funds futures are now suggesting the Fed is on hold until June.

The dollar surged, while Treasuries, stocks, and precious metals tumbled. While some markets retraced a portion of yesterday's moves, the greenback remains on the bid.

In other central bank news: The BoJ refrained from another rate hike. The BoE and Norges Bank held steady. Sweden's Riksbank cut by 25 bps. All of these moves were in line with expectations.

Markets will shift into holiday mode after tomorrow's economic releases but traders will continue to ruminate on the Fed's forward guidance and the implications for interest rate differentials through the upcoming holiday weeks. I think they will conclude that this week's events are generally favorable for the dollar.

Philly Fed Index tumbled 10.9 points to a 20-month low of -16.4 in December, well below expectations of 2.5, versus -5.5 in November. New orders and shipments indexes fell into negative territory but "indicators for future activity continue to suggest widespread expectations for growth over the next six months," according to the report.

Q3 GDP (3rd report) was revised to 3.1%, above expectations of 2.9%, versus 2.8% in initial reports and 3.0% in Q2. This bolsters the Fed's assessment that the economy remains resilient.

Initial Jobless Claims fell 22k to 220k in the week ended 14-Dec, below expectations of 231k, versus 242k in the previous week. Continuing claims fell 12k to 1874k in the week ended 7-Dec from 1886k in the previous week.

Leading Indicators rose 0.3% to 99.7 in November, above expectations of -0.1%, versus -0.4% in October. It was the first monthly rise since Feb'22.

Existing Home Sales jumped 4.8% to 4.150M in November, above expectations of 4.092M. versus 3.960M in October. The median sales price dipped $700 to $406,100 versus a revised $406,800 in October. Prices are down $20,800 from June's record high of $426,900.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$30.18 (+1.17%)

5-Day Change: -$79.16 (-2.95%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +24.08

Gold tumbled to a four-week low of $2,585.51 after the Fed's forward guidance for next year came in less dovish than expected. The yellow metal staged a pretty respectable rebound in overseas trading today, but sellers came back in above $2620. While gold is still up 25% YTD hopes for a 30%+ annual gain have been dented.

So far, the well-defined $2,789.68/$2,541.42 range remains intact. My favored scenario called for range trading to prevail into year-end. That's still a possibility but a more bearish tone has emerged, leaving the $2,541.42 low vulnerable to a test.

The violations of the 100-day and 20-week moving averages are troubling for the bull camp. Gold hasn't been below these indicators for more than a year. Dollar strength also poses a significant headwind.

If the $2,541.42 low is penetrated, focus would shift to the $2,482.74 Fibonacci level (38.2% retracement of the rally from $1,986.16 to the $2,789.68 record high). This support is bolstered by the rising 200-day moving average, which is at $2,470.34 today.

Despite recent price action, the long-term trend remains bullish. JPMorgan Chase recently projected that gold could reach $3,000 in 2025. Central bank gold demand has been a major driving force behind the rally and Goldman Sach doesn't see that slowing down,

A rebound back above the midpoint of the range at $2,665.55 would ease pressure on the downside. That would put gold back above the 20-day moving and close to the 50-day MA ($2,670,07 today).

Silver plunged to three-month lows on Wednesday, weighed by a less dovish Fed and the resulting strength in yields and the dollar. With today's downside extension, the white metal has traded lower in six of the past seven sessions.

With the range violated and silver trading below the 200-day moving average for the first time since March. As noted in yesterday's commentary, the next level of significant support is the $28.306 Fibonacci level (78.6% retrace of the rally from $26.524 to $34.853). Below that, the September low at $27.732 would be the attraction.

Short-term upticks are likely to be viewed as selling opportunities. It would take a rebound above $30 to shift back to a more neutral tone, and a rise above $32 to set a more favorable tone within the old range. That seems unlikely heading into the holiday weeks.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

12/18/2024

Gold and silver remain range-bound with all eyes on the Fed

OUTSIDE MARKET DEVELOPMENTS: All eyes are on the Fed today in anticipation of a third consecutive easing to round out the year. A 25 bps cut is widely expected, resulting in 100 bps of cumulative easing since September.

The market is particularly interested in the Fed's forward guidance for 2025, given the generally resilient economy and the fact that inflation remains above the 2% target. There had been some tapering of easing expectations for next year recently, although a bid in Treasuries heading into the decision suggests some unwinding is happening. A pause is still favored for January.

I look for the forward guidance to emphasize data dependency, striking a cautious tone about sticky inflation. Call it neutral with a slight hawkish tilt. The dots are likely to edge toward 75 bps in additional cuts in the year ahead.

Any over-emphasis on inflation or dots below 75 bps for next year would be positive for the dollar. On the other hand, a more dovish tilt (unlikely) would weigh on the dollar.

The BoE will announce policy tomorrow and is likely to hold the bank rate at 4.75%, amid heightened inflation worries. Governor Bailey signaled last month that the UK budget is likely to stoke inflation.

The BoJ will announce policy tomorrow (our tonight). While the BoJ is the odd man out with a tightening bias, global and regional uncertainty is likely to result in a hold. The BoJ took rates above the zero-bound for the first time in 14 years in March. It was the first rate hike in 17 years. A follow-on hike in July brought the policy rate to 0.25%, a level not seen since February 1999.

MBA Mortgage Applications fell 0.7% in the week ended 13-Dec, correcting gains seen in the previous two weeks. The 30-year mortgage rate rebounded to 6.75%, versus 6.67% in the previous week.

Housing Starts fell 1.8% to 1.289M in November, below expectations 1.344M, versus a revised 1.312M in October (was 1.311M). That's the weakest pace since July. Multifamily starts plunged 23.2%. High mortgage rates remain a headwind.

Current Account Balance widened to a record deficit of -$310.9 bln in Q3, outside expectations of -$284.0 bln, versus a revised -$275.0 bln in Q2 (was -$266.8 bln).

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$0.35 (+0.01%)

5-Day Change: -$74.81 (-2.75%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +26.84

Gold slipped to a new low for the week, but remains broadly consolidative awaiting this afternoon's Fed decision. The market is not expecting any big surprises, perhaps just a slightly more hawkish tilt in the forward guidance.

While I expect the well-defined $2,789.68/$2,541.42 range to hold, we are in the lower half of that range and recent probes into the upper half have proven to be unsustainable. The lows from the past three weeks at $2,628.79/$2,617.65/$2,609.76 provide a solid intervening barrier ahead of the $2,541.42 cycle low.

On the upside, Monday's high at $2,63.89 needs to be negated to clear the way for renewed tests above $2,700. The $2,719.75/$2.723.70 highs are the key to unlocking a challenge of the $2,789.68 record high.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$0.169 (-0.55%)

5-Day Change: -$1.578 (-4.95%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +21.79

Silver remains defensive in advance of the Fed decision. The low from early December at $30.08 is intact thus far, keeping the more important $29.736/703 lows at bay, but the downside is seen as vulnerable.

A dip below $30.080/00 would clear the way for a challenge of those lows, with the potential to extend to the 200-day moving average at $29.601. Below the latter, the next level of significant support is the $28.306 Fibonacci level.

Fresh highs for the week above $30.724 would set a more favorable short-term tone, suggesting initial potential to Friday's high at $31.088. Penetration of the latter would bode well for tests back above $32.00.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

Good morning. The precious metals are lower in early U.S. trading.

U.S. calendar features MBA Mortgage Applications, Housing Starts, Current Account, EIA Data, FOMC statement, Powell presser.

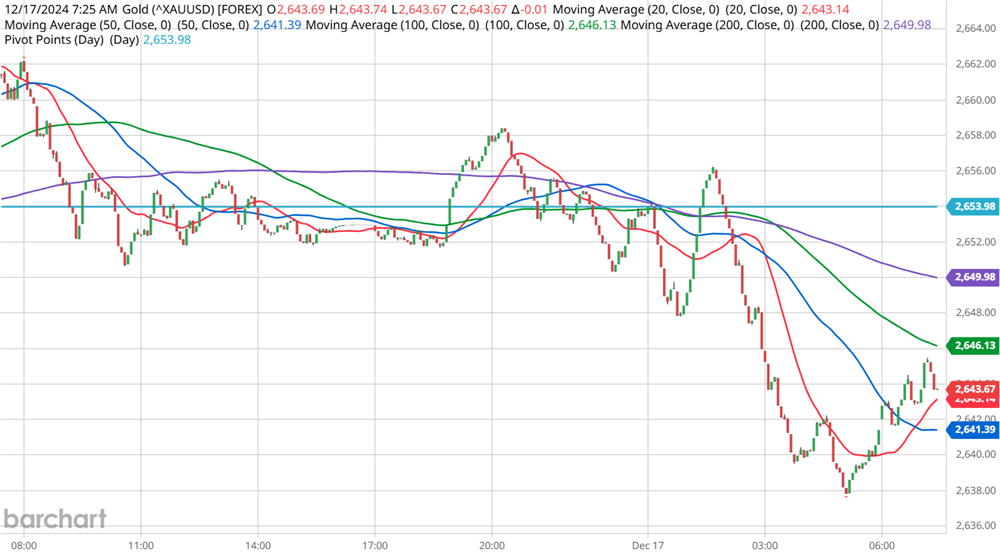

12/17/2024

Gold and silver remain under pressure within their ranges

OUTSIDE MARKET DEVELOPMENTS: Ukraine's security service is taking credit for placing a remotely detonated bomb in Moscow that killed Lt. General Igor Kirillov, the head of Russia’s Nuclear, Biological, and Chemical Defence Forces. Ukraine had charged Kirillov with using banned chemical weapons, a charge that the U.S. State Department has corroborated.

A targeted killing of a key Russian official in Moscow appears to be a new level of escalation in the nearly three-year-old conflict. Russia has vowed retribution.

German Chancellor Olaf Scholz lost a vote of confidence on Monday, paving the way for snap elections in February. The collapse of the German government is just one in a string of spectacular, political crises, ruling party ousters and outright government collapses this year.

Along with Germany, the UK, France, Japan, and South Korea make the list. Arguably, the Trump win and GOP political gains should also be part of the discussion.

Now there are mounting concerns that the Canadian government of Justin Trudeau is on shaky ground following the resignations of key cabinet members. Trudeau's favorability rating is below 30% and he is unlikely to survive next year's election, resulting in rising pressure to resign.

Today's U.S. economic data were a mixed bag. Better-than-expected retail sales bolster the notion of U.S. economic resilience, although industrial production missed expectations.

The two-day FOMC meeting began today and the Fed is widely anticipated to announce a 25 bps rate cut tomorrow. Market focus has shifted to expectations for a "hawkish cut" with forward guidance indicating a slower pace of easing in 2025.

This is helping to underpin the dollar near three-week highs. Further tests in the dollar index above 107 would bode well for an eventual retest of the two-year high from 22-Nov at 108.07.

Retail Sales rose 0.7% in November, above expectations of +0.5%, versus a positive revised +0.5% in October (was +0.4%). Ex-auto +0.2%, below expectations of +0.4%, versus an upward revised +0.2% in October.

Industrial Production fell 0.1% in November, below expectations of +0.3%, versus a revised -0.4% in October (was -0.3%). Capacity Utilization fell to 76.8%, below expectations of 77.3%, versus a revised 77.0% in October.

Business Inventories rose 0.1% in October, below expectations of +0.2, versus a revised unch in September.

NAHB Housing Market Index was steady at 46 in December. The future sales index rose to 66, its highest level since Apr'22.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$10.75 (-0.41%)

5-Day Change: -$51.54 (-1.91%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +26.77

Gold slipped to a new low for the week, leaving support marked by the lows from the past three weeks at $2,628.79/$2,617.65/$2,609.76 vulnerable to tests. However, the yellow metal remains broadly consolidative near the midpoint of the $2,789.68/$2,541.42 range.

I believe the consolidative tone will prevail as the market shifts to holiday mode at the end of this week. Nonetheless, gold is likely to notch its best annual gain since 2010.

The rise in political uncertainty has tempered risk appetite, but gold isn't garnering much benefit. Bitcoin may be stealing the risk aversion thunder amid hopes that the Trump administration will deem the cryptocurrency a reserve asset. Bitcoin set another record high today at $108,226.65.

Gold may see revived haven interest as political and geopolitical risks extend into the new year. Central bank interest should continue to provide a tailwind as well.

A rebound above this week's highs at $2,658.40/$2,663.89 would clear the way for renewed tests above $2700. Penetration of the more formidable $2,719.75/$2.723.70 level would return focus to the $2736.55 Fibonacci level and the all-time high at $2,789.68.

A breach of support at $2,609.76 would favor tests below $2,600 with potential back to the $2,541.42 range low.

Silver is under pressure for a fourth straight session, reaching a two-week low of $30.198. The white metal is having additional weight applied from trade tensions and persistent uncertainty stemming from a lack of specifics from Beijing regarding planned stimulus.

The breach of Friday's low at $30.347 favors tests below $30, although the $29.736/703 lows should prove difficult to penetrate as the market shifts to holiday trading. The rising 200-day moving average is at $29.575 today but will correspond with the cycle low by the Christmas week.

A rebound above $32 is needed to set a more favorable tone within the range. The recent highs at $32.255/306 reinforced the range midpoint at $32.278.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

12/16/2024

Gold and silver remain consolidative, awaiting Fed decision

OUTSIDE MARKET DEVELOPMENTS: This week's focus is squarely on the two-day FOMC meeting that begins tomorrow. Fed funds futures are fully pricing a 25 bps cut for Wednesday's announcement.

It's the forward guidance and the central tendencies for 2025 that the market is most interested in. Easing expectations for the year ahead have ebbed in recent weeks amid signs of a resilient economy and some warmer inflation readings.

I suspect the policy statement and Powell's comments will lean toward a more cautious rate path in 2025 that will likely begin with a January hold. At this point, the market continues to reflect a bias for slightly less than 100 bps in cuts next year.

A less-dovish Fed and more-dovish tilts from some other major central banks are underpinning the dollar. The dollar index reached a two-week of 107.19 last week and remains well-bid to start the new week.

Before the market shifts into holiday mode, we'll also get U.S. retail sales for November (Tuesday) and the Fed's favored measure of inflation (Friday). Median expectations for retail sales are +0.5%. The PCE chain price index is expected to rise 0.2% m/m.

ECB President Christine Lagarde signaled further interest rate cuts are in the offing. While inflation remains elevated, she's seeing some encouraging signs. "If the incoming data continue to confirm our baseline, the direction of travel is clear, and we expect to lower interest rates further," said Lagarde.

Moody's cut France's credit rating to Aa3 from Aa2 based on a view that "the country's public finances will be substantially weakened over the coming years." Fitch and S&P had already made similar downgrades.

Members of South Korea's General Assembly voted on Saturday to impeach President Yoon Suk Yeol after he angered policymakers by declaring martial law earlier in the month. Yoon's presidential powers have been suspended while the Constitutional Court decides if he will be removed or reinstated.

U.S. Empire State Index plunged 31 points to 0.2 in December, below expectations of 9.8, versus 31.2 in November. “On the heels of a strong November, manufacturing activity held steady in New York State in December. The pace of price increases moderated, and employment declined modestly. Firms were fairly optimistic about future conditions,” said Richard Deitz, Economic Research Advisor at the New York Fed.

U.S. Flash Manufacturing PMI fell 1.4 points to 48.3 in December, versus 49.7 in November. "...output is falling sharply and at an increased rate, in part due to weak export demand," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

U.S. Flash Services PMI rose 2.54 points to 58.5, versus 56.1 in November. “The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years..." said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$14.65 (+0.55%)

5-Day Change: +$0.33 (+0.01%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +27.99

Gold remains range-bound near the 20-day moving average. The yellow metal managed to close 0.6% higher last week, despite the failure to sustain gains above $2,700. Consolidative trading is likely to prevail into year-end.

Ongoing geopolitical tensions, expectations for a 25 bps Fed rate cut on Wednesday, and ongoing dovishness from other major central banks are providing support for gold. On the other hand, an anticipated tilt by the Fed to a less-dovish bias and the resulting firmness in the dollar pose a headwind.

A sustained move above $2,700 is needed to set a more favorable tone within the broader range. The $2,719.75/$2.723.70 area now provides a formidable barrier ahead of the $2,789.68 record high.

A short-term trendline off the $2,541.42 cycle low has contained the downside thus far today, but the retreat seen late last week leaves the lows from the past three weeks at $2,628.79/$2,617.65/$2,609.76 vulnerable to a challenge.

Gold ETFs saw net outflows of 1.7 tonnes in the week ended 13-Dec. It was the second consecutive net weekly outflow. Selling by North American investors eclipsed small inflows from Europe and Asia.

CFTC Gold speculative net positions

The COT report for last week saw net speculative long positions increase by 15.9k to 275.6k contracts, versus 259.7k contracts in the previous week. It was the third straight weekly increase in spec longs.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$0.123 (+0.40%)

5-Day Change: -$1.127 (-3.54%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +23.91

Silver is consolidating at the low end of Friday's range after failing once again to sustain gains above $32 last week. While the white metal was encouraged by the most recent Chinese stimulus pledges, the lack of specifics has disappointed once again.

With silver confined to the lower half of the broad $34.853/$29.703 range, I see a modest downside bias. A breach of Friday's low at $30.347 would suggest potential for tests below $30, although the cycle low at $29.703 is likely to remain protected as the market shifts to holiday trading at the end of this week.

A sustained push above $32 is needed to set a more favorable tone within the range. The recent highs at $32.255/306 reinforced the range midpoint at $32.278.

CFTC Silver speculative net positions

Net speculative long positions in silver futures declined 2.1k to 41.2k contracts, versus 43.3k in the previous week. It was the sixth weekly decline out of the last seven.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.