Morning Metals Call

Monday, October 28, 2024

10/24/2024

Gold consolidates recent losses within Wednesday's range

OUTSIDE MARKET DEVELOPMENTS: Doubts about how aggressively the Fed might ease into year-end are on the rise. While a 25 bps cut to the Fed funds rate in November remains baked into the cake, the trade is now less sure about December.

With much of the incoming data suggesting a resilient economy and some worries of a "mission accomplished" moment on inflation, the Fed's policy path has turned somewhat cloudy.

The Beige Book for the upcoming FOMC meeting that was released yesterday showed economic activity was stable or increased modestly in nine of twelve Districts since early September. Economic activity in the Philly, Atlanta, and Minneapolis Districts declined only slightly.

Half the Districts saw employment increases, while the remainder showed little or no change."Demand for workers eased somewhat, with hiring focused primarily on replacement rather than growth."

Inflation "continued to moderate" in most Districts, but the prices of "some food products, such as eggs and dairy, were reported to have increased more sharply." Increasing price sensitivity among consumers was noted in most Districts, but that wasn't reflected in the September retail sales data.

Cleveland Fed President Beth Hammack indicated she is unwilling to declare victory over inflation. "We have made good progress but inflation is still running above the 2% objective," she said.

Treasury yields have been on the rise for a month. With the 10-year yield reaching three-month highs, so too has the dollar index. U.S. stocks seemed to finally take notice on Wednesday, prompting a risk aversion sell-off. The Dow fell more than 400 points on Wednesday, its worst day in over a month.

U.S. 10-Year Treasury Note Yield

On Wednesday the BoC slashed rates by 50 bps, its largest rate cut since the COVID crisis. Amid persistent growth risks in Europe, particularly Germany the largest economy in the EU, talk of an accelerated ECB easing path has intensified.

The prospect for interest rate differentials to rotate more favorably toward the U.S. could be an ongoing tailwind for the greenback. The upside potential for the dollar index is back to the 106.00 level.

U.S. Initial Jobless Claims fell to 227k in the week ended 19-Oct, below expectations of 244k, versus a revised 242k in the previous week. Continuing jobless claims rose to 1,897k for the 12-Oct week, from a revised 1,869k in the previous week.

U.S. New Home Sales rose 4.1% to a 0.738M pace in September, above expectations of 0.718M, versus a negative revised 0.709M in August (was 0.716M). The pullback in mortgage rates from last October's 23-year highs has been generally supportive this year, but the more recent rebound is likely to weigh on October sales.

S&P Global Manufacturing PMI (Flash) rose to 47.8 in October, above expectations of 47.5, versus 47.3 in September.

S&P Global Services PMI (Flash) edged up to 55.3 in October, above expectations of 55.0, versus 55.2 in September.

Chicago Fed National Activity Index fell to -0.28 in September, versus a negative revised -0.01 (was 0.12) in August. The index has been in negative territory for seven of nine months so far this year.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$21.22 (+0.78%)

5-Day Change: +$43.91 (+1.63%)

YTD Range: $1,986.16 - $2,757.95

52-Week Range: $1,812.39 - $2,757.95

Weighted Alpha: +39.64

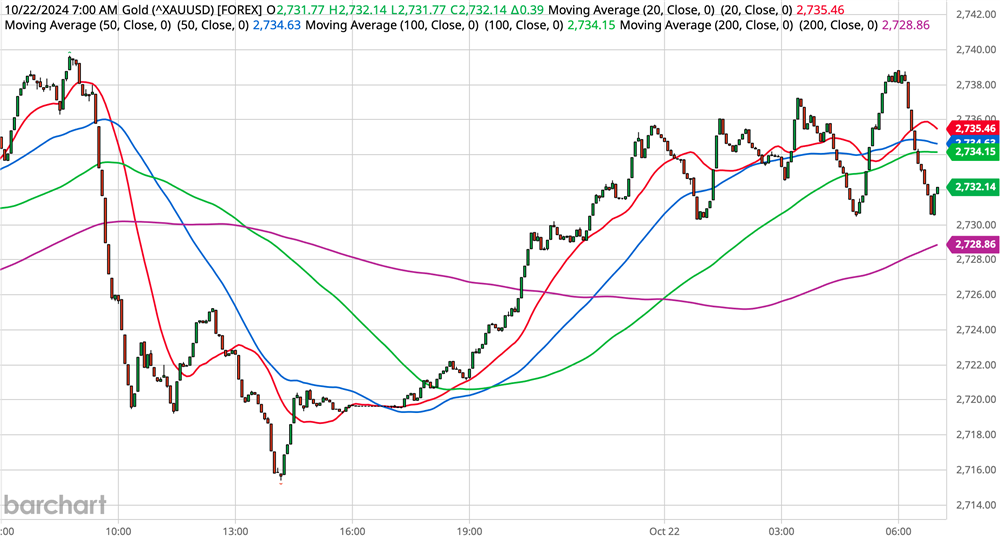

Gold has rebounded from yesterday's retreat, but remains confined to Wednesday's range. Today's price action tempers the technical significance of yesterday's key reversal, but I wouldn't completely discount that chart pattern just yet.

More than half of yesterday's decline has been retraced, but I'd like to see a close above $2,734.56 to suggest we're more likely to see new record highs than a challenge of the $2,700 level on the downside.

Initial support is well-defined at $2,715.50/$2,711.17 and protects the $2,700.00/$2,692.49 zone. Penetration of the latter would shift focus to the 20-day moving average at $2,670.14. The 20-day has been a pretty consistent attraction during the corrective phases of this rally.

Gold has recorded just a single close below the 100-day moving average in more than a year. That occurred on 14-Feb, was slightly more than a dollar, and lasted just one day. That's a strong testament to the strength of this rally.

Fresh record highs above $2,757.95 would bode well for a challenge of the previously established $2,810.38 Fibonacci objective.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.435 (+1.29%)

5-Day Change: +$1.989 (+6.28%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +49.57

Silver extended corrective losses in U.S. trading today. Scope remains for a challenge of the $33 zone, but I am seeing some buying interest at the lower end of today's range.

A convincing move back above $34 would ease short-term pressure on the downside and return credence to the dominant uptrend. The midpoint of the corrective decline is at $34.087.

A breach of this level would favor a challenge of the 12-year high from Tuesday at $34.853. New cycle highs would bode well for the anticipated test of the $35.217 Fibonacci level (61.8% retracement of the decline from $49.752 to $11.703).

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

10/23/2024

Gold and silver turn corrective

OUTSIDE MARKET DEVELOPMENTS: A memo released by the Office of the Director of National Intelligence warned that Russia and Iran may seek to stoke political unrest after the upcoming U.S. election. The memo also suggested "China may be more willing to meddle in certain Congressional races."

I worry the antagonists' goals to increase division, foster doubt about the election results, and hinder the peaceful transfer of power will be far too easy. There are elements aligned with both political camps in the U.S. that are already predisposed to unrest – and perhaps violence – if their preferred candidate loses.

U.S. Treasury Secretary Janet Yellen believes Chinese efforts to stimulate its economy have thus far been insufficient. "Our view has been that raising consumer spending in China as a share of GDP is really important, along with measures to address problems in the property sector," Yellen said.

"So far I would say I haven't really heard any policies on the Chinese side that address that."

The IMF did not factor Chinese stimulus into its latest forecasts because recent jawboning lacked detail. This has been a consistent gripe from the market as well.

The FT reports that the stakes for China and its leader Xi Jinping "could hardly be higher." Failure to act decisively to address growth risks and the property crisis "could throw China into a deflationary spiral similar to that of Japan after the bursting of its real estate bubble in the 1990s, from which it has taken decades to recover.

The Bank of Canada slashed its policy rate by 50 bps to 3.75%, as was widely expected. It was the fourth consecutive BoC policy meeting that ended with a rate cut. “We took a bigger step today because inflation is now back to the 2 per cent target and we want to keep it close to the target,” said Governor Tiff Macklem.

Signs of economic weakness and low inflation in Europe reportedly has the ECB concerned. Citing multiple sources, a Reuters article contends the central bank is contemplating an easing path that would take rates below neutral.

U.S. MBA Mortgage Applications fell 6.7% in the week ended 18-Oct, versus a 17.0% decline in the previous week. It was the fourth consecutive weekly decline as higher mortgage rates continued to sap demand. The 30-year fixed rate remained at a 10-week high of 6.52%.

U.S. Existing Home Sales fell 1.0% to a 3.840M pace in October, below expectations of 3.853M, versus a positive revised 3.880M in September. It's the lowest existing home sales pace in 14 years, weighed by persistently high mortgage rates.

The Beige Book for the November FOMC meeting comes out this afternoon.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +2.18 (+0.08%)

5-Day Change: +$42.41 (+1.59%)

YTD Range: $1,986.16 - $2,757.95

52-Week Range: $1,812.39 - $2,757.95

Weighted Alpha: +38.19

Gold set a new record high at $2,757.95 before retreating to trade lower on the day. The higher high and lower low versus yesterday sets up a potential key reversal.

Recent corrective activity has been quickly met with renewed buying interest. We haven't seen more than a single lower close in two weeks. However, a confirmed key reversal would suggest there is at least scope for a more protracted correction.

Initial support is noted at $2,700.00/$2,692.49 and protects previous resistance at $2,684.45. The 20-day moving average comes in at $2,666.91.

The latest jumbo rate cut, this time from the Bank of Canada, is clear evidence that most of the major central banks are on an easing path. The prospect that the ECB will accelerate rate cuts to achieve a truly accommodative stance is reflective of rising growth risks and worries about disinflation.

The trade continues to favor 50 bps of Fed easing spread over the next two meetings. However, those bets have been tapered recently amid signs of economic resilience and worries about revived inflation.

A rebound above the midpoint of today's range at $2,734.56 would ease short-term pressure on the downside and favor another round of record highs. The previously established $2,810.38 Fibonacci objective remains valid with today's high at $2,757.95 defining a solid intervening barrier.

Silver has turned corrective after the multi-day rally stalled shy of $35. The white metal is off more than 1% and has set new lows for the week.

Initial supports at $33.779 (yesterday's low) and $33.573 (Monday's low) have been exceeded, suggesting potential back to the $33 zone before renewed buying interest is likely to emerge. Secondary support is well defined by former resistance at $32.700/657.

While Chinese President Xi Jinping may be reluctant to unleash a new barrage of stimulus, the FT points out that the Chinese people "have become accustomed to constant improvements in living standards" in recent decades.

Xi and the CCP are going to have to make some hard decisions in the weeks ahead or face potential social unrest. More stimulus seems like the lesser evil. Decisive market-supporting accommodations would bode well for the perpetuation of the uptrend in silver.

A rebound above $34.19 would ease pressure on the downside and favor further tests of the $35.00 level and a true challenge of the critical $35.217 Fibonacci level (61.8% retracement of the decline from $49.752 to $11.703). Yesterday's high at $34.853 provides intervening resistance.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

10/22/2024

Gold sets new highs once again as silver nears $35

OUTSIDE MARKET DEVELOPMENTS: Top secret documents leaked in the U.S. seemed to confirm that Israel is preparing for a retaliatory strike on Iran that will undoubtedly lead to another Iranian strike on Israel. The weekend attack by Iranian proxy Hezbollah on the residence of Israeli Prime Minister Benjamin Netanyahu further raises the stakes.

Israel continues to strike Hamas positions in Gaza and Hezbollah in Lebanon. Attacks on Hezbollah's financial network are a new twist designed to interdict the terrorist group's financing mechanisms that largely flow through Iran.

Israel and Iran seem to be hurdling toward a broader regional war, keeping markets on edge.

The IMF has trimmed its 2025 global growth outlook to 3.2% from 3.3% in July. The IMF has a brighter outlook for U.S. growth with an upgrade of 0.3% to 2.2%.

Nonetheless, the first sentence of the executive summary says it all: "Global growth is expected to remain stable yet underwhelming." The five-year forecast at 3.1% "remains mediocre compared with the prepandemic average."

Tepid growth prospects fortify global easing expectations, but the IMF warned that price risks persist: "Further disruptions to the disinflation process, potentially triggered by new spikes in commodity prices amid persistent geopolitical tensions, could prevent central banks from easing monetary policy, which would pose significant challenges to fiscal policy and financial stability," according to the report.

The resilience of the U.S. economy and risks of revived inflation has prompted the trade to reduce bets for an additional 50 bps of Fed easing into year-end. A 25 bps cut in November remains widely anticipated, but doubts are creeping in about December.

FedSpeak from Daly and Schmid reiterated the mantra of data dependency. Jeffrey Schmid, the new KC Fed president is a centrist and will be a voter in 2025. He said he favors a "cautious and gradual approach to policy," preferring to “avoid outsized moves.”

The Richmond Fed Composite Manufacturing Index rose 7 points to -14 in October, inside expectations of -17, versus -21 in September. The index has been in contraction territory for nearly a year.

"Of its three component indexes, shipments increased from −18 to −8, new orders rose from −23 to −17, and employment increased from −22 to −17," according to the Richmond Fed.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$19.12 (+0.70%)

5-Day Change: +$76.85 (+2.89%)

YTD Range: $1,986.16 - $2,743.84

52-Week Range: $1,812.39 - $2,743.84

Weighted Alpha: +39.85

Gold has set new record highs once again. The yellow metal has set all-time highs for four sessions in a row, driven by rising geopolitical risks and intensifying political uncertainty in the U.S. just two weeks out from the election.

A Reuter's reporter asked me this morning how gold will react based on who wins the U.S. presidential race. I believe gold is agnostically bullish. Half the population will be incredibly disappointed by the outcome regardless of the winner.

This disappointment has the potential to morph into political unrest as the results are questioned, and almost certain legal battles play out. It seems the U.S. is destined to remain bitterly divided politically for some time to come.

The next upside target at $2,810.38 remains highlighted based on a Fibonacci projection. The $2,800 level is deemed an intervening psychological attraction.

Short-term corrective downticks have attracted buying interest and that's likely to continue. A more protracted correction could be triggered by a Middle East cease-fire or signs that inflation is reigniting, which could cause a shift in easing expectations.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.605 (+1.79%)

5-Day Change: +$3.215 (+10.21%)

YTD Range: $21.945 - $34.711

52-Week Range: $20.704 - $34.711

Weighted Alpha: +43.76

Silver continues its march higher in the wake of last week's upside breakout above $32.700. The white metal has traded higher in eight of the past nine sessions and is up more than 10% over the last five.

The critical $35.217 Fibonacci level (61.8% retracement of the decline from $49.752 to $11.703) has quickly come within striking distance. A breach of this level would return considerable credence to the long-term uptrend and favor an eventual return to the $50 zone.

Contingent on a breach of $35.217, the $35.997/$36.000 level will become the next upside target based on a Fibonacci projection. Retreats back into the range should continue to be viewed as buying opportunities.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

10/21/2024

Gold sets new record highs as silver extends gains above $34

OUTSIDE MARKET DEVELOPMENTS: Israeli Prime Minister Benjamin Netanyahu's residence was struck by a Hezbollah drone over the weekend. The PM and his wife were not home at the time. “The agents of Iran who tried to assassinate me and my wife today made a bitter mistake,” said Netanyahu.

The U.S. is investigating the leak of top secret documents that revealed details of Israel's planned retaliatory strike against Iran for its 01-Oct missile barrage. The source of the documents appears to be the U.S. National Geospatial-Intelligence Agency.

Iran fired missiles at Israel in April and earlier this month as retribution for Israeli actions. Israel has vowed retaliation for the latest barrage with one Israeli official calling it a "done deal." Of course, Iran is threatening revenge for this anticipated strike. This cycle continues, heightening risks for an all-out regional war.

China continues to talk a big game on stimulus, but accommodations implemented thus far have failed to relieve market angst over growth risks. Liu Shangxi, head of the Ministry of Finance's Chinese Academy of Fiscal Sciences, told the South China Morning Post that measures ‘should absolutely surpass’ C¥10 trillion to prevent the Chinese economy from "falling off a cliff."

The probability of steady Fed policy in November is back at 15% after falling to 9.7% late last week. With the economy showing signs of resilience, the trade remains somewhat worried that the central bank will pause its easing cycle to prevent inflation from heating back up.

At a speech in New York this morning, Dallas Fed President Lorie Logan said the economy is "strong and stable," but "meaningful uncertainties" remain. "If the economy evolves as I currently expect, a strategy of gradually lowering the policy rate toward a more normal or neutral level can help manage the risks and achieve our goals," Logan said.

U.S. leading indicators fell 0.5% to 99.7 in September, below expectations of -0.3%, versus a negative revised -0.3% in August (was -0.2%). The 99.7 print is the lowest since May 2016.

The Conference Board said, “Weakness in factory new orders continued to be a major drag on the US LEI in September as the global manufacturing slump persists.” The report also cited the fact that the yield curve remains inverted, a decline in building permits, and a "tepid" outlook for future business conditions.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +13.81 (+0.52%)

5-Day Change: +$75.97 (+2.87%)

YTD Range: $1,986.16 - $2,739.66

52-Week Range: $1,812.39 - $2,739.66

Weighted Alpha: +38.78

Gold started the new week with another round of fresh record highs. The yellow metal traded as high as $2,739.66 before pulling back into the range.

High geopolitical tensions, uncertainty about the outcome of the upcoming U.S. elections, expectations of further central bank easing and gold purchases, and dedollarization continue to be the primary driving forces behind gold's rally.

The breach of the $2,732.55 Fibonacci target lends credence to the next upside objective at $2,810.38. With each new record high, the $3,000 level looks increasingly appealing.

Bank of America reaffirmed its $3,000 objective last week in a research note that argued gold may be a better safe-haven option than U.S. Treasuries given the ballooning debt. "Indeed, with lingering concerns over US funding needs and their impact on the US Treasury market, the yellow metal may become the ultimate perceived safe haven asset," analysts wrote.

Importantly, physical gold is arguably the only asset not simultaneously someone else's liability. This makes the yellow metal an ideal hedge.

Not surprisingly, inflows into gold-backed ETFs (someone else's liability) surged last week to 23.7 tonnes. It was the largest weekly inflow in nearly a year. Both U.S. and European investors were strong buyers.

The COT report for last week showed that net speculative long positions increased by 8.2k to 286.4k contracts. There haven't been more than two consecutive weeks of declines in spec long positions since the January/February period.

Silver extended to the upside to trade with a 34 handle for the first time since late November 2012. Last week's impressive performance marked the fifth higher weekly close out of the past six weeks.

Last week's upside breakout above the previous range high at $32.700 is a bullish technical event that bodes well for a short-term challenge of the $35.217 Fibonacci level (61.8% retracement of the decline from $49.752 to $11.703). An eventual breach of the latter would bode well for a return to the record-high $50 level.

Last week's COT report saw the net speculative long position in silver fall by a modest 0.7k to 54.0k contracts. It was the third consecutive weekly contraction and was likely attributable to market disappointment over Chinese stimulus early last week. I imagine Friday's upside breakout pulled a lot of longs back in.

CFTC Silver speculative net positions

The intraday low at $33.573 protects a minor chart point from Friday at $33.094/00. The first level of significant support is marked by former resistance at $32.700.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.