Zaner Daily Precious Metals Commentary

Thursday, September 26, 20249/26/2024

Gold and silver extend higher in anticipation of Chinese fiscal stimulus

OUTSIDE MARKET DEVELOPMENTS: China's Politburo has pledged to deploy "necessary fiscal spending" to boost growth back to its 5% target. Citing sources, a Reuters article reports that the Ministry of Finance plans to issue CN¥2 trillion in sovereign bonds this year.

This comes on the heels of a surprise move by the PBoC earlier in the week that saw reserve requirements and key interest rates lowered. Bloomberg suggests the additional measures would "supercharge" China's stimulus.

"China’s policymakers are pulling out the stops," said David Qu of Bloomberg Economics. Qu noted that China is showing "an unusually high degree of urgency and determination to support the economy."

European stocks and bonds are rallying on mounting expectations that another ECB rate cut is in the offing. The latest ECB Bulletin sees scope for an uptick in inflation in Q4 before resuming the downward path to the 2.0% target in 2025. However, the central bank believes "risks to economic growth remain tilted to the downside."

U.S. durable orders for August were unchanged, better than the -2.6% market expectations, versus a revised +9.9% in July. The ex-transportation print was -0.5%.

The third report for U.S. Q2 GDP came in unrevised at 3.0%. Consumption was revised down to 2.8% from 2.9% in the second report. The price index was steady at 2.5%.

Initial jobless claims fell 4k to 218k in the week ended 21-Sep, below expectations of 225k, versus an upward revised 222k in the previous week. That's the lowest print since May. Continuing jobless claims rebounded 13k to 1,834k.

Today's U.S. data were generally positive, consequently, bets on another jumbo rate cut have moderated somewhat. The potential for a 50 bps rate cut in November stands at 52.1% currently, down from 57.4% yesterday.

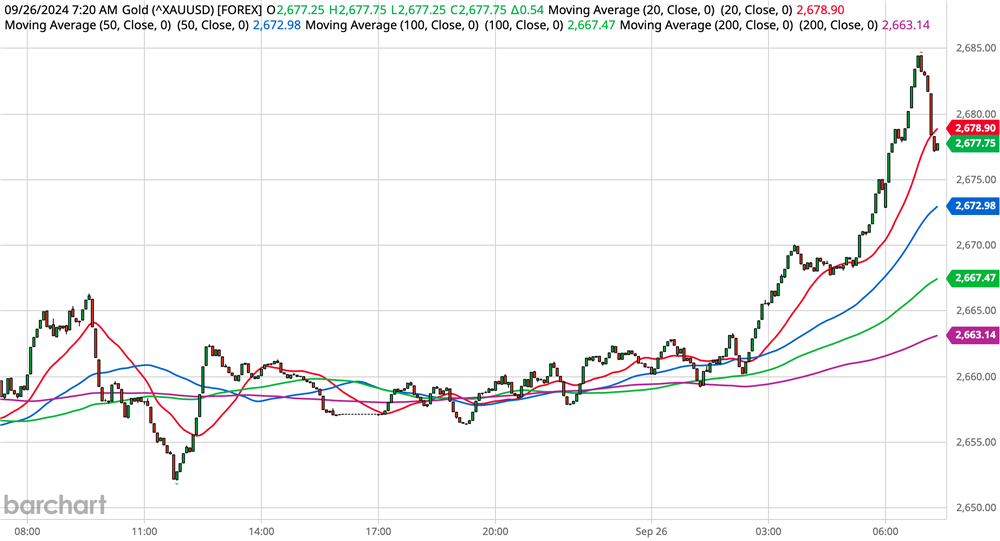

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$15.74 (+0.59%)

5-Day Change: +$76.87 (+2.97%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +44.90

Gold has now set record highs in five consecutive sessions, nine of the last eleven. News that China will add CN¥2 trillion in fiscal stimulus on top of the monetary stimulus announced earlier in the week is the latest driving force.

While gold has retreated into the range after setting the latest ATH at $2,684.45, pullbacks are still seen as corrective and are expected to attract further buying interest. Initial support is marked by the overseas low at $2.656.34, which protects Wednesday's low at $2,652.08. More substantial supports are at $2,624.58 (24-Sep low) and $2,414.86 (23-Sep low).

With the latest Fibonacci objective at $2,674.84 satisfied and exceeded, focus shifts to $2,700.00/$2,709.14. Confidence in the longer-term target at $3,000 continues to grow.

Incrementum, the producers of the In Gold We Trust report, reminded us via X that their bullish projection from 2020 is "almost exactly on track." Incrementum sees potential to $4.821 by 2030!

The most recent In Gold We Trust report 2024 was released in May and is well worth a read if you haven't done so already. The yellow metal is up nearly 13% since the report came out.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.811 (+2.55%)

5-Day Change: +$1.240 (+4.03%)

YTD Range: $21.945 - $32.657

52-Week Range: $20.704 - $32.657

Weighted Alpha: +46.19

Silver clearly likes the idea of "supercharged" Chinese stimulus. The white metal established a new 12-year high of $32.657 before retreating into the intraday range. Silver has gained more than 37% year-to-date.

The violation of the May high at $32.379 reestablishes the 4-year uptrend off the $11.703 low from March 2020. The $33.00 psychological barrier is the next upside target. Beyond that, there's a Fibonacci projection at $33.972.

The next major level I'm watching is $35.217 which marks 61.8% retracement of the entire decline from $49.752 (April 2011 high) to $11.703.

The Asian low at $31.799 remains protected thus far, keeping yesterday's low at $31.642 at bay. Pullbacks are expected to be viewed as buying opportunities with Chinese stimulus and a global bias toward monetary easing expected to provide a persistent tailwind for the market.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

.png)