Zaner Daily Precious Metals Commentary

Wednesday, December 18, 202412/18/2024

Gold and silver remain range-bound with all eyes on the Fed

OUTSIDE MARKET DEVELOPMENTS: All eyes are on the Fed today in anticipation of a third consecutive easing to round out the year. A 25 bps cut is widely expected, resulting in 100 bps of cumulative easing since September.

The market is particularly interested in the Fed's forward guidance for 2025, given the generally resilient economy and the fact that inflation remains above the 2% target. There had been some tapering of easing expectations for next year recently, although a bid in Treasuries heading into the decision suggests some unwinding is happening. A pause is still favored for January.

I look for the forward guidance to emphasize data dependency, striking a cautious tone about sticky inflation. Call it neutral with a slight hawkish tilt. The dots are likely to edge toward 75 bps in additional cuts in the year ahead.

Any over-emphasis on inflation or dots below 75 bps for next year would be positive for the dollar. On the other hand, a more dovish tilt (unlikely) would weigh on the dollar.

The BoE will announce policy tomorrow and is likely to hold the bank rate at 4.75%, amid heightened inflation worries. Governor Bailey signaled last month that the UK budget is likely to stoke inflation.

The BoJ will announce policy tomorrow (our tonight). While the BoJ is the odd man out with a tightening bias, global and regional uncertainty is likely to result in a hold. The BoJ took rates above the zero-bound for the first time in 14 years in March. It was the first rate hike in 17 years. A follow-on hike in July brought the policy rate to 0.25%, a level not seen since February 1999.

MBA Mortgage Applications fell 0.7% in the week ended 13-Dec, correcting gains seen in the previous two weeks. The 30-year mortgage rate rebounded to 6.75%, versus 6.67% in the previous week.

Housing Starts fell 1.8% to 1.289M in November, below expectations 1.344M, versus a revised 1.312M in October (was 1.311M). That's the weakest pace since July. Multifamily starts plunged 23.2%. High mortgage rates remain a headwind.

Current Account Balance widened to a record deficit of -$310.9 bln in Q3, outside expectations of -$284.0 bln, versus a revised -$275.0 bln in Q2 (was -$266.8 bln).

GOLD

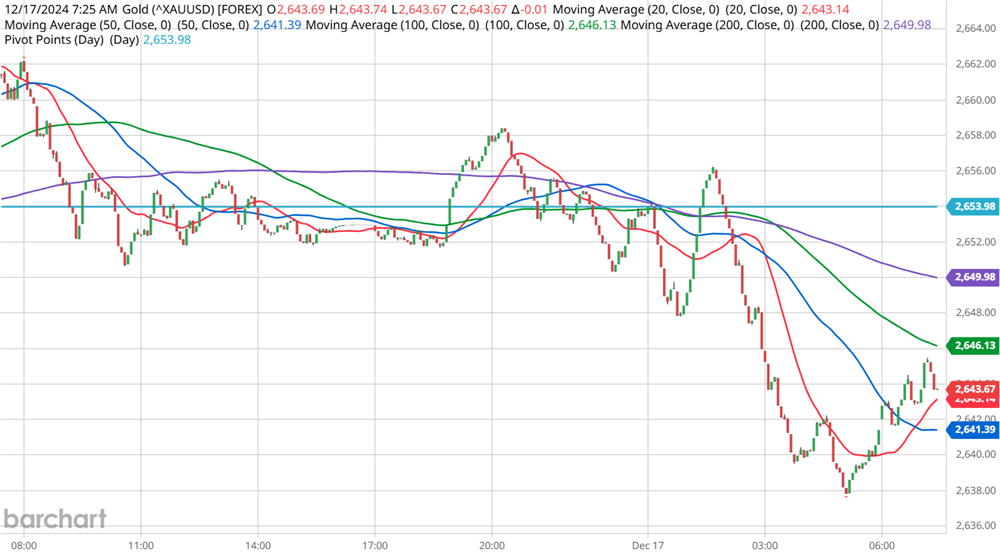

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$0.35 (+0.01%)

5-Day Change: -$74.81 (-2.75%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +26.84

Gold slipped to a new low for the week, but remains broadly consolidative awaiting this afternoon's Fed decision. The market is not expecting any big surprises, perhaps just a slightly more hawkish tilt in the forward guidance.

While I expect the well-defined $2,789.68/$2,541.42 range to hold, we are in the lower half of that range and recent probes into the upper half have proven to be unsustainable. The lows from the past three weeks at $2,628.79/$2,617.65/$2,609.76 provide a solid intervening barrier ahead of the $2,541.42 cycle low.

On the upside, Monday's high at $2,63.89 needs to be negated to clear the way for renewed tests above $2,700. The $2,719.75/$2.723.70 highs are the key to unlocking a challenge of the $2,789.68 record high.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$0.169 (-0.55%)

5-Day Change: -$1.578 (-4.95%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +21.79

Silver remains defensive in advance of the Fed decision. The low from early December at $30.08 is intact thus far, keeping the more important $29.736/703 lows at bay, but the downside is seen as vulnerable.

A dip below $30.080/00 would clear the way for a challenge of those lows, with the potential to extend to the 200-day moving average at $29.601. Below the latter, the next level of significant support is the $28.306 Fibonacci level.

Fresh highs for the week above $30.724 would set a more favorable short-term tone, suggesting initial potential to Friday's high at $31.088. Penetration of the latter would bode well for tests back above $32.00.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.