Morning Metals Call

Friday, November 22, 2024

11/20/2024

Gold remains underpinned by geopolitical risks but revived dollar strength limits

OUTSIDE MARKET DEVELOPMENTS: Russia has pledged to retaliate for President Biden’s decision to allow Ukraine to strike targets within Russia with U.S.-made missiles. The U.S. embassy in Kyiv closed today in anticipation of significant Russian missile and drone attacks.

Sky News is reporting that Ukraine has fired British Storm Shadow missiles into Russia. Russia's recently revised nuclear doctrine views aggression from any non-nuclear state – but with the participation of a nuclear power – a joint attack on Russia.

Does Russia now view itself at war with the U.S. and UK, and perhaps NATO as a whole? While doctrine now suggests a nuclear response is possible, Russian nuclear saber-rattling is nothing new.

Markets are nervously awaiting a response from Putin. Events this week are most certainly escalations of the conflict and markets have shifted to more risk-off positioning.

The U.S. vetoed a UN Security Council resolution that demanded an "immediate, unconditional and permanent cease-fire" in Gaza. The U.S. objected because the resolution did not call on Hamas to release the remaining hostages.

While geopolitical tensions are at the fore of the market's consciousness, speculation about the Fed's policy intentions for the December FOMC meeting persists. Fed funds futures now suggest a 41% probability of rates being held at 4.50%-4.75%. That's up from 17.5% a week ago and 21.8% a month ago.

The prospect of a less-dovish Fed heading into the new year provides an additional tailwind for the dollar. The dollar index set a 13-month high last week largely on post-election investment flows driven by expectations of more market-friendly policies from the incoming President and Congress.

The recent setback in the greenback was limited and had the characteristics of a bull flag formation. This chart pattern favors additional near-term gains. Most of the setback from last week's high has already been retraced.

Scope is seen for a challenge of last year's high in the DX at 107.35. This level is bolstered by the 50% retracement level of the entire decline from the 2022 high at 114.78 to the 2023 low at 99.58.

MBA Mortgage Applications rose 1.7% in the week ended 15-Nov. It was the second consecutive week of improvement but with 30-year mortgage rates reaching a 19-week high of 6.90% headwinds for the housing market persist.

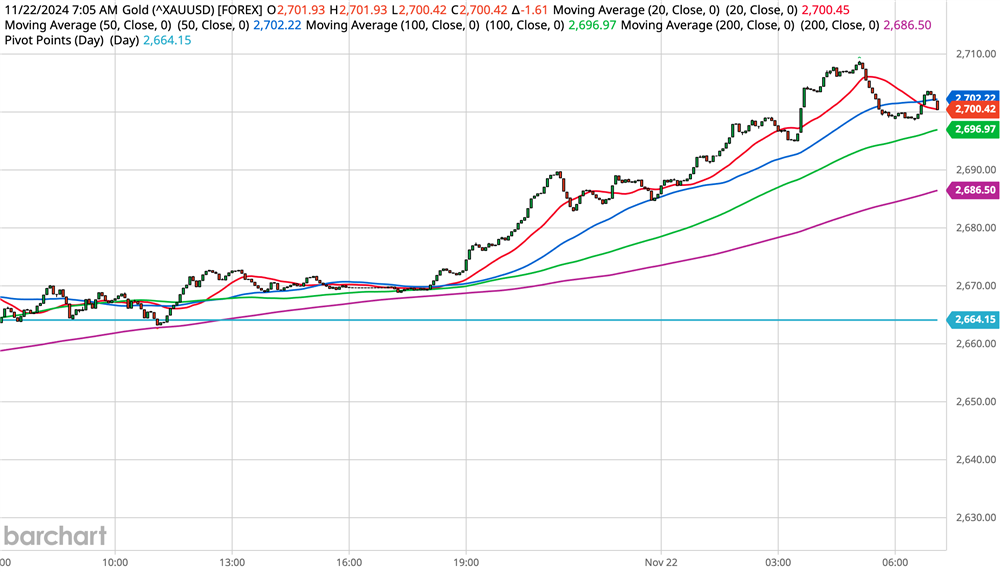

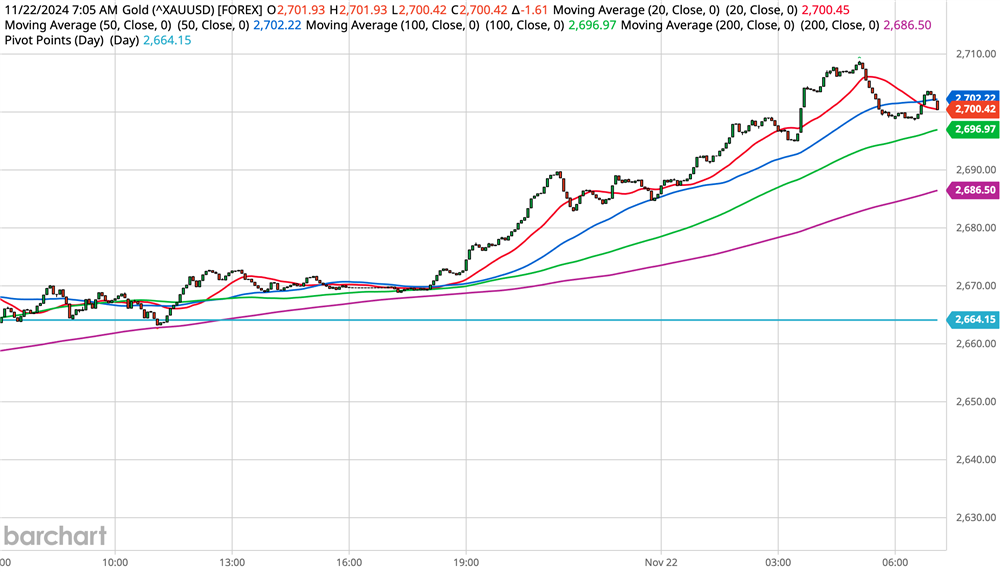

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$4.51 (-0.17%)

5-Day Change: +$76.23 (+2.96%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +31.37

Gold remains underpinned by heightened geopolitical tensions. However, dollar strength and rising expectations of a December hold by the Fed are seen as limiting factors.

Nonetheless, the yellow metal is edging toward an important resistance level at $2,659.09/$2,665.55 where the 50-day moving average corresponds closely with the halfway back point of the recent decline. A push through this zone would suggest to me that the corrective low is in place at $2,541.42.

My initial expectation was that gold would meet resistance shy of the all-time high at $2,789.68 and choppy consolidative trading would prevail into year-end. Such price action would be a continuation pattern within the long-term uptrend. I do believe that trend ultimately resumes.

However, if tensions associated with the war in Ukraine continue to escalate, the uptrend could re-exert itself much faster. If Russia were to use a tactical nuclear weapon or if there is direct fighting between Russian and NATO forces, gold could surge to $3,000 and beyond.

The World Gold Council noted healthy gold jewelry, coin, and bar buying in India during Diwali, despite record-high prices. According to the WGC, "Volatility in domestic equity markets, coupled with rising international prices, has added to gold’s investment appeal." This has also contributed to robust ETF inflows.

Swiss gold exports jumped to 101 tonnes in October, helped by Indian seasonal demand. That's an 8% increase versus September. However, exports are still down about 38% y/y due to slack demand from China and Hong Kong stemming from record-high prices.

If gold is unable to move convincingly above $2,665.55 a move back below $2,600 would have to be considered. Today's overseas low at $2,621.25 and yesterday's low at $2,610.94 provide intervening barriers.

Silver is trading lower today, unable to build on gains notched earlier in the week. The white metal typically does not have the same haven appeal as gold, so there is less of a buffer against today's resurgent dollar.

That being said, the Silver Institute report I cited yesterday notes that Russia's initial invasion of Ukraine and the resulting sanctions corresponded closely with a significant turning point in silver. In times of geopolitical unrest, investors turn to alternative assets, including silver, as an investment.

"During times of safe haven demand due to flare-ups in geopolitical tensions many of the relationships with the fundamental drivers for silver are interrupted," according to the report.

Last week's high at $31.503 successfully contained the upside yesterday, leaving the 50-day moving average at $31.769 protected. Penetration of these levels is needed to shift focus to the more important $32.048/294 zone where good chart resistance corresponds with the halfway back point of the four-week decline.

A move above $32.294 is needed to suggest that the corrective low is in place at $29.736 (14-Nov).

Today's European low at $30.827 marks initial support. Penetration would bode well for another run at the 100-day moving average, which is at $30.394 today.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

11/19/2024

Gold extends gains on haven bid after Ukraine fires U.S.-made weapons into Russia

OUTSIDE MARKET DEVELOPMENTS: Ukraine reportedly fired six U.S.-made ATACMS missiles at a Russian military installation in the Bryansk region of Russia. Moscow reports that five missiles were shot down, the sixth was damaged, and there were no casualties.

The attack occurred just days after President Biden gave the green light for Ukraine to use U.S. weapons to hit targets on Russian soil. President Putin warned in September that “This will mean that NATO countries – the United States and European countries – are at war with Russia."

Putin lowered the threshold for the use of nuclear weapons in response to Biden's decision. "The Russian Federation reserves the right to use nuclear weapons in the event of aggression with the use of conventional weapons against it," said a Kremlin spokesman.

The escalation of the conflict has put markets on edge awaiting Putin's response. Post-election risk-on flows that have dominated the past two weeks have been tempered and perhaps reversed. President-elect Trump has pledged a negotiated peace deal even before he moves into the White House. Uncertainty and risks abound.

The haven bid has buoyed Treasuries and gold. The dollar index remains off the 13-month high set last week, but the downside is seen as limited from here.

U.S. Housing Starts contracted to a 1.311M pace in October, below expectations of 1.330M, versus a revised 1.353M in September (was 1.354M). Building Permits slid to a 1.416M pace from 1.425M in September. Housing Completions tumbled to 1.614M versus 1.688M.

FedSpeak is due from KC Fed President Jeffrey Schmid (centrist) this afternoon.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$17.05 (+0.65%)

5-Day Change: +$39.37 (+1.52%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +30.57

Gold has extended to the upside lifted by safe-haven demand after Ukraine wasted no time in using U.S. weapons after receiving permission to do so from President Biden. Just over 38.2% of the two-week decline has now been retraced.

Further escalation in Ukraine should lead to further upside retracement. Russia's use of tactical nuclear weapons or the direct involvement of NATO forces could almost certainly send gold soaring to new record highs and beyond.

My position has been that the decline off the $2,789.68 record high (30-Oct) is a correction within the long-term uptrend. The high-to-low magnitude of the drop has been just shy of 9% thus far. I was also heartened by the fact that the 100-day moving average survived last week's challenge.

Nonetheless, it's premature to suggest the corrective low is in. My preferred scenario was that a range would develop and choppy consolidative trading would prevail into year-end.

Heightened risks associated with the war in Ukraine could absolutely reignite the dominant uptrend. Markets are nervously awaiting Putin's response to today's missile attack.

The next resistances I'm watching are $2,656.21 (50-day moving average) and $2,665.55 (50% retracement). Penetration of the latter would go a long way toward confirming that the corrective low is in place at $2,541.42.

If President-elect Trump, or some other party, can get Russia and Ukraine to the negotiating table geopolitical tensions could moderate pretty quickly. That would likely put gold back on the defensive.

A negotiated peace would almost certainly require Ukraine to cede territory to Russia, something they appear loathe to agree to. After 1,000 days of Russian aggression within Europe, is it even possible for the U.S. and its allies to put NATO expansion back on the table?

Failure to sustain the recent gains back above $2,600 would favor a test of the halfway back point of the rally at $2,589.86. A breach of the latter would leave the 100-day moving average and last week's low vulnerable to further tests.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.115 (+0.37%)

5-Day Change: +$0.671 (+2.18%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +28.73

Silver extended to new highs for the week in early U.S. trading, buoyed by strength in gold and helped by a generally neutral dollar. However, the white metal has since slipped back into negative territory leaving the price confined to last week's range.

With last week's high at $31.503 intact, the 50-day moving average at $31.722 is protected. Penetration of these levels is needed to shift focus to the more important $32.048/294 zone where good chart resistance corresponds with the halfway back point of the four-week decline.

A move above $32.294 would strongly suggest that the corrective low is in place at $29.736 (14-Nov).

The Silver Institute released a report today highlighting the benefits of a silver allocation for diversification and risk reduction. "Historically, silver has proven its value during economic and geopolitical crises, serving as a reliable hedge against inflation, currency devaluation, and systemic financial instability," according to the report.

New intraday lows below $31.099 would return focus to a pivot point at $30.890 with potential back to $30.600 (50% retrace of the rally from last week's low).

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

11/18/2024

Gold and silver bounce on revived geopolitical risks, softer dollar

OUTSIDE MARKET DEVELOPMENTS: President Biden has given Ukraine permission to use U.S. long-range missiles to strike military targets within Russia. Vladimir Putin had previously warned that such an attack would mean the U.S. and Russia are at war.

“Today, there is a lot of talk in the media about us receiving a permit for respective actions. Hits are not made with words. Such things don’t need announcements. Missiles will speak for themselves,” said Ukrainian President Zelensky.

After 1000 days of war, the Russian military is depleted – to the point of using North Korean troops on the frontline – and it seems unlikely they would seek direct conflict with the U.S. and NATO. However, Putin has already threatened to use nuclear weapons.

This is a rather significant escalation. After nearly two weeks of post-election repositioning, there has been a realization that geopolitical risks persist.

Israel conducted a targeted strike in Beirut on Sunday that killed a key Hezbollah spokesman. The terrorist group responded by firing more than one hundred rockets into Northern Israel.

China's Xi Jinping spoke with President Biden on the sidelines of the APEC conference in Lima, Peru. "China is ready to work with the new U.S. administration, to maintain communication, expand the cooperation and manage differences, so as to drive forward a steady transition of the China-U.S relationship for the benefit of the two peoples," said Xi.

The two leaders also agreed it was better for human beings rather than AI to control their nuclear arsenals. That's reassuring!

U.S. NAHB Housing Market Index rose three points to a seven-month high of 46 in November from 43 in October. The future sales component was the driving force, defying the rebound in mortgage rates that began in October.

TIC Data for September comes out this afternoon.

Chicago Fed President Austin Austan Goolsbee warned that clearing in the $28 trillion US Treasury market has become much more concentrated in recent years. He views this as a risk.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$31.90 (+1.24%)

5-Day Change: -$15.28 (-0.58%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +28.32

Gold rebounded nearly 2% as market focus returned to geopolitical risks. The yellow metal appears poised for its first higher daily close in seven sessions, helped by a setback in the dollar.

The move back above $2,600 is encouraging following last week's bounce off the 100-day moving average. However, additional gains are needed to return confidence to the longer-term uptrend.

Initial resistances are at $2,614.77 (13-Nov high) and $2,625.32 (12-Nov high). More important levels to watch this week are $2,636.26 (38.2% retrace), $2,653,93 (50-day MA), and $2,655.65 (50% retrace).

Penetration of the latter would signal that the corrective low is in place. At that point, I expect choppy consolidative trading to prevail into year-end.

If tensions between Russia, the U.S., and NATO flare, the uptrend could certainly re-exert itself more quickly. A rebound above $2,700 would put the record high from 30-Oct at $2,789.68 back in play.

Initial support is marked by a minor intraday chart point at $2,582.71, which protects today's Asian low at $2,563.06 and Friday's low at $2,556.18. More important supports are noted at $2,548.47 (100-day MA) and $2,541.42 (14-Nov low).

There were 23.7 tonnes of net outflows from global ETFs last week. European investors were the leading sellers at -18.2 tonnes. It was the biggest net weekly outflow in more than a year. Interestingly, in the first full post-election trading week, there were 0.8 tonnes of inflows from U.S. investors.

Last week's COT report revealed net speculative long positions in gold futures contracted by 18.8k to 236.5k contracts. It was the third straight weekly drop and the lowest since the 14-Jun week.

Silver rebounded to a five-session high above $31, boosted by a higher gold price, a weaker dollar, and revived geopolitical risks. The white metal is up nearly 3% intraday.

The net speculative long position in silver futures declined by 5.7k to 47.6k last week according to the latest CFTC COT report. It was the third consecutive weekly decline and the lowest reading in nine weeks.

CFTC Silver speculative net positions

Silver still needs to regain the $32 level to ease pressure on the downside and to suggest that the low is in. Intervening resistance is noted at $31.664/691, where the 50-day MA corresponds closely with the 38.2% retracement level of the three-week decline.

On the downside, former resistances at $31.021/000 and $30.773 now offer support. Today's overseas low and the low from Friday at $30.260/200 now protect the cycle low at $29.736 (14-Nov low).

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

11/15/2024

Gold and silver rebound modestly but appear poised for a third straight weekly loss

I'm in Baltimore for the Whitman Winter Expo. I'm going to make today's commentary short and sweet so I can get to the show.

OUTSIDE MARKET DEVELOPMENTS: U.S. Retail Sales rose 0.4% in October, above expectations of +0.3%, versus a positive revised +0.8% in September (was +0.4%). Ex-auto rose 0.1% on expectations of +0.4%, versus an upward revised +1.0% in September (was +0.5%)

U.S. Empire State Index surged 43.1 points to a 38-month high of 31.2 in November, well above expectations of -0.9, versus -11.0 in October.

U.S. Import Price Index +0.3% in October, above expectations of -0.1%, versus -0.4% in September. Ex-petro was +0.2%.

U.S. Export Price Index +0.8 in October, well above expectations of -0.1%, versus a revised -0.6% in September.

Industrial Production and Business Inventories come out later this morning. FedSpeak is due from Collins and Williams.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$5.30 (+0.21%)

5-Day Change: -$114.38 (-4.26%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +27.34

Gold is trading modestly higher, looking to end its five-day losing streak, but will still notch a third consecutive lower weekly close.

The yellow metal remains confined to yesterday's range thus far, but we could see some additional short-covering into the weekend as traders ring up profits on this week's more than 4% plunge.

A breach of yesterday's high at $2,580.58 could spark a move back to $2,600.00. However, at this point, I'm inclined to view upticks as corrective within the short-term downtrend.

Bears are likely to view a bounce as a selling opportunity. There may also still be some longs in the market contemplating a belated capitulation at a higher price.

That being said, I like the rebound off the 100-day moving average that we saw yesterday. It's just premature to suggest the low is in.

A further retracement back above $2,636.26 and more importantly $2,665.55 would return a measure of credence to the uptrend. However, I'm not expecting new record highs until Q1'25 at this point. Choppy range trading is likely to prevail for the remainder of 2024.

On the downside, fresh cycle lows below $2,541.42 would shift focus to the next level of significant support at $2,482.74, which marks a 38.2% retracement of this year's rally.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.244 (+0.80%)

5-Day Change: -$0.578 (-1.85%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +27.57

Silver managed a higher daily close yesterday and there's been some modest upside follow-through today. Nonetheless, the white metal appears destined for a third straight lower weekly close.

Silver needs to regain the $32 level to ease pressure on the downside and to suggest that the low is in. Intervening resistances are noted at $31.021 (13-Nov high) and $31.618 (50-day MA).

A breach of yesterday's low at $29.736 would allow for a true test of the $29.706 Fibonacci level. Below the latter, $29.00 and the 200-day moving average at 28.727 would be the attraction.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.