Morning Metals Call

Tuesday, December 3, 2024

12/2/2024

Gold and silver weighed by firmer dollar

OUTSIDE MARKET DEVELOPMENTS: Ukrainian President Zelenski has suggested that he might be willing to cede territory currently in Russian hands – at least temporarily – if his country is accepted into NATO. “If we want to stop the hot phase of the war, we need to take under the NATO umbrella the territory of Ukraine that we have under our control,” Zelensky said.

This seems like a non-starter for Russia as NATO expansion to include Ukraine was seen by many as a pretext for the invasion. The FT reports that the Kremlin requires the end of U.S. aid to Ukraine, the removal of Zelenski, and a discussion between Putin and Trump on “all the issues of the global order at the highest level.”

Putin is warning that Russia could strike “decision-making centers” in Kyiv with ballistic missiles, while the U.S. is sending an additional $725M in military aid to Ukraine. Peace in Ukraine does not seem imminent.

Israel says Hezbollah fired on IDF positions in disputed territory, testing the fragile ceasefire. Hezbollah acknowledged the attack saying it was a “defensive and warning response” to repeated Israeli violations of the ceasefire.

Meanwhile, the HTS rebel group has seized Aleppo, the second-largest city in Syria with little opposition from government forces. It is widely believed that the Russian and Iranian-backed forces of Syrian President Bashar al-Assad will mount a counteroffensive.

President-elect Trump has warned the BRICS countries that he won't tolerate the creation of a new currency to challenge the status of the dollar as the preeminent global reserve currency. He threatened 100% tariffs and loss of access to U.S. markets for failing to heed his warning.

If this latest threat of tariffs has any teeth, the de-dollarization trend could be slowed. However, it highlights the "exorbitant privilege" the U.S. has maintained for decades. The fact that Trump is prepared to defend the dollar may harden the resolve of the BRICS and could draw the attention of other trading partners.

The dollar starts the week on firmer footing, retracing some of last week's losses. Trump's jawboning is likely a factor, as are trimmed expectations for additional rate cuts next year. While a 25 bps rate cut in December is still favored, Fed funds futures suggest a bias toward just one additional 25 bps cut in H1'25.

It's a data-heavy week ending with the November jobs report on Friday. We'll also hear lots of FedSpeak, including from Chairman Powell.

U.S. S&P Global Manufacturing PMI final rose to a six-month high of 49.7 in November versus a flash reading of 48.8 and 48.5 in October.

U.S. Manufacturing ISM jumped 1.9 points to a five-month high of 48.4 in November, above expectations of 47.7, versus 46.5 in October. Prices modered to 50.3 from 54.8 in October.

U.S. Construction Spending rose 0.4% in October, above expectations of +0.2%, versus +0.1% in September. The hurricanes provided a boost to spending.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$8.33 (-0.31%)

5-Day Change: +$12.24 (+0.47%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +29.45

Gold is under modest pressure, weighted by a firmer dollar. Despite four straight higher daily closes to end last week, the yellow metal still posted a 2.4% weekly loss.

Monday's sharp drop spurred by the Israel-Hezbollah ceasefire was the dominant feature on the chart, but geopolitical tensions remain broadly elevated, providing some underpinnings for the market.

Dollar strength spurred by tough talk from President-elect Trump to the BRICS nations and expectations of a more hawkish Fed is seen as a headwind. Choppy consolidative trading within the $2,789.68/$2,541.42 range into year-end remains likely.

Today's probes above the 20-day moving average at $2,639.20 have been a struggle, leaving the more important 50-day MA protected at $2,669.47. The latter is bolstered by the midpoint of the range at $2,665.55.

Thursday's low at $2,623.08 has contained the downside and the bounce from $2,623.31 fortifies this support level. Last week's low at $2,609.76 marks secondary support.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -0.130 (-0.42%)

5-Day Change: +$0.123 (+0.41%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +27.36

Silver caught a bit of a bid in overseas trading after better-than-expected Chinese manufacturing data provided some demand optimism. However, upticks could not be sustained and the white metal continues to straddle the 100-day and 20-week moving averages.

With price action confined to the lower half of last week's range, the short-term technical bias remains to the downside. Support at $29.736/703 defines a potential double-bottom that perhaps warrants a challenge.

Penetration would shift focus to the rising 200-day moving average at $29.159.

It would take a breach of resistance at $31.417/465 to confirm the double-bottom and set a more favorable tone within the range. Good intervening resistance is noted at $30.853/656 where the 20-day moving average corresponds closely with Friday's high.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

11/27/2024

Gold edges higher on increased odds for a December rate cut and softer dollar

OUTSIDE MARKET DEVELOPMENTS: The ceasefire between Israel and Hamas took effect last night and appears to be holding. Over the next 60 days, Hezbollah will withdraw at least 25 miles from the border and Israel will pull out of Lebanon.

In the meantime, negotiations will continue to craft lasting peace. The Biden administration now turns its attention to a ceasefire between Israel and Hamas. That may be harder to achieve.

The minutes from the November FOMC meeting were released yesterday afternoon. While the bias remains toward normalization, the committee acknowledged that recent FedSpeak has been "interpreted as signaling a more gradual pace of policy easing than previously thought."

The minutes reiterated that the policy path remains data-dependent. Perhaps not surprisingly the members studiously avoided discussion of the election results.

The minutes didn't really move December rate cut expectations, but this morning's pre-Thanksgiving rush of data saw the potential for a 25 bps cut edge up to 70.0%, versus 59.4% yesterday and 55.7% a week ago.

U.S. Durable Orders rose 0.2% in October, below expectations of +0.3%, versus a positive revised -0.4% in September (was -0.8%). Ex-transportation was +0.1%. Shipments -0.6%.

U.S. Advance Indicators International Trade Deficit narrowed 8.8% to -$99.1 bln in October, inside expectations of -$102.0 bln, versus -$108.7 bln. Wholesale inventories rose 0.2% to $905.1 bln. Retail inventories rose 0.1% to $824.7 bln.

U.S. Q3 GDP (2nd report) unchanged at 2.8% in line with expectations. The chain price index was also unchanged and in line at +1.8%.

U.S. Initial Jobless Claims fell 2k to a 30-week low of 213k in the week ended 23-Nov, below expectations of +217k, versus a revised 215k in the previous week. Continuing claims rose to 1,907k in the 16-Nov week, versus a revised 1,898k in the previous week.

U.S. Personal Income rose 0.6% in October, above expectations of +0.3%, versus +0.3% in September.

U.S. PCE rose 0.4% in October, in line with expectations, versus a revised +0.6% in September. The chain price index rose 0.2% m/m and the annualized rate accelerated to 2.3%, versus 2.1% in September. Core +0.3% m/m and 2.8% y/y, up from +2.7% in September.

U.S. Pending Home Sales Index rose 1.98% to 77.4 in October, versus 75.8 in September. Despite the recent rebound, the index remains at weak levels with 30-year mortgage rates near 7%.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$19.05 (+0.72%)

5-Day Change: -$8.77 (-0.33%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +27.19

Gold is trading higher for a second session, buoyed by an uptick in December rate cut expectations and a modestly firmer dollar. The yellow metal remains just below the midpoint of the $2,789.68/$2,541.42 range ahead of the holiday.

I continue to watch the 20- and 50-day moving averages which are at $2,655.49/$2,667.77 today and have successfully capped the upside thus far. The midpoint of the aforementioned range is at $2,665.55.

A push through this zone would bode well for renewed tests above $2,700. Monday's high comes in at $2,719.75 and protects the 78.6% retracement level at $2,736.55.

On the downside, the overseas low at $2,627.83 protects yesterday's low at $2,609.76. The 100-day MA comes in at $2,568.67 and stands in front of the $2,541.42 cycle low.

Silver continues to struggle on upticks above the 100-day moving average. While the range from the 11-Nov week remains intact, the downside looks vulnerable.

If yesterday's low at $30.087 gives way a retest of the $29.736 low from 14-Nov becomes likely. Below the latter, the rising 200-day moving average at $29.044 attracts.

The key resistance level for silver is 32.294, which is the halfway back point of the decline from $34.853 (22-Oct high) to $29.736 (14-Nov low). This level must be exceeded to return some credence to the longer-term uptrend, but it's well protected by multiple tiers of resistance.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

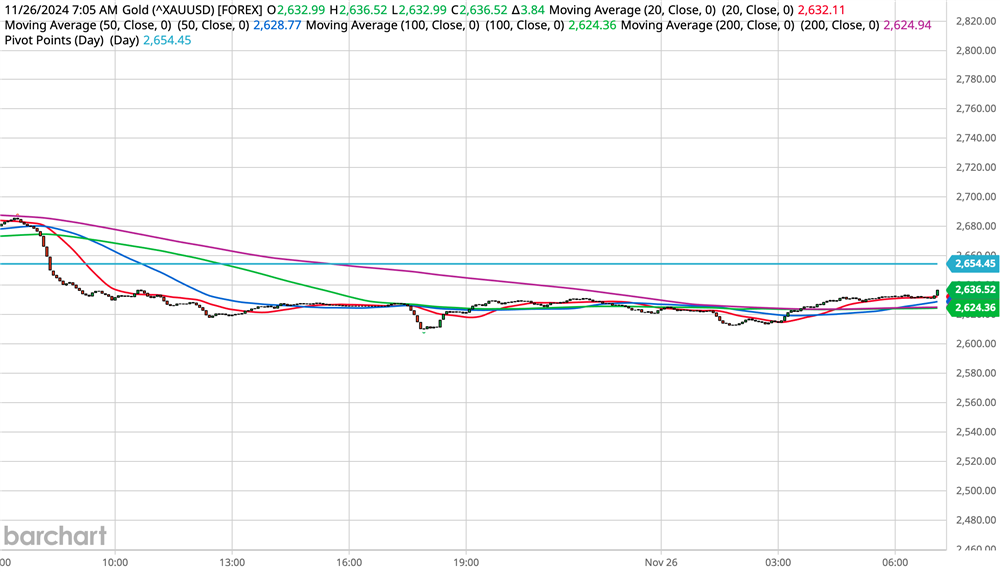

11/26/2024

Gold and silver remain defensive after Monday's losses

OUTSIDE MARKET DEVELOPMENTS: A ceasefire between Israel and Hezbollah appears imminent. As part of the deal, Hezbollah would vacate positions along Israel's northern border allowing the IDF to return its full attention to eradicating Hamas.

The prospect of a truce dialed down global geopolitical risks somewhat stoking risk appetite over the past 24 hours. However, the Israel-Hezbollah conflict is just one part of a complex web of risks. Arguably the recent escalation of the war in Ukraine has greater and far-reaching global implications.

Market enthusiasm over President-elect Trump's nomination of Scott Bessent for Treasury Secretary also contributed to the surge in U.S. risk-on sentiment. Bessent is a highly respected hedge fund manager who will provide sober counsel to President Trump and perhaps smooth some of the rough edges of his trade policies.

Trump is threatening America's largest trading partners with significant tariffs, including 25% on all products coming from Canada and Mexico, and an additional 10% on China. Markets are understandably concerned about a potential trade war and heightened inflation risks.

The President-elect has indicated that the tariffs are a penalty for failing to address the flow of illegal immigrants and drugs into the U.S. This suggests to me that Trump is leveraging access to the world's most desirable consumer market as a negotiating tool to further his broader agenda.

“One tariff would be followed by another in response, and so on until we put at risk common businesses," worried Mexico's President Claudia Sheinbaum. “I think we are going to reach an agreement,” she said.

Nonetheless, the threats of tariffs will foster a sense of global uncertainty and market angst at least through inauguration day. At that point, we'll see if the incoming President moves to impose those tariffs or if "agreements" are quickly achieved.

Scott Bessent is known to be a deficit hawk and if approved by the Senate he'll have his work cut out for him from the get-go. The deficit surged during the COVID crisis and while it moderated subsequently it remained generally larger than pre-COVID levels and is growing once again.

With the national debt now over $36 trillion and debt servicing expenses surging, the new Congress should at least consider reestablishing the debt ceiling to show of commitment to addressing this issue.

U.S. Case-Shiller Home Price Index (nsa) fell 0.3% to 333.6 in September, versus a revised 334.8 in August. It was the first back-to-back monthly decline since January as prices moderated from the 335.8 record high in July. The annualized pace of home price appreciation slowed to 4.6% versus 5.2% y/y in August.

U.S. FHFA Home Price Index jumped 0.7% to a record high of 430.3 in October, above expectations of +0.3%, versus a revised 427.4 in September. It was the fifth consecutive monthly gain, as tight supply continues to override the headwind posed by high mortgage rates.

U.S. New Home Sales plunged 17.3% to 0.610M in October, well below expectations of 0.723M, versus 0.738M in September. Affordability remains a huge issue as prices continue to rise and mortgage rates remain elevated. Two major hurricanes in late September and early October adversely impacted sales as well.

U.S. Consumer Confidence rose 2.1 points to a 16-month high of 111.7 in November, above expectations of 111.4, versus a positive revised 109.6 in October (was 108,7). Consumers are optimistic about the incoming government. While the assessment of the family's current financial situation slipped, consumers had more favorable expectations for the labor market, inflation, and the stock market.

FOMC Minutes from the November 6-7 meeting and M2 come out later today.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$6.81 (+0.26%)

5-Day Change: +$0.23 (+0.01%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +26.62

Gold extended this week's losses in overseas trading to $2,609.76 before stabilizing somewhat. The yellow metal notched its biggest one-day loss in four years on Monday as hopes for an Israel-Hezbollah ceasefire and cheer over Trump's pick for Treasury spurred risk appetite.

Yesterday's optimism has been tempered somewhat today as markets digest Mr. Trump's latest threats of tariffs. There seems to be some consensus that tariffs will reignite inflation and perhaps prompt central banks to leave rates at restrictive levels.

If that proves to be the case, will gold react as the classic inflation hedge, or will it be weighed by its non-yielding status if interest rates rise? I'd lean toward the former based on gold's solid performance during Fed tightening cycles, including the most recent one.

I'd show you Fed fund with a gold price overlay but for some reason, the Fed removed the gold data set from FRED a couple of years ago. I guess it was inconvenient...

The short-term bias is to the downside, but I suspect that buying interest will resurface somewhere ahead of the $2,541.42 cycle low. We can consider support mentioned in yesterday's commentary at $2,610.94/$2,609.54 intact. This level is defined by the low from 19-Nov and 61.8% of the rally off the low.

A test back below $2,600 can not be ruled out, but I think the $2,580/$2,575 zone will contain the downside. Again, I believe choppy range trading will prevail into year-end.

The 20- and 50-day moving averages have converged at $2,662.22/$2,665.90 which is the resistance level to watch on the upside. Penetration would bode well for renewed tests above $2,700.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.236 (+0.78%)

5-Day Change: -$0.600 (-1.92%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +20.22

Silver continues to test below the 100-day moving average but price action remains confined to the range established two weeks ago between $31.503 and $29.736. Today's intraday low at $30.087 provides an intervening barrier ahead of the cycle low.

The short-term bias remains to the downside and tests back below $30 can not be ruled out. A breach of the $29.736 low from 14-Nov would shift focus to the rising 200-day moving average at $29.007.

The 20- and 50-day MAs are at $31.347 and $31.781 today. This area is bolstered by solid chart resistance at $31.417/465 and must be cleared to set a more favorable tone within the range.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

11/25/2024

Gold and silver hit hard by revived risk-on sentiment

OUTSIDE MARKET DEVELOPMENTS: Markets have been cheered by President-elect Trump's broadly appealing choice of Scott Bessent for Treasury Secretary. This has boosted risk appetite offsetting some of the risk-off flows associated with hot geopolitical tensions between Russia and the West.

Bessent is known to be a fiscal hawk who will hopefully be keen to address America's surging debt burden, which is now more than $36 trillion. To accomplish that and keep the economy on an even keel, Bessent may seek to temper Trump's campaign promises for aggressive tax cuts and tariffs.

Stocks and Treasuries are higher. Lower yields have pulled the dollar index off last week's 13-month high.

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$26.83 (-0.99%)

5-Day Change: +$20.32 (+0.78%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +26.60

Gold has come under significant selling pressure amid revived risk appetite, notching the biggest one-day drop since 07-Jun when we saw surprisingly strong May jobs data. The yellow metal has retraced about half of last week's solid gains.

President-elect Trump's nomination for Treasury Secretary and optimism about a possible ceasefire between Israel and Hezbollah have shifted market focus to riskier assets and away from havens like gold.

However, the conflict between Israel and Hamas continues and tensions between Russia and the West remain extremely high. Any escalation in either theater could quickly swing market sentiment back toward risk-off.

I still anticipate a 25 bps rate cut in December, but recent FedSpeak has taken on a more cautious tone heading into 2025, which also poses a bit of a headwind for gold. Prospects for a December hold continue to hover around 40% but became close to a 50-50 proposition on Friday.

Global ETFs saw a modest net inflow of 3.4 tonnes last week on heightened geopolitical risks, ending the string of weekly outflows at two. North American buying eclipsed outflows from Europe and Asia.

Futures traders were apparently less inclined to buy into last week's rally. The latest CFTC COT report showed net speculative long positions fell 2.1k to 234.4k contracts in the week ended 22-Nov from 236.5k contracts in the previous week. It was the fourth consecutive weekly decline.

Last week's gains back above $2,700 went a long way toward suggesting the corrective low is in place at $2,541.42. From there I was expecting choppy consolidative trading to prevail into year end. Today's price action reinforces that expectation with competing risk-on/risk-off forces competing for the attention of investors.

I suggest that such a consolidation phase would bode well for an eventual continuation of the long-term uptrend. A rebound above $2,668.84/$2,669.91 would ease pressure on the downside and suggest potential for further probes above $2,700.

With gold back below the 20- and 50-day moving averages, the short-term bias is back to the downside. Supports to watch are at $2,621.25 (20-Nov low) and $2,610.94/$2,609.54. The latter is marked by the low from 19-Nov and 61.8% of the rally off the $2,541.43 cycle low.

Silver plunged more than 3% in sympathy with gold. The much smaller, more thinly traded silver market has a higher beta that lends itself to amplified moves, particularly on the downside.

Despite the recent swings, the white metal remains confined to the range established in the week ended 15-Nov. However, today's breach of last week's low at $30.260 and the move back below the 100-day moving average suggests the $29.736 cycle low from 14-Nov remains vulnerable to a challenge.

Unlike gold, last week's gains in silver failed to signal that the corrective low was likely in place. I was watching the 20- and 50-day moving averages and the $32.294 Fibonacci level for that confirmation.

The CFTC COT report for last week showed net speculative long positions declined by 1.3k to 46.3k contracts, versus 47.6k in the previous week. While the decline was slight, it was the fourth consecutive weekly decline in net spec long positioning.

CFTC Silver speculative net positions

The 20- and 50-day MAs are at $31.551 and $31.787 respectively and are protected by solid chart resistance at $31.417/465. A rebound through this zone is needed to reinvigorate the bull camp.

I still think we could get a range form as long as gold holds its low. However, a fresh cycle low in silver below $29.736 would shift focus to the rising 200-day moving average at $28.970.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

Good morning. The precious metals are lower in early U.S. trading.

U.S. calendar features Chicago Fed National Activity Index, Dallas Fed Index.