Zaner Daily Precious Metals Commentary

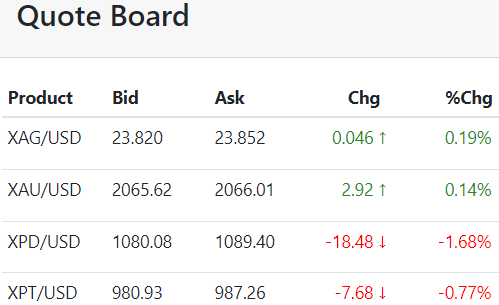

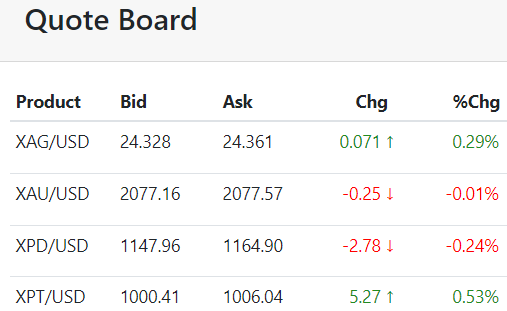

Wednesday, January 3, 2024The gold bears were out this morning as worries over Japanese insurers dumping U.S. government bonds, to cover losses related to this week's earthquakes, sent both bond yields and the dollar sharply higher.

This gold sell-off comes as central banks continue to talk about the need for weaker economic data before they discuss rate cuts, and, on cue, we saw better-than-expected employment data in Europe, adding to worries of a slower-than-expected central bank pivot.

Furthermore, the trade today could see early selling intensify if US ISM manufacturing data comes in positive as expected especially with the afternoon release of the FOMC meeting minutes as any pushing back of US rate cut timing is clearly a major blow to the bull case...[MORE]

Please subscribe to receive the full report via email by clicking here.