Zaner Daily Precious Metals Commentary

Monday, December 30, 202412/30/2024

Gold remains defensive in its range heading into year-end. Silver remains weak.

OUTSIDE MARKET DEVELOPMENTS: Thin holiday trade persists into year-end with another holiday-shortened week. Japan and Europe are largely closed tomorrow. All markets are closed on New Year's Day.

Once the holidays are behind us, the market's attention will shift to inauguration day on January 20. Trump has vowed to take swift action on the trade front by initiating sweeping tariffs. Markets are worried that such measures will stoke global trade tensions and weigh on the global economy.

Trump has also pledged to end inflation in the U.S. although how he intends to accomplish that goal is unclear. Other major priorities include; sealing the southern border and negotiating a peace deal between Russia and Ukraine.

Trump's plans to cut taxes, slash burdensome regulations, and shrink the government should positively impact growth. However, many are worried that higher deficits will be the result.

Many of the promises are short on specifics, so there's a fair amount of uncertainty out there. The market will weigh in more decisively as the details come out and it becomes clear whether the new president has the support of the GOP majorities in Congress.

Chicago PMI fell 3.3 points to a seven-month low of 36.9 in December, below expectations of 42.2, versus 40.2 in November. It was the third straight monthly decline and the 13th consecutive reading below 50.

Dallas Fed Manufacturing Index jumped 6.1 points to a 33-month high of 3.4 in December, well above expectations of -0.4, versus -2.7 in November. That's the first positive reading since April 2022.

Pending Home Sales Index rose 2.2% to 79.0 in November, above expectations of +0.7%, versus 77.3 in October. Despite a four-month climb, the index remains at depressed levels amid persistent housing market headwinds.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$5.18 (-0.20%)

5-Day Change: -$7.29 (-0.28%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +24.59

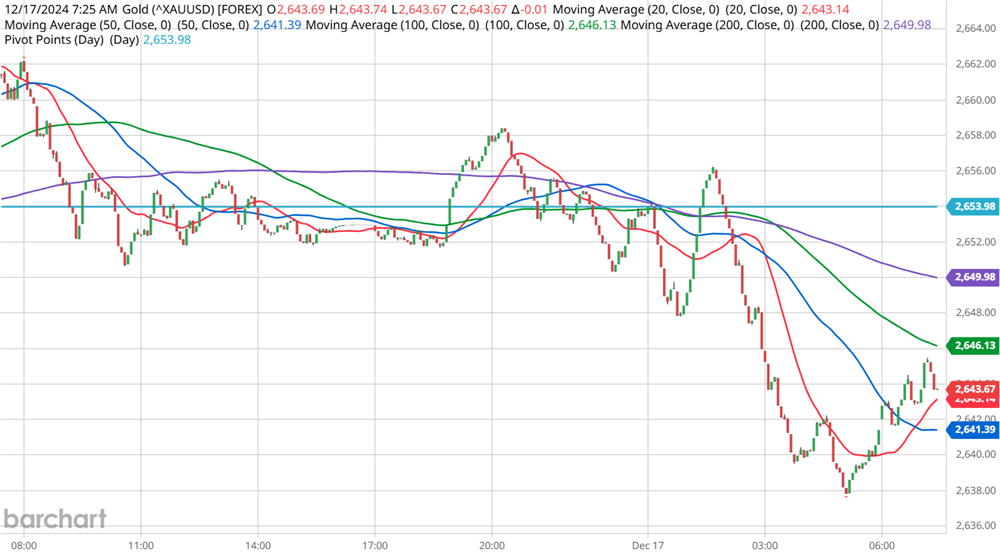

Gold has slipped to a five-session low weighed by a firmer dollar. Nonetheless, the yellow metal remains within the confines of the well-defined $2,789.68/$2,541.42 range.

With both Treasuries and the dollar rallying and stocks under pressure, today's price action smacks of year-end book squaring. The $2,585.51 low from 19-Dec provides a solid intervening barrier ahead of the range low at $2,541.42.

I do expect the latter to hold into the new year, although gold has been trading heavier than I might have expected. Recent tests below the 100-day moving average are particularly troubling, as is the comparative weakness in silver.

Global gold ETFs saw a net outflow of just 0.2 tonnes in the week ended 27-Dec. Moderate selling by North American investors was largely offset by Asian and European buying.

Regardless of President Trump's initial fiscal policy moves, the U.S. economy remains in a significantly better position than those of Europe, the UK, China, Canada, and others. Investment flows into the U.S. should continue to buoy the dollar and pose a headwind for gold.

While I can't rule out another serious test of the downside with the potential, I still view the consolidation since the $2,789.68 record high as a continuation pattern within the longer-term uptrend. The yellow metal is still up more than 25% YTD, which will be its best annual performance since 2010.

Since 2000, there have only been six losing years for gold.

Chart courtesy of Macrotrends.net

I envision ongoing geopolitical tensions and central bank buying to remain bullish influences on gold in 2025. The ever-growing global debt load continues to provide an incentive for diversification out of currency and into a hard asset.

A rebound above the midpoint of the range at $2,665.55 would bode well for renewed tests above $2700 with potential back to the record high at $2,789.68. An eventual breach of the latter would boost confidence in the longer-term bullish scenario that favors a challenge of $3,000.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$0.104 (+0.35%)

5-Day Change: -$0.301 (-1.02%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +18.47

Silver remains defensive below the 200-day moving average as the trade weighs growth risks in China and Europe. The white metal is back within striking distance of the 19-Dec low at $28.783.

Fresh cycle lows would bode well for the anticipated test of the $28.306 Fibonacci level (78.6% retrace of the rally from $26.524 to $34.853). Below that, the September low at $27.732 would be in play.

While silver is still up more than 21% YTD, recent price action has done some damage to the longer-term bullish outlook.

Several more months of choppy consolidation may be in the offing as much of the world looks to revive growth. However, given the broadly positive supply/demand dynamics of the silver market, I continue to believe the uptrend will ultimately re-exert itself. Fresh record highs in gold in 2025 would certainly help the cause.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.