Morning Metals Call

Tuesday, December 17, 2024

12/16/2024

Gold and silver remain consolidative, awaiting Fed decision

OUTSIDE MARKET DEVELOPMENTS: This week's focus is squarely on the two-day FOMC meeting that begins tomorrow. Fed funds futures are fully pricing a 25 bps cut for Wednesday's announcement.

It's the forward guidance and the central tendencies for 2025 that the market is most interested in. Easing expectations for the year ahead have ebbed in recent weeks amid signs of a resilient economy and some warmer inflation readings.

I suspect the policy statement and Powell's comments will lean toward a more cautious rate path in 2025 that will likely begin with a January hold. At this point, the market continues to reflect a bias for slightly less than 100 bps in cuts next year.

A less-dovish Fed and more-dovish tilts from some other major central banks are underpinning the dollar. The dollar index reached a two-week of 107.19 last week and remains well-bid to start the new week.

Before the market shifts into holiday mode, we'll also get U.S. retail sales for November (Tuesday) and the Fed's favored measure of inflation (Friday). Median expectations for retail sales are +0.5%. The PCE chain price index is expected to rise 0.2% m/m.

ECB President Christine Lagarde signaled further interest rate cuts are in the offing. While inflation remains elevated, she's seeing some encouraging signs. "If the incoming data continue to confirm our baseline, the direction of travel is clear, and we expect to lower interest rates further," said Lagarde.

Moody's cut France's credit rating to Aa3 from Aa2 based on a view that "the country's public finances will be substantially weakened over the coming years." Fitch and S&P had already made similar downgrades.

Members of South Korea's General Assembly voted on Saturday to impeach President Yoon Suk Yeol after he angered policymakers by declaring martial law earlier in the month. Yoon's presidential powers have been suspended while the Constitutional Court decides if he will be removed or reinstated.

U.S. Empire State Index plunged 31 points to 0.2 in December, below expectations of 9.8, versus 31.2 in November. “On the heels of a strong November, manufacturing activity held steady in New York State in December. The pace of price increases moderated, and employment declined modestly. Firms were fairly optimistic about future conditions,” said Richard Deitz, Economic Research Advisor at the New York Fed.

U.S. Flash Manufacturing PMI fell 1.4 points to 48.3 in December, versus 49.7 in November. "...output is falling sharply and at an increased rate, in part due to weak export demand," said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

U.S. Flash Services PMI rose 2.54 points to 58.5, versus 56.1 in November. “The service sector expansion is helping drive overall growth in the economy to its fastest for nearly three years..." said Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$14.65 (+0.55%)

5-Day Change: +$0.33 (+0.01%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +27.99

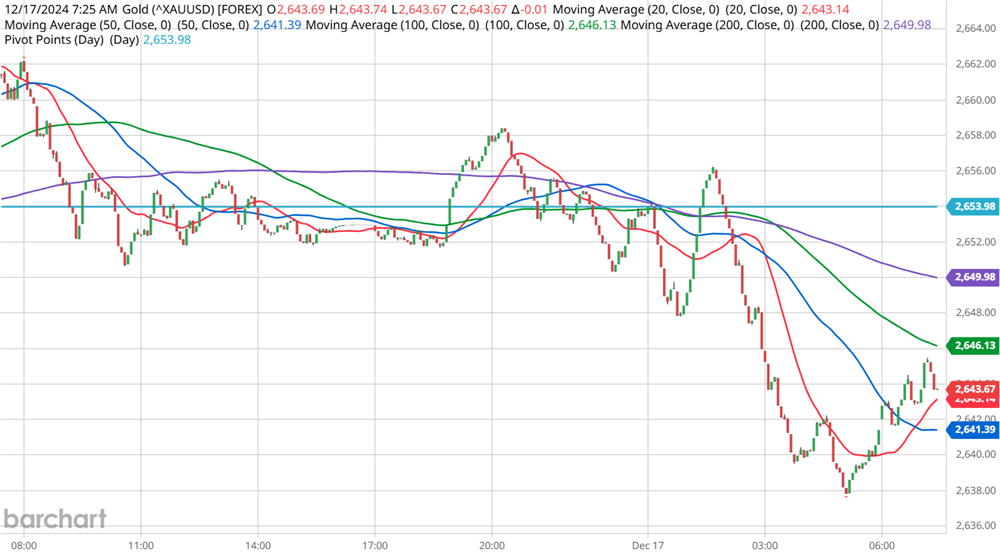

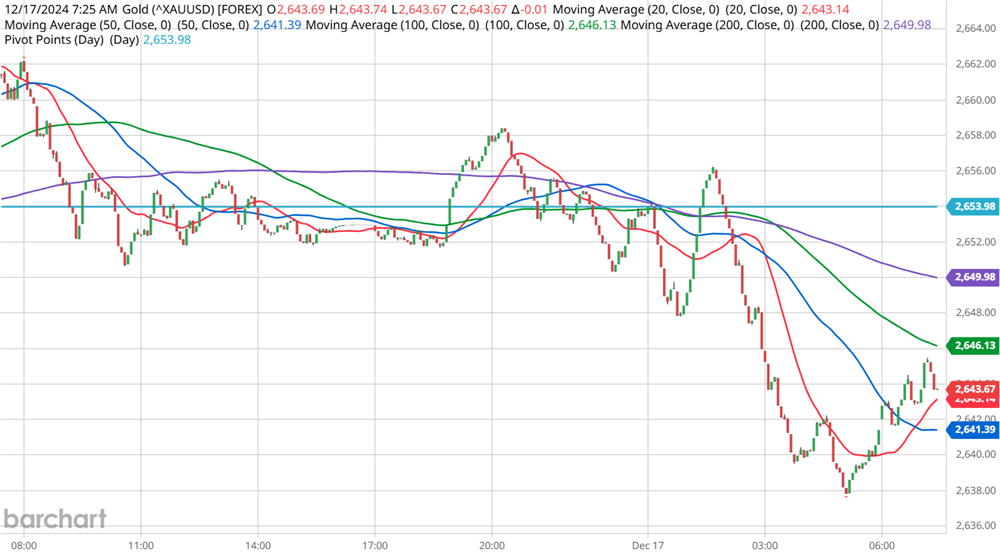

Gold remains range-bound near the 20-day moving average. The yellow metal managed to close 0.6% higher last week, despite the failure to sustain gains above $2,700. Consolidative trading is likely to prevail into year-end.

Ongoing geopolitical tensions, expectations for a 25 bps Fed rate cut on Wednesday, and ongoing dovishness from other major central banks are providing support for gold. On the other hand, an anticipated tilt by the Fed to a less-dovish bias and the resulting firmness in the dollar pose a headwind.

A sustained move above $2,700 is needed to set a more favorable tone within the broader range. The $2,719.75/$2.723.70 area now provides a formidable barrier ahead of the $2,789.68 record high.

A short-term trendline off the $2,541.42 cycle low has contained the downside thus far today, but the retreat seen late last week leaves the lows from the past three weeks at $2,628.79/$2,617.65/$2,609.76 vulnerable to a challenge.

Gold ETFs saw net outflows of 1.7 tonnes in the week ended 13-Dec. It was the second consecutive net weekly outflow. Selling by North American investors eclipsed small inflows from Europe and Asia.

CFTC Gold speculative net positions

The COT report for last week saw net speculative long positions increase by 15.9k to 275.6k contracts, versus 259.7k contracts in the previous week. It was the third straight weekly increase in spec longs.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$0.123 (+0.40%)

5-Day Change: -$1.127 (-3.54%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +23.91

Silver is consolidating at the low end of Friday's range after failing once again to sustain gains above $32 last week. While the white metal was encouraged by the most recent Chinese stimulus pledges, the lack of specifics has disappointed once again.

With silver confined to the lower half of the broad $34.853/$29.703 range, I see a modest downside bias. A breach of Friday's low at $30.347 would suggest potential for tests below $30, although the cycle low at $29.703 is likely to remain protected as the market shifts to holiday trading at the end of this week.

A sustained push above $32 is needed to set a more favorable tone within the range. The recent highs at $32.255/306 reinforced the range midpoint at $32.278.

CFTC Silver speculative net positions

Net speculative long positions in silver futures declined 2.1k to 41.2k contracts, versus 43.3k in the previous week. It was the sixth weekly decline out of the last seven.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

12/12/2024

Gold and silver retreat despite SNB and ECB rate cuts

OUTSIDE MARKET DEVELOPMENTS: While the geopolitical focus shifted to Syria over the past week, Israel continues to prosecute its war against Hamas. Tensions remain high in other regions as well.

Ukrainian missiles and drones struck an oil depot and an "industrial facility" within Russia on Wednesday. Ukraine also fired six U.S.-made ATACMS missiles at a Russian military airfield.

Russia claims that all the ATCMS were shot down or defeated with electronic warfare measures. "This attack by Western long-range weapons will not go unanswered and appropriate measures will be taken," said the Russian Defense Ministry.

There are worries that the promised retaliation will come in the form of another hypersonic Oreshnik missile. Putin also warned previously that the use of NATO-provided weapons like the ATACMS could prompt a Russian response against the providers of those systems.

Earlier this week, China launched one of its largest-ever maritime training exercises in the East and South China Seas. Nikkei Asia reported that China "wants to 'pressure test' Taiwan and see how far it can go." However, Chinese forces are also operating in waters around Okinawa and the Philippines.

The Swiss National Bank (SNB) surprised with a jumbo 50 bps rate cut, halving its policy rate from 1.0% to 0.5%. It was the biggest cut in nearly a decade, bringing the policy rate to its lowest since November 2022.

The SNB noted in the policy assessment that "underlying inflationary pressure has decreased." However, growth risks have become more pronounced.

“Uncertainty about the economic outlook has increased in recent months. In particular, the future course of economic policy in the US is still uncertain, and political uncertainty has also risen in Europe. In addition, geopolitical tensions could result in weaker development of global economic activity. Equally, it cannot be ruled out that inflation could remain higher than expected in some countries.” – SNB Monetary policy assessment

The ECB followed with a 25 bps cut, as was widely expected. The central bank noted that inflation continued to edge down, but remains elevated. They also acknowledged the economy is weakening.

Today's easings come on the heels of yesterday's jumbo rate cut by the BoC and in advance of next week's anticipated 25 bps cut by the Fed. With the policy emphasis shifting from price risks to growth risks, further easing is likely in 2025.

Outgoing Treasury Secretary Yellen expressed regret about not making "more progress" on the deficit during her tenure.

“I am concerned about fiscal sustainability, and I am sorry that we haven’t made more progress. I believe that the deficit needs to be brought down, especially now that we’re in an environment of higher interest rates.” – Treasury Secretary Janet Yellen

Alluding to having made any progress at all has to be a joke. During Yellen's tenure at Treasury, the national debt has increased by $8.4 trillion to exceed $36 trillion. Not to mention the $6.8 trillion increase that occurred when she served as vice-chair and chair of the Fed.

In just the last two months alone, the federal budget deficit reached $622 bln, a $242 bln increase over the same period last year. Government outlays are up 18%, while revenue has dropped 7%.

U.S. PPI rose 0.4% in November, above expectations of +0.3%, versus an upward revised +0.3% in October (was +0.2%); 3.0% y/y, up from a revised 2.6% pace in October (was 2.4%). Core was in line with expectations at +0.2%, versus +0.3% in October. The annualized rate of producer inflation was steady at 3.4%, but October was revised up to 3.4% from 3.1%.

U.S. Initial Jobless Claims surged 17k to 242k in the week ended 7-Dec, above expectations of 220k, versus a revised 225k in the previous week. Continuing jobless claims rose to 1,886k in the 30-Nov week, up from 1,871k in the previous week.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$6.34 (-0.23%)

5-Day Change: +$49.63 (+1.89%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +31.33

Gold eked out a new five-week high in Asian trading at $2,723.70 but was unable to find the stops that I thought were likely above resistance at $2,714.94/$2,719.75. The yellow metal is presently trading more than 1% lower, reinforcing expectations for consolidative trading into year-end.

Nonetheless, the underlying trend remains bullish with help from the dovish stances of key central banks which are likely to extend into 2025. Heightened geopolitical tensions are seen as broadly supportive as well.

The BoC, SNB, ECB, and PBoC have all indicated rising concerns about growth, suggesting they may be more aggressive in cutting rates moving forward. Meanwhile, the resilient U.S. economy may prompt the Fed to be less aggressive in early-2025. The resulting shift in interest rate differential expectations is buoying the dollar, which is limiting the upside in gold.

The World Gold Council released its Gold Outlook 2025 today. "Gold is poised for its best annual performance in more than a decade – up 28% through November," trumpets the WGC. It has indeed been a great year with record highs established through late October.

The WGC remains bullish on gold for 2025, but their outlook is nuanced:

“The market consensus of key macro variables such as GDP, yields and inflation – if taken at face value – suggests positive but much more modest growth for gold in 2025. Upside could come from stronger than expected central bank demand, or from a rapid deterioration of financial conditions leading to flight-to-quality flows. Conversely, a reversal in monetary policy, leading to higher interest rates, would likely bring challenges. In addition, China’s contribution to the gold market will be key: consumers have been on the sidelines while investors have provided support. But these dynamics hang on the direct (and indirect) effects of trade, stimulus and perceptions of risk.” – World Gold Council

If inflation reverses direction, central banks might have to revert to a more restrictive monetary policy, which would be a headwind for gold. Potential US tariffs are seen by many as a risk that could drive up inflation.

We'll have to wait until after 20-Jan to see how U.S. trade policy unfolds. Some central banks have specifically blamed Trump's tariff threats for stoking uncertainty.

I'm sticking to my choppy/consolidative call for the last several weeks of this year. Given this year's stellar price performance, investors and traders will likely look to lock in profits on upticks within the range. At the same time, gold is still in an uptrend so setbacks within the range continue to offer buying opportunities.

Today's Asian high at $2,723.70 now marks an intervening barrier ahead of the $2,736.55 Fibonacci level (78.6% retracement of the decline from $2,789.68 to $2,541.52). Above the latter, chart resistance at $2,748.72/87 is the last significant barrier ahead of the $2,789.68 all-time high.

Yesterday's low at $2,678.27 has contained the downside thus far, keeping the 50-day moving average ($2,670.62 today) at bay. The latter protects the 20-day MA at $2,648.96 and this week's low at $2,628.79.

Silver reached a five-week high of $32.306 in overseas trade, but for the fourth straight session gains above $32.00 could not be sustained. Today's weakness in gold, this week's upward bias in the dollar, and ongoing concerns about economic growth in much of the world weigh on the white metal.

Silver plunged more than 4% intraday to challenge important support at $30.958/900, where the 20-day moving average corresponds closely with the low for the week. A breach of this level would shift focus to the 100-day moving average at $30.523.

Last week's low at $30.080 provides an additional tier of support ahead of the double bottom at $29.736/703. I continue to favor range trading into year-end, although as mentioned, the range may have narrowed to $32.306/$29.703.

A rebound above the midpoint of today's range at $31.628 is needed to ease short-term pressure on the downside. The $32.278/306 level has been fortified as a key resistance.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

12/11/2024

Gold reached five-week highs on geopolitical tensions and easing expectations

OUTSIDE MARKET DEVELOPMENTS: The Bank of Canada (BoC) slashed its policy rate by 50 bps to 3.25%, as was widely expected. While the BoC signaled a more gradual easing path moving forward, "the possibility the incoming US administration will impose new tariffs on Canadian exports to the United States has increased uncertainty and clouded the economic outlook."

The ECB will announce policy tomorrow. A 25 bps cut is anticipated, but a larger 50 bps cut is likely under consideration based on mounting growth risks. The SNB is expected to ease as well.

While U.S. CPI came in a little warmer than expected, it does not take next week's expected rate cut off the table. In fact, Fed funds futures now put the probability of a 25 bps cut at 94.7%, up from 88.9% yesterday and 78.1% last week.

Israel has conducted hundreds of attacks across Syria, hitting strategic weapons stockpiles, launchers, airfields, and warships. IDF ground troops have been deployed into the demilitarized zone and by some accounts beyond.

Other Arab nations are accusing Israel of taking advantage of the turmoil in Syria, raising the temperature in the region. Israel's ambassador to the UN maintains these are “limited and temporary measures to counter any further threat to its citizens.”

China is said to be considering allowing the yuan to weaken in 2025 to offset some of the price pressures expected from the Trump administration's threatened tariffs. A weaker yuan would be consistent with the Politburo's pledge of "appropriately loose" monetary policy as a means to underpin the floundering economy.

U.S. MBA Morgage Applications rose 5.4% in the week ended 06-Dec, versus +2.8% in the previous week. This was a refi-driven move as 30-year mortgage rates edged lower for a fourth week from a 19-week high of 6.9%

U.S. CPI rose 0.3% in November, above expectations of +0.2%, versus +0.2% in October; +2.7% y/y, up from 2.6% in October. Core was in line with expectations at +0.3% m/m, steady at 3.3% y/y.

U.S. Treasury Budget for November comes out later today. The market is expecting the deficit to increase to -$365.5 bln from -$257.5 bln in October.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$2.38 (+0.09%)

5-Day Change: +$65.80 (+2.48%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +33.62

Gold is trading back above $2700 for the first time in two weeks, buoyed by rising Middle East tensions and expectations of further monetary easing from several key central banks. The yellow metal has tested the late-November highs at $2,714.94/$2,719.75, which have capped the upside thus far.

While gold has become rather overbought on a short-term basis, there should be some stops up here that the bull camp is going to want to run. I expect additional gains to $2,736.55 (78.6% retracement of the decline off the record high) and possibly as high as $2,748.87 (high from 05-Nov).

Barring a severe escalation on the geopolitical front, I continue to think the range for the remainder of the year is in place. That being said, at this point, we're less than $70 away from the record high.

The underlying trend remains decisively bullish and price action since the $2,789.68 high was established on 30-Oct has all the indications of a continuation pattern. I'm just thinking the trend won't resume until after the first of the year, but each new uptick eats into my confidence on that call.

On the downside, initial support is noted at $2,700.00/$2,694.64. A retreat below this level would favor a pullback to the 50-day moving average at $2,670.08 and further consolidation.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$0.188 (-0.59%)

5-Day Change: +$0.839 (+2.68%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +33.54

Silver continues to be underpinned by recent strength in gold. The white metal has probed back above $32, but Monday's high at $32.255 remains intact thus far.

Industrial metals continue to be suspicious of the stimulus pledges offered by Chinese policymakers. Investors are also uncertain about the implications of President-elect Trump's proposed tariffs, particularly regarding China which is the world's biggest consumer of these resources.

Monday's confirmation of the double bottom at $29.736/$29.703 favors the upside. A breach of $32.255/278 is needed to perpetuate the two-week uptrend and shift focus to the next tier of Fibonacci resistance at $32.886 (61.8% retracement level of the decline off the late-October peak).

On the downside, I'm watching the 50-day moving average at $31.723 on a close basis. Secondary support is marked by the overseas low at $31.582. More substantial support at $30.900/788 is presently considered well-protected.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

12/10/2024

Gold sets two-week highs on Middle East tensions and easing expectations

OUTSIDE MARKET DEVELOPMENTS: Uncertainty prevails in Syria, where the HTS rebel group now controls the country after taking Damascus and ousting Bashar al-Assad over the weekend. HTS spun off from al Qaeda and is considered a terrorist group by the U.S. and UN.

It is unclear at this point if the removal of Assad calms the region or dials up the risk level. Israel is not taking any chances and has seized a buffer zone in the Golan Heights and launched airstrikes against Syrian military installations. The IDF seeks to deny the rebels–or any other group–access to weapons that could be used against Israel.

The Reserve Bank of Australia held steady on rates today, as was widely expected. However, the RBA board took on a decidedly more dovish tone, suggesting rate cuts could be in the offing early in the new year. The Aussie dollar fell in reaction.

The global bias remains toward easing, with rate cuts expected this week from the BoC, ECB, and SNB. The Fed is widely expected to trim rates again next week.

China's exports slowed significantly to a 6.7% annual pace in November, below expectations of +8.5% versus +12.7% in October. Imports fell 3.9%.

The bad news on the trade front comes a day after Chinese policymakers pledged additional stimulus measures. Trade and the broader Chinese economy will face further headwinds if the incoming Trump administration deploys threatened tariffs.

U.S. NFIB Small Business Optimism Index rose eight points to 101.7 in November, versus 93.7 in October.

“The election results signal a major shift in economic policy, leading to a surge in optimism among small business owners. Main Street also became more certain about future business conditions following the election, breaking a nearly three-year streak of record high uncertainty. Owners are particularly hopeful for tax and regulation policies that favor strong economic growth as well as relief from inflationary pressures. In addition, small business owners are eager to expand their operations.” – NFIB Chief Economist Bill Dunkelberg

U.S. Q3 Productivity was unrevised at 2.2%, versus 2.1% in Q2.

U.S. Q3 ULC was revised lower to 0.8%, versus a 1.9% advance print and -1.1% in Q2 (was +2.4%). This reduces labor costs as a source of inflation, further increasing the likelihood of a Fed rate cut next week.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$23.62 (+0.90%)

5-Day Change: +$35.05 (+1.33%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +31.14

Gold extended to fresh two-week highs as heightened Middle East tensions centered on Syria continue to attract haven interest. Impending rate cuts from several key central banks continue to offer support as well.

Yesterday's breach of resistance at $2,650.65/$2,655.48 and the violation of the 50-day moving average favored a short-term test above $2700. This level is now within striking distance. More substantial resistance is well defined by the late-November highs at $2,714.94/$2,719.75.

If the bull camp musters a breach of $2,719.75 focus will initially shift to the $2,736.55 Fibonacci level, 78.6% retracement of the decline off the record high at $2,789.68. A minor chart point is noted at $2,748.72/87.

Despite this week's gains, the yellow metal is still range bound and I suspect that will continue into year-end. However, I believe the underlying trend is still decisively bullish and is likely to reestablish itself early in the new year.

Heraeus is thinking along the same lines, suggesting that gold's price range will be $2,450 to $2,950 in 2025. The company sees geopolitical tensions in Ukraine and the Middle East, and ongoing central bank interest as the major supporting factors.

Silver remains generally well bid, at the high end of yesterday's range. The white metal is being supported by strength in gold and some level of optimism about the latest Chinese stimulus pledges.

The weak trade numbers out of China initially weighed on silver, but perhaps they will steel the resolve of policymakers in Beijing. Heraeus notes that "global industrial demand for silver is on track to reach a record high of at least 700 moz this year." They are optimistic about 2025 as well.

Strong demand and a supply deficit bode well for the underlying uptrend. However, choppy consolidative action is likely to prevail into year-end.

The midpoint of the $34.853/$29.703 range is at $32.278, just above yesterday's high at $32.255. Penetration of this level would clear the way for an upside extension to $32.886, the 61.8% retracement level of the decline off the late-October peak. A measuring objective off the double bottom that was confirmed yesterday targets $33.194.

Today's intraday low at 31.728 corresponds closely with the 50-day moving average and should keep congestive chart support at $31.454/291 at bay.

now provides support. This level protects the more important $30.900/788 zone, where today's Asian low corresponds closely with the 20-day moving average.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

12/9/2024

Gold firms on Middle East tensions, rate cut expectations, return of PBoC buying

OUTSIDE MARKET DEVELOPMENTS: Rebel forces in Syria seized the capital of Damascus, forcing President Bashar Assad to flee the country. Assad was granted asylum in Russia.

President Biden called Assad's ouster a “fundamental act of justice,” but warned it was also “a moment of risk and uncertainty.” The power vacuum created could lead to even greater turmoil in the region similar to what happened in Iraq and Libia.

Israel moved quickly to temporarily seize a buffer zone in the Golan Heights amid the heightened uncertainty. The IDF also struck chemical weapons sites and long-range rocket installations within Syria to prevent those weapons from falling into the wrong hands.

Chinese stocks and bonds rallied after policymakers signaled that more accommodations would be forthcoming to support the economy. The Politburo pledged to boost demand, and stabilize property and stock markets by pursuing "more proactive" fiscal policies, "moderately loose" monetary policy, and "extraordinary counter-cyclical policy adjustments."

In the wake of Friday's U.S. nonfarm payrolls report, the market is increasingly convinced that the Fed will continue its easing campaign when the FOMC meets next week. Payrolls modestly beat expectations, but the unemployment rate ticked up to 4.2%.

Fed funds futures currently reflect an 86% probability for a 25 bps rate cut at the last policy-setting meeting of the year. At this point, the market is leaning toward a hold in January.

The Fed's focus this week will be on U.S. CPI data for November. The market is expecting a headline increase of 0.2% m/m and +0.3% for core.

The global easing trend remains highlighted. The BoC is expected to deliver another 50 bps cut on Wednesday. The ECB and SNB are expected to cut rates by 25 bps on Thursday. The ECB may contemplate a larger cut amid weak growth and despite hotter inflation in November.

U.S. Wholesale Sales fell 0.1% in October, below expectations of +0.2%, versus a positive revised +0.5% in September (was +0.3%). Wholesale inventories rose 0.2%, versus -0.2% in September.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$23.62 (+0.90%)

5-Day Change: +$29.51 (+1.12%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +30.45

Gold is up more than 1% to start the new week, buoyed by heightened geopolitical tensions in the Middle East, expectations of central bank rate cuts, and news that the PBoC bought gold in November. Despite today's gains, the yellow metal remains well within the well-defined $2,789.68/$2,541.42 that has dominated for more than three weeks.

The collapse of the Assad regime in Syria has stoked geopolitical risks in the region, prompting Israel to take preemptive actions. Expectations that a number of major central banks will move to ease policy over the next two weeks are providing additional lift to gold.

China's central bank resumed buying gold for reserves in November after a six-month hiatus. Official data showed an increase of 160,000 ounces in gold reserves.

"The resumption will send a signal that the PBoC has grown accustomed to these record high price levels and is prepared to build reserves regardless," Saxo Bank's Ole Hansen told Reuters.

The RMB price of gold was up 28% through November. The high price and ongoing economic uncertainty dented Chinese jewelry demand this year, but investment demand for bars, coins, and ETFs were offsetting forces.

Global ETF holdings fell 8.2 tonnes in the week ended 06-Dec. It was the first net decline in three weeks and all regions were sellers.

The COT report for last week showed net speculative long positions increased by 9.4k to 259.7k contracts, versus 250.3k in the previous week. The second consecutive weekly increase puts spec-long positioning at a five-week high.

CFTC Gold speculative net positions

The breach of chart resistance at $2,650.65/$2,655.48 and the probe above the 50-day moving average at $2,668.31 set a more favorable tone within the broader range. Scope is seen for short-term tests above $2,700, but the late-November highs at $2,714.94/$2,719.75 look well protected.

Former resistance at $2,655.48/$2,650.65 now marks initial support. This level protects more important supports at $2,631.10/$2,628.79 (20-day MA and today's overseas low) and the lows from the past two weeks at $2,617.65/$2,609.76.

More choppy range trading into year-end remains favored.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$0.304 (+0.97%)

5-Day Change: +$1.590 (+5.21%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +33.33

Silver surged more than 4% intraday to trade above $32 for the first time in four weeks. The white metal was lifted by pledges for more Chinese stimulus, heightened Middle East tensions, and an easier tone in the dollar.

Net speculative long positioning in silver futures rose 0.5k to 43.3k contracts last week, versus 42.8k in the previous week. While the rise was modest, it broke a string of five weeks of consecutive contractions in long positioning.

CFTC Silver speculative net positions

While silver could not sustain probes above $32, today's gains confirm the double bottom at $29.736/$29.703. The move back above the 50-day moving average lends additional confidence to a bullish scenario that favors a move into the upper half of the $34.853/$29.703 range.

The midpoint of that range is at $32.278. Penetration of this level would clear the way for an upside extension to $32.886, the 61.8% retracement level of the decline off the late-October peak. The measuring objective off the double bottom targets $33.194.

Former congestive resistance at $31.454/291 now provides support. This level protects the more important $30.900/788 zone, where today's Asian low corresponds closely with the 20-day moving average.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.