Gold rebounds on dollar retreat; spotlight on US jobs data

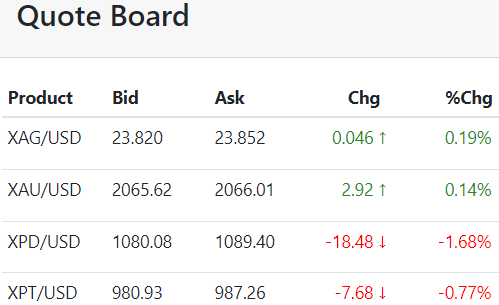

Thursday, January 4, 2024Jan 4 (Reuters) - Gold prices rebounded from a two-week low on Thursday, as a pullback in the dollar lifted demand among investors who are looking ahead to a U.S. jobs report that could shed more light on the Federal Reserve's next move on interest rates.

Spot gold was up 0.2% to $2,044.69 per ounce as of 1210 GMT, after hitting its lowest since Dec. 21 on Wednesday. U.S. gold futures rose 0.5% to $2,052.10 per ounce...[LINK]