Morning Call

Wednesday, November 22, 2023

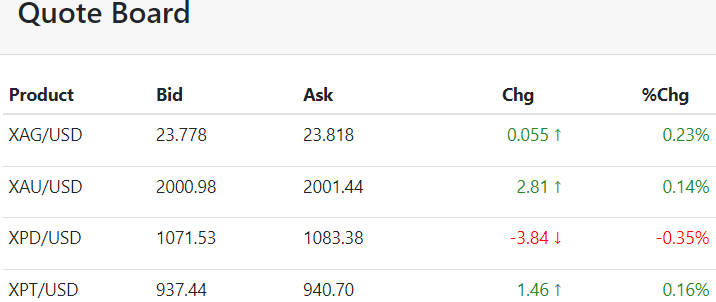

In the early going today the charts favor the bull camp with December gold showing respect for support at the 200-day moving average of $1981.50. The market is also supported fundamentally by a downside extension in the dollar and evidence of significant expansion in Swiss gold exports.

In our opinion, the gold and silver are primarily focused on action in the dollar. With the dollar (and many non-dollar currencies) sitting on 200-day moving averages, several trend signals could be in the offing.

Part of the bullishness from the 53% jump in Swiss gold exports last month was factored in following news last week that Indian gold imports had jumped sharply...[MORE]

Please subscribe to receive the full report via email by clicking here.

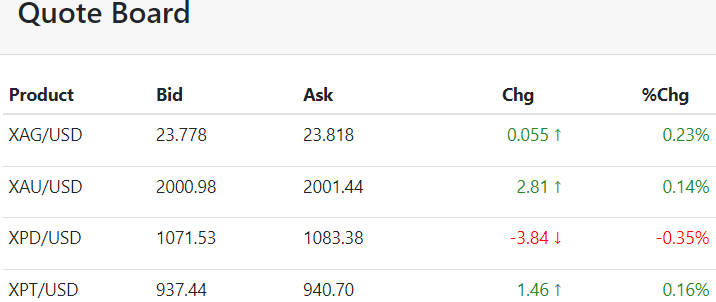

Nov 21 (Reuters) - Gold prices rose to an over two-week high on Tuesday, as the U.S. dollar dipped on expectations that the Federal Reserve is done hiking interest rates, while investors awaited minutes from the central bank's latest meeting for further policy cues.

Spot gold climbed 0.5% to $1,987.79 per ounce, as of 1215 GMT, after hitting its highest level since Nov. 3 earlier in the session...[LINK]

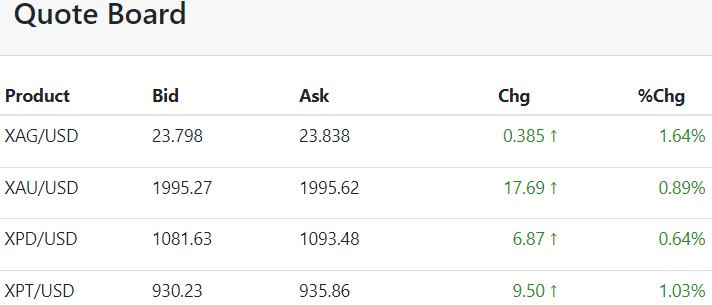

We see the action in gold and silver this morning as very discouraging and defeating for the bull camp, especially in gold given the sharp range down extension of the US dollar.

In fact, with the Indian government pegging October gold imports jumped by 60% over year-ago levels (the highest in 31 months), a surging bear case in the dollar, and expectations the FOMC meeting minutes will again confirm the US rate hike cycle is done, the gold market should be up $11 instead of down $11.

In addition to the strong jump in Indian gold imports, the Reserve Bank of India added 9 tons of gold in the third quarter which should revitalize hopes of ongoing global central bank gold purchases...[MORE]

Please subscribe to receive the full report via email by clicking here.

Nov 20 (Reuters) - Gold prices on Monday slipped from their two-week highs hit in the last session, as U.S. Treasury yields bounced back, with investors looking forward to the minutes of Federal Reserve's last meeting to gauge the U.S. central bank's policy stance.

Spot gold was down 0.4% at $1,972.26 0 per ounce as of 1146 GMT, after rising as high as $1,993.29 on Friday. U.S. gold futures fell 0.5% to $1,974.60...[LINK]

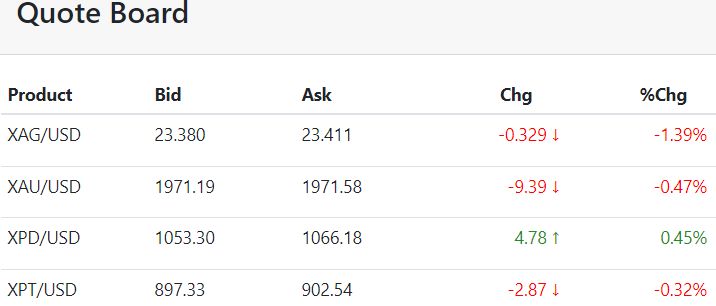

Good morning. The precious metals are mostly lower in early U.S. trading.

U.S. calendar features Leading Indicators.

Gold and silver face a critical "focus" junction today with action in the dollar likely to support, while US data and misguided/overstated disinflation predictions undermine sentiment.

However, we favor the downward tilt with the euphoria from the end of the historic US interest rate hike cycle fully injected into gold and silver prices with the rallies earlier this week.

We think the focus will be primarily on US continuing claims this morning which will be followed by what is expected to be soft US heavy industry/manufacturing data...[MORE]

Please subscribe to receive the full report via email by clicking here.

Nov 16 (Reuters) -Gold prices rose on Thursday as the U.S. Treasury yields edged lower, amid prospects that the Federal Reserve is done with its rate hike cycle.

Spot gold gained 0.3% to $1,965.08 per ounce, as of 1056 GMT. U.S. gold futures rose 0.2% to $1,967.70...[LINK]

Good morning. The precious metals are higher in early U.S. trading.

U.S. calendar features Philly Fed Index, Import/Export Price Indexes, Initial Jobless Claims, Industrial Production, NAHB Housing Mkt Index, TIC Data.

FedSpeak due from Barr, Mester, Waller, Williams, & Cook.