Blog

Zaner Daily Precious Metals Commentary

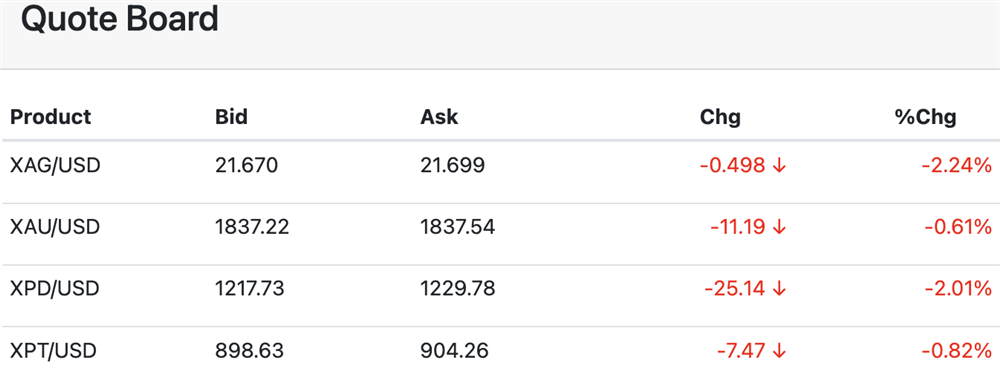

Wednesday, October 4, 2023While the gold and silver markets have managed to respect yesterday's spike low, classic fundamentals remain bearish with the best hope of bottoming action coming from significantly oversold technical conditions.

However, given the largest month-over-month jump in US job openings since July 2021, the trade is anticipating positive US jobs sector news again today which in turn is expected to produce even higher US treasury yields and even higher US dollar exchange rates.

In fact, Fed dialogue regarding the potential for sharp gains in long-term interest rates suggests the Fed sees ongoing normalization of the yield curve as a sign their tightening policies are working...[MORE]

Please subscribe to receive the full report via email by clicking here.

Gold pressured by higher bond yields; palladium hits 5-year low

Wednesday, October 4, 2023Oct 4 (Reuters) -Gold held near a seven-month low on Wednesday, while palladium slipped to its weakest level since late 2018, as a sell-off in the U.S. bond markets lifted yields after economic data raised worries that interest rates will likely remain high.

Spot gold was steady at $1,822.20 per ounce by 0948 GMT, while U.S. gold futures dropped 0.2% to $1,838.40...[LINK]

Zaner Daily Precious Metals Commentary

Tuesday, October 3, 2023With a fresh higher high in the dollar overnight outside market pressure looks to have extended into another session for gold and silver.

However, continuing dollar strength is no surprise after Fed speeches yesterday confirmed unanimity among Fed members of the need to keep policy restricted for some time to bring #inflation down to the Fed's 2% targeted rate.

In fact, the Fed has definitively stressed the potential long duration of tight policy to achieve their goal...[MORE]

Please subscribe to receive the full report via email by clicking here.

Gold extends slide as hawkish Fed, firm dollar dominate mood

Tuesday, October 3, 2023Oct 3 (Reuters) - Gold extended losses on Tuesday, hitting a seven-month low as expectations around the Federal Reserve keeping interest rates high boosted the dollar and bond yields, while focus turned to U.S. job openings data due later in the day.

Spot gold was down 0.1% at $1,825.70 per ounce at 1207 GMT, dropping to its lowest since March 9. Bullion was down for a seventh consecutive session...[LINK]

Morning Call

Tuesday, October 3, 2023

Grant on Gold – October 2, 2023

Monday, October 2, 2023Gold slid nearly 4% last week, ending the month of September with a loss of 4.7%. It was the second consecutive lower weekly close and the second consecutive lower monthly close as well.

Passage of the continuing resolution over the weekend pushes the government shut-down risk into November, leaving markets to now focus almost exclusively on rising yields, expectations of “higher for longer” rates, and the rallying dollar. All of this adds weight to a gold market that was already on the defensive.

The 10-year yield reached a 16-year high of 4.71% on Monday, helping to lift the dollar index to a 10-month high. This pushed gold to a 6-month low of $1823.59.

For perspective, the yellow metal is now just over 12% off its all-time high of $2075.80 from August 2020 and just below the midpoint of the range that emerged over the past 12 months ($1614.92 – $2067.00).

Last week’s violation of the August low at $1884.88 leaves the lower bound of the bear channel around $1810 vulnerable to a short-term challenge. The 200-week SMA at $1814.72 further highlights this area. Below that, the 61.8% retracement level of the rally from $1614.92 to $2067.00 comes in at $1787.61.

In order to attract buyers back to the gold market, there needs to be some indication that rates and the dollar have topped out. With Treasury borrowing expected to be $852 bln in Q4, Treasury supply continues to surge, underpinning yields.

As of the end of September, total debt outstanding was $33.2 trillion. The national debt should be just north of $34 trillion by year-end. U.S. GDP for 2023 is forecast to come in around $26 trillion, resulting in a debt/GDP ratio of about 130%.

Whether Congress passes another continuing resolution in November or an actual budget, make no mistake, deficits and debt will continue to rise. The national debt is on track to exceed $50 trillion within 10 years.

With interest rates at multi-year, and in some cases multi-decade highs, financing our debt poses a huge problem. According to Treasury, “As of August 2023 it costs $808 billion to maintain the debt, which is 15% of the total federal spending.”

Debt servicing is an ever-increasing economic headwind and is simply unsustainable. At some point, the Fed may have no other choice than to reinstitute quantitative easing as a means to inflate away the debt. The implications for the dollar would be dire. By extension, the implications for gold would be quite bullish.

Silver

Silver lost 5.8% last week, 9.2% in September, and 2.5% in Q3. The white metal extended lower on Monday, reaching a 6-month low of $21.02 after important support at $22.11 (23-Jun low) gave way.

With more than 61.8% of the rally from $17.56 to $26.15 now retraced, the next significant support level to watch is the low for the year at $19.90 (10-Mar). The 78.6% Fibonacci support comes in at $19.38.

Even better than expected manufacturing PMI and ISM prints for September failed to generate a bid on Monday. Fundamental focus now shifts to auto sales on Tuesday, factory orders on Wednesday, and jobs data on Friday.

The median expectation for September nonfarm payrolls is 165k jobs. The unemployment rate is expected to tick down to 3.7%.

Fed Chairman Powell participated in a roundtable discussion on Monday. While he didn’t comment on policy specifically, he said the central bank was focused on ensuring a healthy economy and strong jobs market by checking inflation.

If taming inflation remains the Fed’s primary goal, Powell reinforced the “higher for longer” theme. The takeaway from the last FOMC meeting was that there was scope for one more rate hike before year-end. However, Fed funds futures continue to reflect a belief that the Fed is already on pause.

Silver needs a robust economy and strong consumer demand for electronics and automobiles to stoke demand. The industrial metals, including silver and copper, don’t seem to have much faith in the Fed’s ability to orchestrate a soft landing.

PGMs

Platinum slid to a new low for the year on Monday at $876.80. A retest of last year’s low at $796.34 must now be considered.

Good auto/truck sales numbers on Tuesday could provide some support. The market is expecting auto sales of 2.3M and light truck sales of 9.7M.

According to Edmunds, the average interest rate on a new car purchase was 7.4%. For a used vehicle it was 11.2%. These are the highest rates in 8 years and are sapping demand, especially for those with less-than-pristine credit.

Additionally, the expanding autoworkers strike threatens to adversely impact supply moving forward. An additional 7,000 workers join the picket line this week amid ongoing contract negotiations.

Palladium remains defensive at the low end of its multi-year range.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

Zaner Daily Precious Metals Commentary

Monday, October 2, 2023While the recovery in the dollar is not significant this morning, and the slide in treasuries has not resulted in higher highs in (an upside breakout) in treasury yields, outside forces have clearly shifted back in favor of the bear camp.

Apparently, China released its manufacturing PMI readings for September overnight which countervailed recent signs of green shoots and a measure of optimism that was associated with the upcoming extended holiday.

Once again, the US Congress "kicked the debt problem down the road" with a continuing resolution pushing the threat into mid-November...[MORE]

Please subscribe to receive the full report via email by clicking here.

Gold languishes at 7-month low on surging dollar, higher US rates

Monday, October 2, 2023Oct 2 (Reuters) - Gold fell 1% on Monday, languishing near seven-month lows to kick off the last quarter of the year, as a stronger U.S. dollar and prospects of interest rates staying higher for longer erode bullion’s appeal.

Spot gold was down 0.9% by 0933 GMT to $1,831.81 per ounce, its lowest since March 10. U.S. gold futures slipped 1% to $1,847.50...[LINK]

Morning Call

Monday, October 2, 2023