Gold climbs to over three-week high on US rate cut bets

Thursday, December 28, 2023Dec 28 (Reuters) - Gold prices steadied after hitting a more than three-week high on Thursday, deriving support from a weaker U.S. dollar and lower bond yields as markets bet on rate cuts by the Federal Reserve early next year.

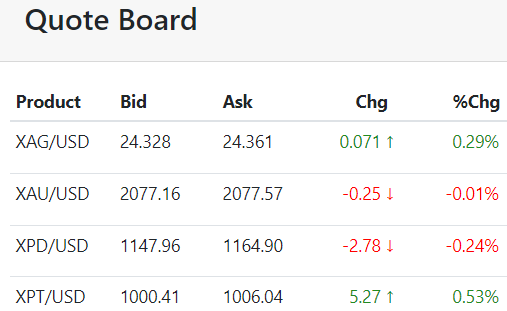

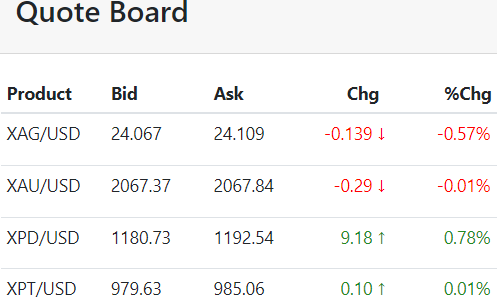

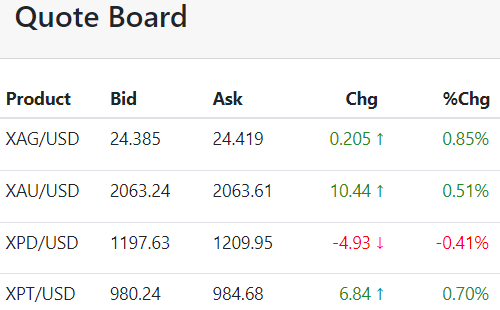

Spot gold was steady at $2,072.09 per ounce at 1206 GMT after earlier rising as high as 2,088.29, the most since Dec. 4. U.S. gold futures were down 0.5% at $2,082.20...[LINK]