Blog posts of '2023' 'June'

Gold slips as firm dollar counters bets for Fed pause

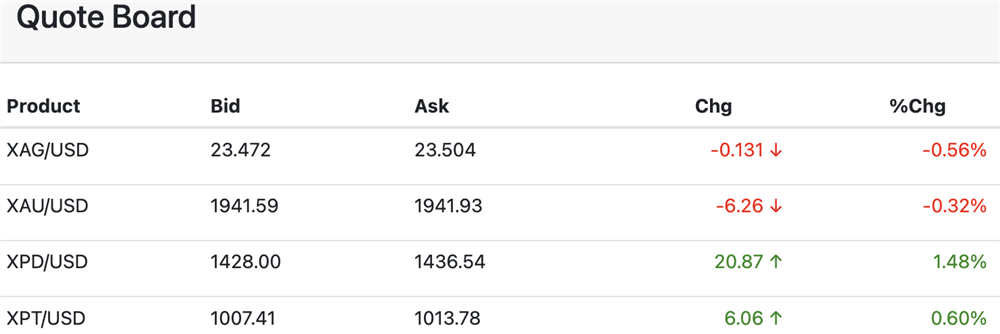

Monday, June 5, 2023June 5 (Reuters) - Gold slipped on Monday as the dollar firmed after strong U.S. payrolls data last week, offsetting some of the support for zero-yield bullion from bets that the Federal Reserve may pause rate hikes in June.

Spot gold fell 0.4% to $1,939.44 per ounce by 1130 GMT, close to its lowest level since May 30. U.S. gold futures fell 0.7% to $1,956.40 per ounce...[LINK]

Morning Call

Monday, June 5, 2023Good morning. The precious metals are mixed in early U.S. trading.

U.S. calendar features Services PMI & ISM, Factory Orders, FedSpeak from Mester.

Zaner Daily Precious Metals Commentary

Friday, June 2, 2023Gold heads for best week since April on Fed pause bets

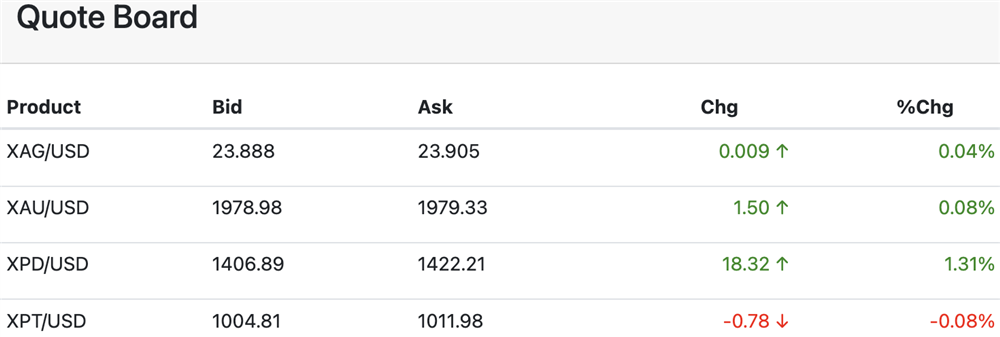

Friday, June 2, 2023June 2 (Reuters) - Gold prices were on track on Friday for their biggest weekly rise since early April, buoyed by hopes the U.S. Federal Reserve would not raise interest rates at its policy meeting this month, which also weighed on the dollar and bond yields.

Spot gold was up 0.1% to $1,980.49 per ounce at 1005 GMT. U.S. gold futures were up 0.1% to $1,997.40...[LINK]

Morning Call

Friday, June 2, 2023Good morning. The #preciousmetals are mostly higher in early U.S. trading.

U.S. calendar features Nonfarm Payrolls (+193k expected).

Zaner Daily Precious Metals Commentary

Thursday, June 1, 2023Gold subdued as risk assets gain on U.S. debt bill passage

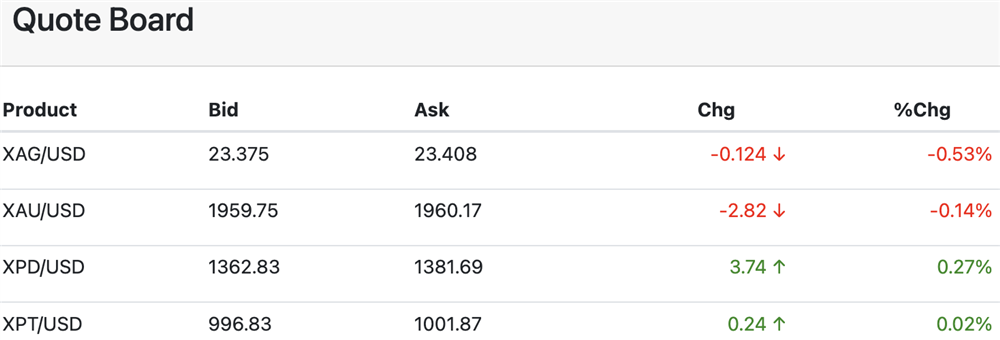

Thursday, June 1, 2023June 1 (Reuters) - Gold prices edged lower on Thursday as risky assets got a boost from the passage of a U.S. debt ceiling bill ahead of the Federal Reserve’s key policy setting meeting.

Spot gold slipped 0.11 % to $1,960.09 per ounce by 1014 GMT. It fell 1.4% over the month of May. U.S. gold futures were down 0.2% on the day at $1,977.30...[LINK]

Morning Call

Thursday, June 1, 2023Good morning. The precious metals are mixed in early U.S. trading.

U.S. calendar features Challenger Layoffs, Initial Jobless Claims, Q1 Productivity & ULC revised, EIA Data, Manufacturing ISM & PMI, Construction Spending, Auto Sales.

FedSpeak due from Harker.