Grant on Gold – July 17, 2023

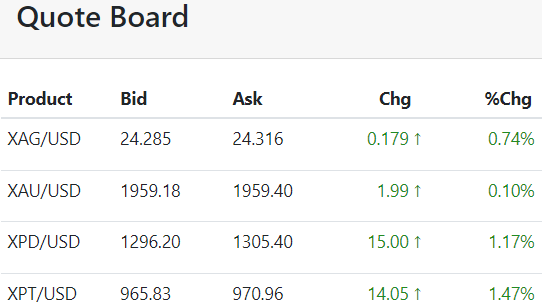

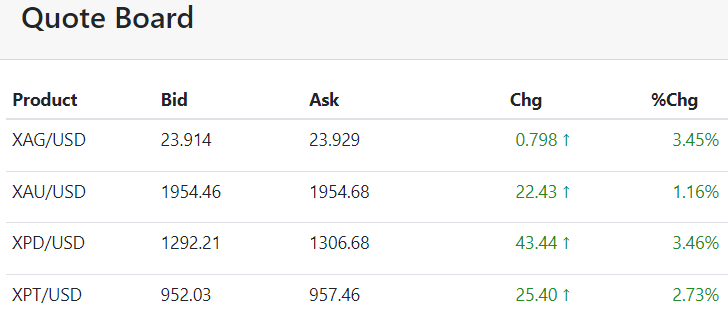

Monday, July 17, 2023Gold jumped 1.5% last week, boosted by a weaker dollar. The dollar index collapsed to a more than 1-year low amid heightened expectations that the Fed’s tightening cycle is nearing its conclusion.

One more 25 bps rate hike is widely anticipated when the FOMC meets next week. That would take the Fed funds rate to 5.25-5.50%. After that, Fed funds futures favor the central bank being on hold through the end of the year.

A report that the BRICS countries (Brazil, Russia, India, China, South Africa) planned to introduce a gold-backed currency at their August summit in South Africa added additional weight to the greenback and lift for the yellow metal. Such a currency would be a direct competitor to the dollar, perhaps hastening the de-dollarization of the global economy that is already underway.

The initial report came from state-run Russia Today (RT), so there are some questions as to its veracity. However, there has been talk of a BRICS currency for years.

While some of the BRICS nations have been aggressively accumulating gold in recent decades, there are some doubts as to whether they have enough to meaningfully back a reserve currency. I’d say that depends to a large degree on actual gold reserves as compared to reported reserves, as well as the underlying price of gold.

Official Gold Reserves of BRICS Nations (Tonnes) through Q1 2023

| Country | Gold Reserves Tonnes | Gold Reserves as % of Total Reserves |

| Brazil | 129.65 | 2.42% |

| Russian Federation | 2,326.52 | 24.9% |

| India | 794.62 | 8.66% |

| China | 2,068.36 | 3.9% |

| South Africa | 125.38 | 12.07% |

That’s a total of 5,444.53 tonnes of gold. That’s still well below reported U.S. reserves of 8,144.46 tonnes, not that gold provides any backing for the dollar. But it is widely believed that Chinese reserves are significantly underreported.

Some respected gold analysts think Chinese reserves may be as high as 30,000 tonnes! “The PRC probably has as much as 30,000 tonnes hidden in various accounts, but not declared as official reserves,” said Alasdair McLeod Head of Research at GoldMoney.

Ross Norman has quipped, “Put an additional zero on the end” of reported Chinese gold reserves and it will get you closer to reality.

I suspect the gold holdings of the Russian Federation are underreported as well. Meanwhile, the Indian government continues to work relentlessly to monetize the estimated 25,000 tonnes of gold held by Indian households, despite past failures to do so.

The expansion of U.S. trade sanctions against Russia, Venezuela, and others have sparked interest in a BRICS currency from all corners of the globe. Algeria, Argentina, Bahrain, Bangladesh, Egypt, Ethiopia, Indonesia, Iran, Audi Arabia, and the UAE have recently applied for membership in BRICS. Nearly two dozen more have expressed an interest in joining.

There’s a lot of gold potentially in play, beyond just reported reserves of the current BRICS members.

Developing a stable monetary union among such a diverse group is a daunting task. At a minimum, syncing monetary, economic, and fiscal policies will be a long and undoubtedly bumpy road.

However, if such a currency is indeed to be backed by gold, it seems likely that BRICS members, and potential future members, would be well served by accumulating as much gold as they possibly can.

Such a strategy does not bode well for fiat currencies, including those of BRICS members. However, the dollar may be the most vulnerable as members and potential members seek to diversify their reserve holdings out of greenbacks.

Gold is presently trading less than 6% off its all-time high against the dollar. It’s less than 10% off the all-time highs against the euro and pound, and about 12% below its record high against the Swiss franc.

Diversifying your own reserve holdings out of dollars seems a prudent strategy. The recent corrective consolidation phase in gold suggests the dominant uptrend may not be over yet. In addition, the recent plunge in premiums makes buying physical metals even more appealing.

A rebound above $1983.50 would bode well for renewed tests above $2000. Once the latter is regained, I’d be feeling pretty confident about new record highs.

Silver

Silver surged 8% last week to set a 9-week high just below $25. It was the third consecutive higher weekly close.

Weaker-than-expected inflation data and a decent payrolls number for June build a strong case for a Fed pause after the July FOMC meeting. That suggests there is a chance the U.S. will avoid recession, which bodes well for commodities.

Economist Nomi Prins believes the upcoming BRICS summit and the prospect of a serious challenge to dollar hegemony is a threat to the greenback and to the U.S. treasury market. Not a good scenario given the massive and growing size of our national debt. This may prompt hedge funds to sell dollars and buy gold and silver.

More than 61.8% of the April to June decline has already been retraced and silver is back above all of the critical moving averages. A trade above $25 would clear the way for a retest of the $26.08/14 highs from April and May.

An eventual penetration of the latter would put silver back on track for a challenge of the important $30 zone.

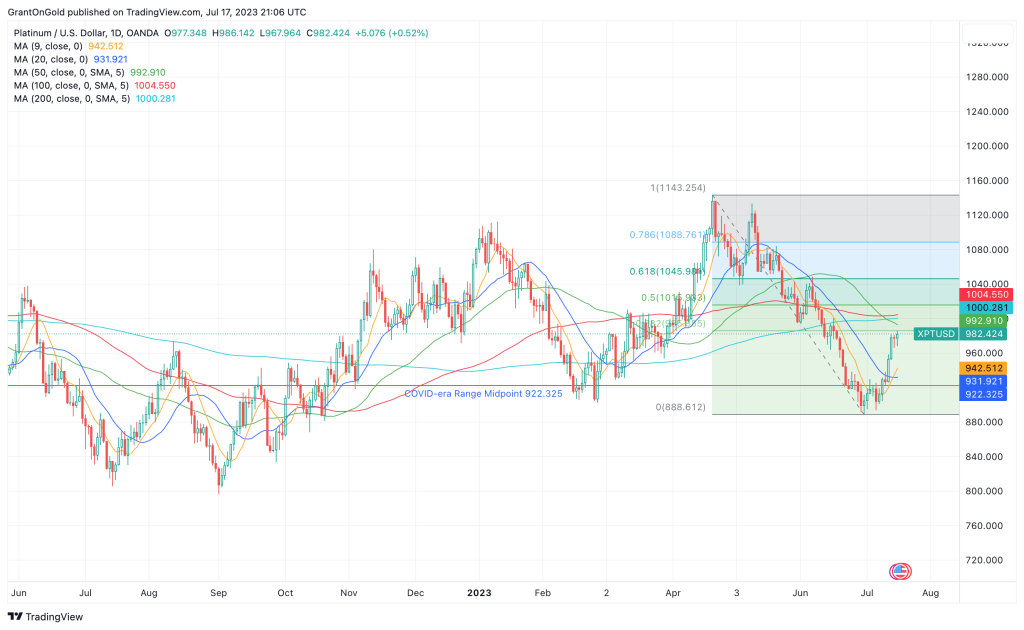

PGMs

The weaker dollar, the anticipated end of Fed tightening, and the prospects for a soft landing have helped buoy platinum, resulting in a gain of 7% last week. A short-term rise above $1000 would favor additional retracement toward resistance at $1046/$1049.

Palladium remains defensive near 4½-year lows, weighed by dimmed auto-sector demand prospects as the desire for EVs grows and platinum for palladium substitution in autocats persists.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.