Morning Call

Monday, July 10, 2023

July 7 (Reuters) - Gold prices edged up on Friday but were on track for a fourth consecutive weekly loss as strong U.S. jobs data strengthened bets for higher-for-longer interest rates by the Federal Reserve.

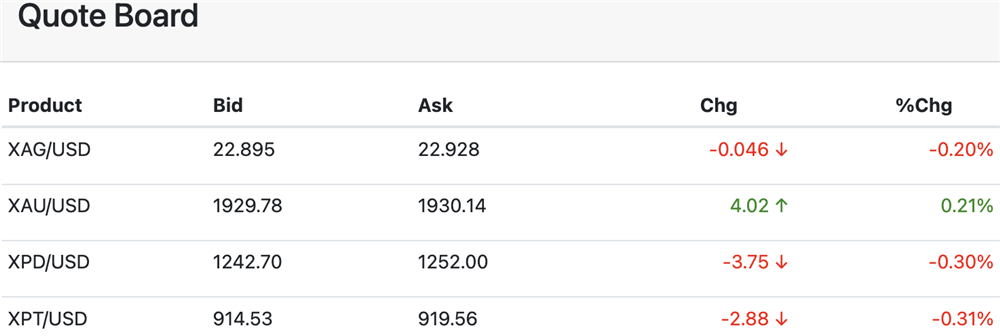

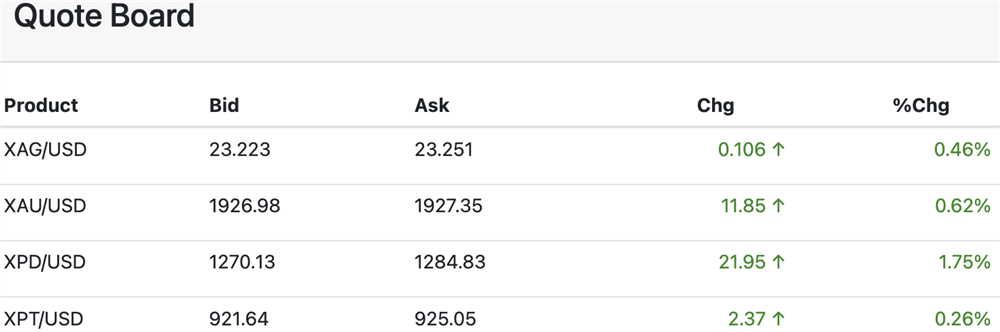

Spot gold was up 0.3% to $1,915.79 per ounce by 0902 GMT, with analysts attributing the small uptick to bargain hunting. U.S. gold futures rose 0.3% to $1,921.80...[LINK]

The path of least resistance is pointing down in gold and silver to start today with the dollar overnight initially posting a 4-day high and potentially poised to receive further lift from today's active US scheduled report slate.

In retrospect, the release of the Fed meeting minutes yesterday afternoon revealed some Fed members were in favor of a 25-basis point rate hike last month despite the Fed's ultimate decision to leave rates unchanged.

Given numerous indications from the Fed, they are data dependent, US jobs-related data over the coming 2 sessions will be quite important and likely to set the trend in gold...[MORE]

Please subscribe to receive the full report via email by clicking here.

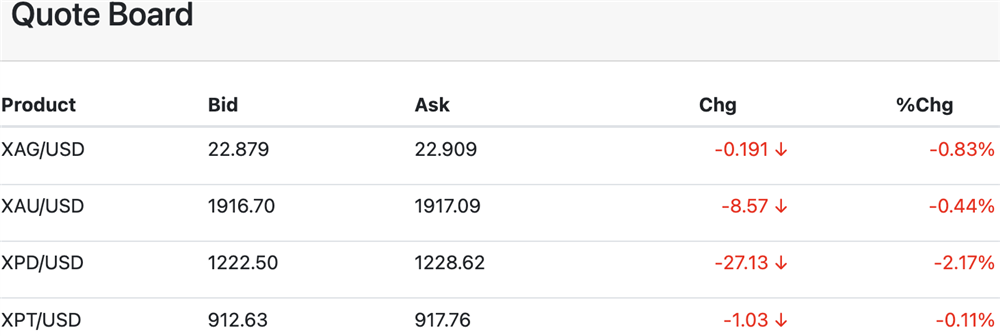

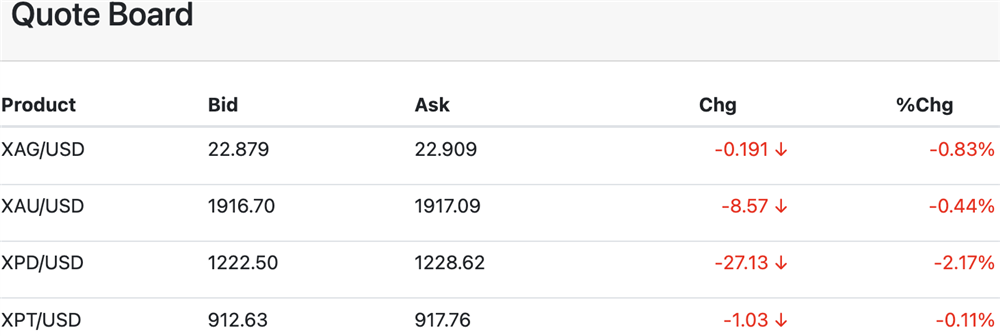

July 6 (Reuters) - Gold prices gained on Thursday, helped by a weaker dollar, while investors braced for U.S. jobs data that could influence the Federal Reserve’s policy trajectory.

Spot gold rose by 0.4% to $1,924.62 per ounce by 1134 GMT, while U.S. gold futures gained 0.2% to $1,931.20...[LINK]

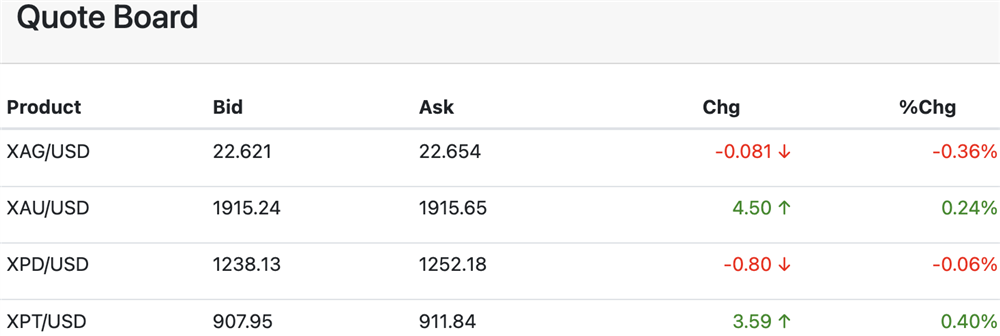

July 5 (Reuters) - Gold prices were rangebound on Wednesday in cautious trading ahead of the Federal Reserve’s June policy meeting minutes due later in the day.

Spot gold little changed at $1,927.39 per ounce by 1104 GMT, trading in a $8 range, while U.S. gold futures were up 0.3% to $1,934.70...[LINK]