Morning Call

Thursday, December 28, 2023

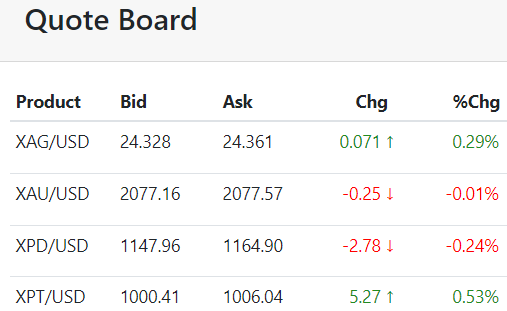

With a new low for the move in the dollar early today and slightly weaker treasury rates, gold and silver bulls look to extend their recent control.

In addition to the constant lift from the fully entrenched expectation of lower global rates gold and silver are likely to benefit from favorable Chinese industrial profit results as China remains the number one consumer of gold.

Apparently, the Chinese central bank has predicted China will achieve its 5% growth target next year and that combined with signs of continued cash infusions from the Bank of India provides a very solid demand base...[MORE]

Please subscribe to receive the full report via email by clicking here.

Contrasted with historic inflation/gold price patterns, further evidence of "sharply falling" global inflation provides gold and silver with ongoing fundamental cushion.

In other words, "significant" declines in UK, eurozone, and Italian inflation (Italian year-over-year producer prices declined by a startling 12.6%) directly or indirectly provide the US Fed with evidence that US inflation is also poised to fall.

While the CME Fed funds watch tool has not registered a significant increase in the probability of a March US rate cut this week, it is possible that reality is catching up with what the Feds Goolsbee earlier this week indicated was market expectations for cuts running ahead of the Fed's internal dialogue...[MORE]

Please subscribe to receive the full report via email by clicking here.

Dec 21 (Reuters) - Gold prices crept higher on Thursday, but traded in a relatively tight range as investors looked to U.S. economic data for further clarity on the Federal Reserve's next monetary move.

Spot gold was up 0.3% at $2,034.79 per ounce, as of 1217 GMT, trading in a narrow $10 range in the session so far. U.S. gold futures fell 0.1% to $2,046.30...[LINK]

With some global inflation readings plummeting overnight and others coming in below expectations, the prospect of rate cuts next year has improved again.

In fact, the CME Fed watch tool raised prospects of a January 31st cut by 4% to 12.4% and increased its March rate cut prospect to 71%.

However, despite renewed rate cut chatter and a downward bias in the dollar both gold and silver are trading lower signaling a lack of bullish sensitivity today...[MORE]

Please subscribe to receive the full report via email by clicking here.

The path of least resistance in gold is down with hawkish dialogue from the Chicago Fed President yesterday, November Swiss gold exports dropping 28% (mostly because the world's second-largest consumer India imported 67% less gold from Switzerland), and a lack of corrective action in the dollar following last weeks compacted rally.

However, an offset to the negative demand signals from declining Swiss gold exports is the fact that Chinese purchases from Switzerland increased by ten percent on 25 tons in sales versus the lower 16.4-tonne sales to India.

With both volume and open interest falling off and given the reversal from last week's highs, we suspect the bullish bias from last week has run its course...[MORE]

Please subscribe to receive the full report via email by clicking here.

Despite a lack of direction in the dollar in the early going today, the gold market remains vulnerable on its charts but supported by global central bank dovishness.

While we suspect gold and silver will take a huge amount of direction from the dollar and from US treasuries there is a developing physical demand threat from ongoing malaise in the Chinese economy.

The struggling Chinese economy is partially verified by ongoing weakness in Chinese equity markets relative to the very impressive gains in global equity markets...[MORE]

Please subscribe to receive the full report via email by clicking here.

Despite a building overbought condition in gold and silver, prices continue to extend on the upside this morning in what we consider long-term fundamental-based investment trading.

Evidence of the bulls piling on the trade was seen overnight from Commerzbank predicting gold to reach $2150 in the second half of next year and silver to reach $30 per ounce by the end of next year.

As we have indicated in financial market coverage all week the magnitude of the anticipated pivot by the Fed, after a historic rate hike cycle obviously justifies a significant and sustained reaction in precious metal prices...[MORE]

Please subscribe to receive the full report via email by clicking here.

The gold and silver trade is euphoric over what the trade is calling an official pivot by the US Fed toward cutting interest rates as the rallies from yesterday's lows are quite profound and appear to have momentum.

As in other markets, near-term overbought technical signals in gold and silver should be ignored by the markets today, as traders continue to embrace euphoria which is likely to extend through today's session.

Obviously, the sharp slide in the dollar and the precipitous drop in interest rates combined with a dovish Fed is a perfect bullish storm that is likely to be capable of attracting buying fuel despite a quickly expanding and overdone net spec and fund long positioning...[MORE]

Please subscribe to receive the full report via email by clicking here.

Downtrends in gold and silver are likely to extend with initial US inflation readings soft but the dollar does not show definitive weakness from that news.

In fact, further evidence of the negative bias toward gold and silver is the lack of support from a resumption of a falling US interest rate environment.

The bear camp should also be emboldened by the prospects of slumping Chinese physical demand as troubles in the Chinese economy (verified by continued weakness in Chinese equity markets and a disappointing new loan report) should crimp Chinese gold imports...[MORE]

Please subscribe to receive the full report via email by clicking here.