Zaner Daily Precious Metals Commentary

Wednesday, September 18, 20249/18/2024

Gold and silver await Fed decision

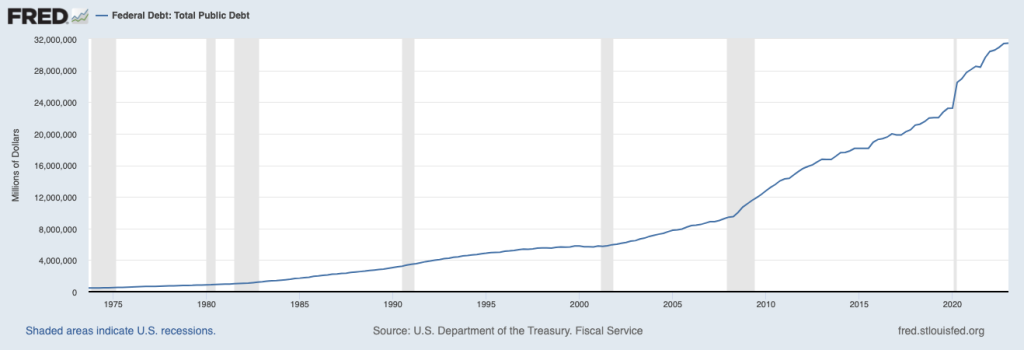

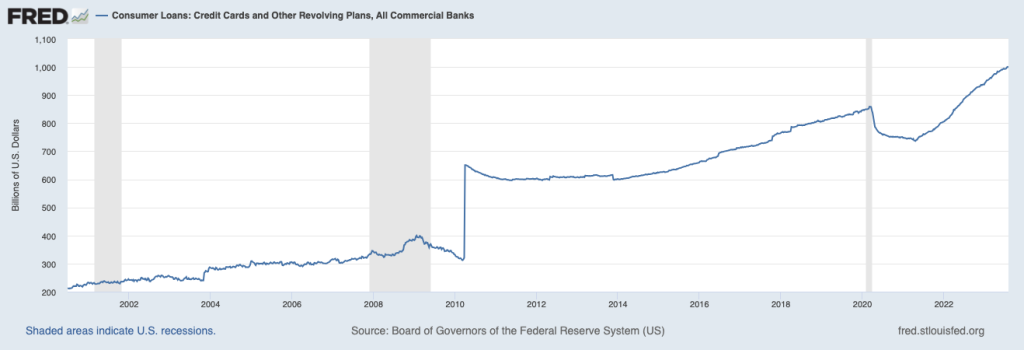

OUTSIDE MARKET DEVELOPMENTS: Fed funds futures continue to suggest a 50 bps cut when the Fed announces policy this afternoon. That bias seems to ignore the central bank's "data dependency" mantra. Recent data have reflected an economy that remains resilient and therefore warrants a more conservative 25 bps cut.

The policy statement, economic projections, and Powell's presser will be closely scrutinized for clues as to the likely rate path moving forward. The market continues to price in 100 bps in cuts by year-end, implying that at least one of the three remaining FOMC meetings will end with a 50 bps cut. I just don't think it will be this one.

Former St. Louis Fed President Bullard agrees. He said the case for a half-point Fed rate cut is "overblown" in a CNBC interview this morning.

UK CPI held steady at 2.2% y/y in August. However, core CPI accelerated to 3.6% y/y from 3.3% in July on the back of rising services prices. The BoE was already expected to hold steady on rates tomorrow and the inflation data seals the deal.

The BoE made its initial rate cut in August on a controversial 5-4 vote. The rebound in inflation suggests the decision may have been premature. I'm sure this will be mentioned in the board room of the Eccles Building today.

ECB Governing Council Member and Bundesbank President Joachim Nagel urged patients on inflation, noting that services inflation in particular remains "alarmingly high." Nagel warned that borrowing costs "will certainly not go down as quickly and sharply as they went up." While this hints at an ECB hold in October, recent ECBSpeak has been mixed.

U.S. mortgage applications jumped 14.2% in the week ended 13-Sep as 30-year mortgage rates dropped to a 23-month low of 6.15%. While the purchase index rose 5.4%, high rates remain a headwind for the housing market.

U.S. housing starts rose 9.6% to 1.356M in August, above expectations of 1.311M, versus 1.237M in July. That's the best print since April as a strong 15.8% surge in single-family starts offset a 4.2% decline in multi-family starts. Completions increased by 9.2% to 1.788M.

Reports of a potential explosive device near a Trump rally on Long Island further amplifies political tensions in the U.S. This is a developing story.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$6.36 (+0.25%)

5-Day Change: +$58.33 (+2.32%)

YTD Range: $1,986.16 - $2,589.13

52-Week Range: $1,812.39 - $2,589.13

Weighted Alpha: +34.76

Gold is narrowly confined within yesterday's range as the trade eagerly awaits today's Fed decision. A cautious 25 bps cut could initially lead to corrective action, but regardless of the size, the Fed's first rate cut in more than four years is a generally bullish event for the yellow metal.

Even if the Fed goes aggressive and cuts by a half-point it would imply smaller cuts in November and December. This may lead to the "sell the fact" event I've warned about in previous commentary this week.

The guidance provided in the statement, the dots, and Powell's presser will set expectations for the two remaining FOMC meetings this year, and into Q1'25.

Downticks on Tuesday were successfully contained by support at $2,559.79/$2,557.21. This level is reinforced by yesterday's low at $2,561.96. Secondary support is noted at $2,529.57/$2,525.52. The 20-day moving average has provided good support on a close basis for more than a month and comes in at $2,523.13.

If gold sells off on the Fed's decision, it may take a dip below $2,500 to entice renewed buying interest. Solid chart support at $2,474.31/08 is bolstered by the 50-day moving average at $2,469.80.

On the upside, fresh record highs above $2,589.13 would clear the way for attainment of the $2,597.15/$2,600.00 objective. A secondary target is marked by Fibonacci resistance at $2,619.35. New highs would also intensify speculation about an eventual move toward $3,000.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$0.095 (-0.31%)

5-Day Change: +$1.773 (+6.18%)

YTD Range: $21.945 - $32.379

52-Week Range: $20.704 - $32.379

Weighted Alpha: +31.39

Silver has slipped to new lows for the week as traders are perhaps a little less inclined to go long into the FOMC statement. A softer tone in gold and a slightly better dollar weigh.

A retreat below $30 must be considered if the Fed cuts by just a quarter-point. However, such a move would suggest potential for a retreat to the $29 zone where the important moving averages are clustered.

On the other hand, penetration of resistance at $30.963/$31.073 would keep the white metal on track for a challenge of the $31.652 high from 11-Jul. Above the latter, the high for the year at $32.379 (21-May) would attract.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.