Morning Metals Call

Wednesday, October 16, 2024

10/15/2024

Gold and silver firm despite dollar strength

OUTSIDE MARKET DEVELOPMENTS: In what the AP called a "symbolic display of anger," North Korea blew up unused sections of roads and rail lines that once linked the two Koreas. The action prompted the South Korean military to fire warning shots.

North Korea was angered this week by anti-north leaflets being dropped by drones over its capital Pyongyang. Seoul has not taken responsibility for the drone flights, but civilization unification groups frequently send propaganda north by balloon. The North sends trash balloons south in retaliation.

North Korean leader Kim Jong Un has accused South Korea and the U.S. of provoking hostilities in the region because of their tighter military ties. Kim has threatened to use the country's nuclear weapons in the event of a conflict.

China surrounded Taiwan on Monday with warplanes and warships to simulate a blockade as part of a large-scale one-day military drill. Chinese military drills around Taiwan have become increasingly frequent in recent years. Taipei and Washington have condemned China for raising tensions in the region.

With the Russia-Ukraine conflict raging, NATO began its annual nuclear exercise on Monday ramping up tensions on the Continent. NATO Secretary General Mark Rutte said the exercise is a display of the alliance's deterrence capabilities.

That messaging is clearly aimed at Russia. A Russian government spokesman said the "exercises lead to nothing but further escalation of tension."

All these factors, along with Israel's ongoing multifront war against regional terrorists, have global geopolitical risks quite high at the moment. Safe haven assets such as gold, the Swiss franc, and the dollar have seen stronger buying interest.

Canadian CPI fell 0.4% m/m in September, below expectations of -0.2%, versus -0.2% in August. The annualized pace of consumer inflation eased to 1.6% from 2.0% in August, the lowest since Feb'21. This raises the likelihood of a 50 bps rate cut by the BoC next week.

U.S. Empire State Index tumbled 23.4 points in October to a five-month low of -11.9, well below expectations of 3.0, versus 11.5 in September. However, optimism about the six-month outlook rose to a 25-month high of 38.7.

NY Fed Empire State Manufacturing Survey

The evidence of weakness in the manufacturing sector didn't impact Fed policy expectations much. The market is still widely anticipating an additional 50 bps points in easing through year-end, evenly divided into 25 bps cuts in November and December.

Fed Governor Christopher Waller worried yesterday that the economy is not cooling at the central bank's desired pace. "I view the totality of the data as saying monetary policy should proceed with more caution on the pace of rate cuts than was needed at the September meeting,” Waller said.

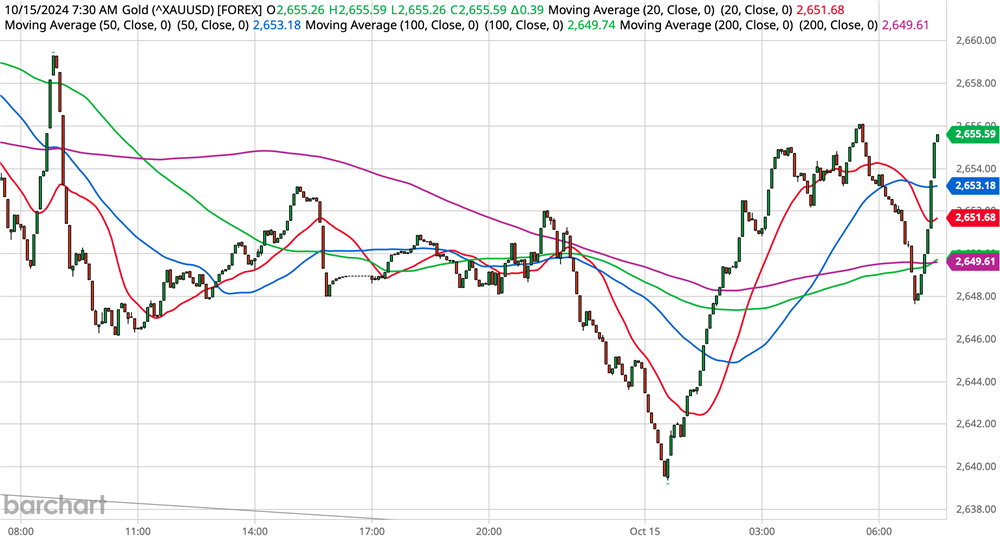

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +4.67 (+0.18%)

5-Day Change: +$36.83 (+1.40%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +35.95

Gold firmed to a two-week high as the trade reduced bets on steady Fed policy in November after a weak Empire State reading. The yellow metal approached the high for the month at $2,670.67 (01-Oct) before retreating into the range.

Gold remains supported by heightened geopolitical tensions and continues to shrug off strength in the dollar. The dollar index remains well-bid after setting an 11-week high on Monday at 103.36. The last time DXY was above 103.30 was 08-Aug. Gold closed at $2,427.04 that day.

Talk out of the London Bullion Market Association's annual conference in Miami indicates that official sector buying is likely to remain a tailwind for the gold market. Reserve diversification is a primary motivation for central bank purchases.

A breach of initial resistance at $2,670.67 would clear the way for a retest of the record high at $2,684.45 (26-Sep). Penetration of the latter would bode well for an upside extension to a measuring objective off the recent correction at $2,718.42. New record highs would also boost confidence in the longer-term target at $3,000.

Today's overseas low at $2,639.35 protects the more important $2,628.36 low from Friday. Key short-term support is well defined at $2,606.62/$2,604.09.

Silver has once again bounced from intraday tests below $31 helped by strength in gold. While the breach of resistance at $31.537/615 is encouraging, ongoing worries about the state of the Chinese economy and weakness in U.S. manufacturing pose headwinds.

Beijing continues to promise it will take appropriate measures to reach its 5% growth goal, but the market is keen to hear plan specifics. Simple jawboning over the past week has resulted in some degree of uncertainty.

A close above the 20-day moving average at $31.361 today would provide some additional technical encouragement. A move back above $32 is needed to clear the way for a retest of the 12-year high at $32.700 (04-Oct).

On the downside, keep an eye on $31.361 on a close basis. This level protects the more important $30.950/856 zone.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

10/14/2024

Gold remains within site of record highs amid heightened geopolitical risks

OUTSIDE MARKET DEVELOPMENTS: The U.S..bond market, the Fed, and banks are closed today for the Columbus Day holiday. The U.S. stock market is open.

Canadian markets are closed for Thanksgiving.

Japan markets were closed for Health/Sports Day.

North Korea has accused South Korea of flying drones over Pyongyang and dropping anti-North leaflets. The North is viewing this as a serious provocation and is said to be preparing to blow up roads and cut rail lines that connect the two countries. Pyongyang has also put border artillery units on high alert and has threatened retaliation if the incitements continue.

China's military launched a new round of war games near Taiwan as a warning against the "separatist acts of Taiwan independence forces." Bejing said further action was possible, "until the Taiwan issue is completely resolved." The PLA drills have drawn strong condemnation from Tapei and Washington.

Over the weekend, the Chinese government promised additional economic stimulus to achieve its growth goals. However, Beijing again failed to deliver the specifics the market was craving.

Last week's U.S. inflation data were benign for the most part, and the market continues to expect a 25 bps rate cut from the Fed in November. The prospects for steady policy stand at 15.9%.

The unwinding of bets that favored more aggressive Fed easing continues to lift the dollar. The dollar index set new 8-week highs in overseas trading and is threatening to move above the 100-day moving average for the first time since July.

This week's key U.S. economic reports are Sep retail sales (+0.3% expected) and Sep industrial production (-0.1%). Both come out on Thursday.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$0.04 (0.00%)

5-Day Change: +$9.76 (+0.37%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +35.52

Gold is consolidating last week's rebound and thin holiday conditions are expected to prevail once London closes. Last week's corrective setback stalled in front of the $2,600 level, leaving the yellow metal within striking distance of the all-time high at $2,684.45.

Heightened tensions between the Koreas along with China's latest intimidation of Taiwan add to the already high geopolitical risk environment. Haven interest should continue to provide a solid underpinning for the gold market.

While dollar strength is seen as a headwind, I continue to be impressed by gold's resilience. The last time the dollar index was above 103.20, gold was trading nearly $200 lower than its current price.

Global ETFs saw net outflows of 6.4 tonnes last week. Modest inflows of 2.1 tonnes from North American investors were eclipsed by European and Asian outflows.

The COT report for last week saw the net speculative long position reduced by 21.7k to 278.2k contracts. It was the second consecutive weekly decline.

CFTC Gold speculative net positions

The recent corrective activity in gold provides an upside measuring objective of $2,718.42. The high from October 1 at $2,670.67 and the record high at $2,684.45 (26-Sep) provide intervening barriers.

Today's intraday low at $2,644.62 protects the more important $2,628.36 low from Friday. Key short-term support is now well defined at $2,606.62/$2,604.09.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -0.258 (-0.82%)

5-Day Change: -$0.526 (-1.66%)

YTD Range: $21.945 - $32.700

52-Week Range: $20.704 - $32.700

Weighted Alpha: +34.05

Silver dipped briefly back below $31 in overseas trading as weekend talk of Chinese stimulus was disappointingly vague. While the ongoing jawboning suggests additional measures to spur growth will be forthcoming, the trade is keen to hear the specifics.

Dollar strength and geopolitical tensions are seen as potentially limiting factors on the upside. However, gold's resilience provides at least a modicum of support.

The COT report for the week ended 11-Oct revealed a 2.2k decline in silver's net speculative long position to 54.7k contracts. It was the second consecutive weekly decline off of the more than four-year high of 62.2k contracts from the 27-Sep week.

CFTC Silver speculative net positions

A close back above the 20-day moving average at $31.318 and a breach of resistance at $31.615 would shift focus to more important chart/Fibonacci resistance at $31.713/756. Penetration of the latter would bode well for further tests above $32.00 and eventually fresh 12-year highs above $32.700.

Today's low at 30.950 now provides a good intervening barrier ahead of the corrective low from last week at $30.229. The 50- and 100-day moving averages have converged at $29.770/760 and mark another important support to watch.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

Good morning. The precious metals are lower in early U.S. trading.

U.S. bond market, Fed, and banks are closed for Columbus Day holiday. The stock market is open.

Canadian markets are closed for Thanksgiving holiday.

10/9/2024

Gold and silver consolidate yesterday's losses amid hopes for more Chinese stimulus

OUTSIDE MARKET DEVELOPMENTS: Chinese stocks are retracing recent stimulus-driven gains on revived growth concerns. The Shanghai Composite Index closed down 6.62% and the CSI300 lost 7.05% today. These were the biggest daily losses since the COVID crisis.

Hong Kong's Hang Seng index lost another 1.7% today, following a plunge of 9.5% on Tuesday. That was the biggest drop since the global financial crisis in 2008. Commodities remain defensive.

The market is demanding more stimulus, which will likely be met. Beijing has announced that a fiscal policy briefing will be held on Saturday, where Finance Minister Lan Fo’an is expected to introduce additional measures to boost growth.

The ECB is widely expected to cut rates by another 25 bps next week. "A cut is very probable, and furthermore it won't be the last," said Banque de France Governor Francois Villeroy de Galhau. With inflation continuing to moderate, ECB policy remains tilted toward easing amid persistent growth risks.

While the Chinese and European (especially German) economies continue to display weakness, last week's strong U.S. jobs report reflects a resilient U.S. economy. Today's update to the Atlanta Fed's GDPNow model estimates Q3 GDP to be 3.2%, up from 2.5% on October 1. The Blue Chip consensus remains below 2% but is rising gradually.

With the prospects for a U.S. recession considerably diminished, the market has priced out the possibility of another oversized Fed rate cut. However, solid growth has the potential to revive inflationary pressures.

U.S. CPI and PPI data are out on Thursday and Friday respectively. While the market expects both to show benign 0.1% monthly increases, there are whispers of upside risk.

Dallas Fed President Lorie Logan (moderate hawk) warned today of "still meaningful" upside risks to inflation. "I continue to see a meaningful risk that inflation could get stuck above our 2% goal," she said. Logan sees "a more gradual path back to a normal policy stance" as appropriate.

The dollar has rebounded in recent weeks as the market pivoted to less-dovish policy expectations. The dollar index reached a new eight-week high today.

U.S. MBA mortgage applications fell 5.1% in the week ended 04-Oct, weighed by a five-week high in 30-year mortgage rates of 6.36%. Refinances fell 9.3%.

U.S. wholesale sales fell 0.1% in August, below expectations of +0.4%, versus +1.1% in July. Wholesale inventories rose 0.1%.

The minutes from the September 17-18 FOMC meeting will be released this afternoon.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -0.51 (-0.02%)

5-Day Change: -$41.33 (-1.55%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +36.01

Gold is consolidating yesterday's losses with price action confined to the lower end of Tuesday's range. While the yellow metal is trading lower for a sixth session, the magnitude of the correction thus far from the $2,684.45 record high (26-Sep) has been less than 3%.

High geopolitical tensions and political uncertainty are seen as supportive factors that should limit the downside. The shift in Fed rate cut expectations toward a more conservative 25 bps and the corresponding rise in the dollar pose headwinds for gold.

UBS believes gold's rally still has legs. They see ongoing central bank buying and steady consumer demand in China and India as important driving forces. UBS now forecasts $2,800 by year-end and $3000 in 2025.

HSBC has a year-end target of $2,725 and expects a broad range of $2,350 to $2,950 through 2025. HSBC cites central bank demand, expectations for further Fed easing, and rising concerns over fiscal deficits in major economies at tailwinds for gold.

I'd like to see gold climb back above the 20-day moving average at $2,623.57 to boost confidence in the longer-term bullish outlook.

On the downside, initial support at $2,607.26/09 protects the more important $2,600.00/$2,597.42 level. Penetration of the latter would shift focus to $2,579.26 (50% retrace of the rally from $2,474.08 to $2,684.45).

Silver has stabilized somewhat in the wake of yesterday's 3.2% plunge. While the white metal is trading lower for a third session, additional downside progress has not been seen today.

Revived hopes for additional Chinese stimulus are providing some support, but markets seem inclined to wait until after Saturday's policy briefing to see exactly what Beijing is considering. A much-anticipated press conference on Tuesday disappointed, leading to the recent sell-off.

While the double top formation on the daily chart remains troubling, I believe China is inclined to make whatever accommodations are necessary to ensure the attainment of its 5% growth target.

News this week that Russia is considering holding silver as a reserve asset has rather bullish implications as well. Russian reserve buying has the potential to boost demand considerably in a market that is expected to notch its fourth consecutive structural supply deficit in 2024.

A close back above the 20-day moving average at $31.186 would ease short-term pressure on the downside and favor renewed tests above $32. The eventual negation of the double top at $32.657/$32.700 would put silver back on track for attainment of previously established objectives at $33.00 and $33.972.

On the other hand, if solid support at $30.00/$29.85 gives way, a more protracted corrective/consolidative phase becomes likely. The 100- and 50-day moving averages are rising to bolster this area and come in at $29.743 and $29.577 today. Today's intraday low at $30.281 and yesterday's low at $30.229 mark the initial downside barriers.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

10/8/2024

Gold and silver correct on tepid post-holiday stimulus messaging from China

OUTSIDE MARKET DEVELOPMENTS: Risk-off sentiment has surfaced on renewed worries about the Chinese economy. The Golden Week holiday has ended and a much-anticipated press conference by the chairman of the National Development and Reform Commission was a disappointment. No new stimulus measures were announced.

Chinese stocks saw record volume after the weeklong holiday closure. Initial strong gains were pared into the close. Meanwhile, Hong Kong’s Hang Seng index plunged 9.5%, its worst day since 2008. Commodities are in retreat.

Hurricane Milton continues to strengthen, prompting evacuation orders as the storm approaches the west coast of Florida. Milton is expected to make landfall near Tampa Bay tomorrow and could be the worst storm to hit the U.S. in more than a century.

Tensions remain extremely high in the Middle East amid expectations that Israel is preparing to strike Iran in retaliation for last week's missile barrage. Iranian nuclear facilities are considered by many to be likely targets.

A rare earthquake in Iran over the weekend has some speculating that a nuclear weapon test may have been conducted. CIA Director William Burns said on Monday that he sees no evidence that Iran is rushing the development of such a weapon.

A Wall Street Journal article worries that Iran may now realize that its ballistic missiles and Hezbollah proxies in Lebanon are "less powerful than previously thought." This may prompt Iran to accelerate its nuclear program to achieve a more substantial deterrent against Israel.

The Israeli and U.S. position has always been that Iran can not be allowed to get a nuclear weapon. The deterrent Iran seeks is the exact thing that could prompt a joint strike on the country.

The Japanese yen has come under renewed pressure as prospects for another big Fed rate cut have dimmed. This elicited warnings from key Japanese policymakers that hinted at the potential for direct intervention to support the yen.

The U.S. NFIB Small Business Optimism Index edged up to 91.5 in September from 91.2 in August. It is the 33rd consecutive month below the 50-year average of 98. The Uncertainty Index jumped 11 points to a record high of 103 with the U.S. election less than a month away.

RCM/TIPP Economic Optimism Index rose 0.8 points to a 16-month high of 46.9 in October, versus 46.1 in September. While an improvement, it was the 38th straight month below 50. A sub-50 reading indicates economic pessimism.

The U.S. trade deficit narrowed to -$70.4 bln in August, inside expectations of -$70.6 bln, versus a revised -$78.9 bln in July. The deficit narrowed 10.5% from a 25-month high in July to a 5-month low that some attribute to proactive moves by importers and exporters in advance of what at the time was a threatened strike by longshoremen.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$3.58 (+0.14%)

5-Day Change: -$17.86 (-0.67%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +38.04

Gold slid to a three-week low in early U.S. trading on dampened risk sentiment after China failed to announce any new stimulus as the Golden Week holiday came to an end. The yellow metal is trading lower for a fifth straight day.

The breach of chart support at $2,633.48/$2,627.20 cracked the range that had held for five sessions, prompting a challenge of the important 20-day moving average at $2,614.80. While gold has tested below the SMA, the next tier of chart support at $2,600.00/$2,597.42 remains intact thus far.

High geopolitical tensions and persistent political uncertainty ahead of the U.S. elections continue to provide some underpinning to the market. Meanwhile, the erosion of Fed rate cut expectations and the firm dollar weigh.

September saw a fifth consecutive month of inflows into gold-backed ETFs. Inflows totaled 18.4 tonnes ($1.4 bln). North American investors continue to lead the charge.

North Americans have been net buyers for three straight months. Asian investors extended their buying streak to 20 consecutive months.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -0.376 (-1.19%)

5-Day Change: -$0.220 (-0.70%)

YTD Range: $21.945 - $32.700

52-Week Range: $20.704 - $32.700

Weighted Alpha: +37.57

Silver came under selling pressure along with the rest of the commodities sector on revived concerns about the health of the Chinese economy. The white metal plunged more than 4% intraday to approach the $30 zone.

The violation of support at $30.963 confirms the $32.657/$32.700 double top. A more serious challenge of the $30.00/$29.85 zone seems likely, especially on a close below the 20-day moving average at $31.090. The 100- and 50-day moving averages come in at $29.745 and $29.545.

Given the short-term market fallout stemming from China's tepid stimulus messaging today, I suspect at a minimum they'll start jawboning in favor of further accommodations as soon as Wednesday. Ultimately, more stimulus is likely forthcoming based on Beijing's commitment to its growth targets.

A rebound above the 20-day would ease short-term pressure on the downside and favor renewed tests above $32.00. A minor intraday chart point at $30.595 marks an intervening barrier.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.