Morning Metals Call

Tuesday, October 1, 2024

9/30/2024

Gold and silver remain corrective ahead of month-end and quarter-end

OUTSIDE MARKET DEVELOPMENTS: China's CSI 300 stock index surged 8.5% on Monday, its biggest gain since 2008, as markets continued to digest last week's bazooka stimulus. Hong Kong's Hang Seng Index posted a 2.4% gain and is now up 24% YTD.

The easing of home-buying restrictions in three major Chinese cities provided additional lift to shares and its troubled real estate sector. Steel and iron ore prices surged. Copper reached a 4-month high of $4.7382 before retreating somewhat.

Bejing is pulling out all the stops to get growth back to its 5% target. There's a growing sense that if additional stimulus is needed to achieve that goal, it will be forthcoming. That provides a considerable market tailwind.

Iran has vowed retaliation for recent Israeli attacks that have effectively decapitated Hezbollah. The Wall Street Journal is reporting that Israeli special forces have been conducting targeted raids within southern Lebanon, possibly paving the way for a broader IDF ground incursion.

ECB President Christine Lagarde is worried that the EU "recovery is facing headwinds." That acknowledgment may boost the prospects for an October ECB rate cut, but European bonds and shares were under pressure today.

German HICP inflation fell to 1.8% y/y in September, versus 2.0% in August. Italian HICP inflation fell to 0.8% y/y in September from 1.2% in August. These readings below the ECB target of 2.0% may provide clearance for more easing, but Lagarde sees scope for a Q4 inflation rebound driven by energy prices.

Chicago PMI rose to 46.6 in September, above expectations of 45.9, versus 46.1 in August. While comfortably above the May low of 35.5, the barometer has been in contractionary territory for 24 of the past 25 months. Troubles at Boeing continue to pose a headwind.

The Dallas Fed Index improved to -9.0 in September, inside expectations of -10.7, versus -9.7 in August. "Moderate upward pressure on prices and wages continued in September," according to the Dallas Fed. The comments section highlights how political uncertainty ahead of the November election has weighed on sentiment.

Fed President Powell will speak at the NABE conference later today.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$6.68 (-0.25%)

5-Day Change: +$5.07 (+0.19%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +42.86

Gold is maintaining a corrective tone to start the new week as traders ring up profits for month-end and quarter-end. The yellow metal is lower for a second session after setting a record high of $2,684.45 on Thursday.

Despite the recent setback, gold is poised to notch an eighth consecutive monthly rise and a fourth straight quarterly gain. The quarterly gain should be the best since Q1'16.

The trend remains decisively bullish. Consequently, pullbacks are likely to be viewed as buying opportunities. The $2,700.00/$2,709.14 objective remains valid, with intervening barriers noted at $2,665.36, $2,673.67, and $2,684.45.

Supports at $2,624.58 and $2,614.86 protect the $2,600 zone. The rising 20-day moving average, which provided good support earlier in the rally, comes in at $2,575.17 today.

The COT report showed net speculative long positioning increased 5.3k contracts to 315.4k last week. That's the highest spec long positioning in more than four years.

CFTC Gold speculative net positions

I'm anticipating that gold ETFs saw good inflows last week as well, although my source for that information has not been updated yet. I'll cover ETFs tomorrow.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -0.485 (-1.53%)

5-Day Change: +$0.544 (+1.77%)

YTD Range: $21.945 - $32.657

52-Week Range: $20.704 - $32.657

Weighted Alpha: +43.32

Silver has corrected to the $31 zone on position squaring on this, the last trading day of September and Q3. However, last week's move to fresh 12-year highs has swung the technical picture decisively back in favor of the bull trend off the COVID-era low at $11.703.

I suspect the housing market reforms in China will ultimately have a positive impact on silver, as they have for steel and copper today. Silver has become an increasingly important component in home construction.

The net speculative long position in silver futures jumped 3.9k to 62.2k contracts according to the latest COT report. That's the biggest net-long position since late February 2020 and may be contributing to the recent corrective pressure.

CFTC Silver speculative net positions

While additional downticks toward the $30 zone can not be ruled out, market focus is likely to remain on buying strategies in anticipation of further tests above $32.

On the upside, I have a Fibonacci projection at $33.972. Intervening barriers are found at $31.829, $32.227, and $32.657. Further out, a key retracement level is highlighted at $35.217 (61.8% retracement of the entire decline from $49.752 to $11.703).

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

9/27/2024

Gold and silver turn corrective after this week's big run-ups

OUTSIDE MARKET DEVELOPMENTS: Japan's former Defense Minister Shigeru Ishiba has been chosen to lead the ruling Liberal Democratic Party and is set to become the country's next Prime Minister. Ishiba favors a strong military and close security ties with the U.S.

Ishiba has pledged to continue the economic policies of outgoing PM Fumio Kishia, focusing on increasing real wages, boosting consumption, and ending deflation. He also favors more government spending to revitalize depopulated regions. Addressing Japan's declining population is a priority.

The yen surged in reaction and Japanese stocks fell. Ishiba supports an independent BoJ and the market seems to think there is now a heightened chance of more rate hikes.

Israel and Hezbollah forces in Lebanon continue to trade fire. IDF troops have been told to prepare for possible ground operations within Lebanon. This would be a significant escalation.

“Israel has every right to remove this threat and return our citizens to their home safely. And that’s exactly what we’re doing … we’ll continue degrading Hezbollah until all our objectives are met,” Israeli Prime Minister Benjamin Netanyahu told the UN General Assembly this morning.

Netanyahu made no mention of the 21-day ceasefire proposal being brokered by the U.S. and France, suggesting that the deal is not in play.

Hurricane Helene has been downgraded to a tropical storm after making landfall on Florida's Gulf Coast last night. Floridians are dealing with mass power outages and flooding. At least 11 have died as the storm tracks north through Georgia causing severe flooding.

U.S. personal income rose 0.2% in August, below expectations of +0.4%, versus +0.3% in July. The savings rate ticked down to 4.8%.

PCE was up 0.2% in August, below expectations of +0.3%, versus +0.5% in July. The PCE inflation rose 0.1% resulting in a 2.2% annualized pace. Core PCE inflation also ticked up 0.1%; 2.7% y.y.

The final Michigan Sentiment reading for September was 70.1, up from a preliminary print of 69.0 and 67.9 in August. The current conditions index was revised up to 63.3, while the final expectations reading was raised to 74.4. The one-year Inflation rate was adjusted down to 2.7%, the lowest since December 2020.

The U.S. Advance Indicators report for August showed the trade gap narrowed by 8.3% to -$94.3 bln thanks to a better-than-expected $4.1 bln rise in exports to $177 bln. Wholesale inventories rose 0.2% and retail inventories climbed 0.5%.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$8.05 (-0.30%)

5-Day Change: +$49.01 (+1.87%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +45.46

Gold has slipped to a three-session low as traders took profits after this week's gains. Today is the first day of the week that a new record high has not been established. When September ends on Monday, it will mark the eighth consecutive higher monthly close.

Today's losses are seen as corrective within the well-established uptrend. Renewed buying interest is likely to surface with good supports noted at $2,624.58 (24-Sep low) and $2,414.86 (23-Sep low).

While the trade is arguably getting crowded, all the fundamental factors that have been driving gold higher are still very much in place. Heightened geopolitical tensions, political uncertainty, generally easier global monetary policy, a weaker dollar, Chinese stimulus, and strong central bank buying are all likely to persist and perhaps even intensify.

My next upside target is $2,700.00/$2,709.14. There are psychological barriers at $2,800 and $2,900 on the way to the longer-term objective is $3,000.

On last night's earnings call, Costco CFO Gary Millerchip said their physical gold sales were up "double digits" in Q3. Bullion is a driving force behind Costco's eCommerce revenue. Costco CEO Ron Vachris said the company had "no plans at this time" to create Kirkland Signature branded bullion.

Silver has retreated to approach the midpoint of this week's broad range. Even with today's pullback, the white metal is still up 4.7% this week.

Chinese monetary stimulus and expectations for up to CN¥2 trillion in fiscal stimulus drove silver to a 12-year high of $32.657 on Thursday. This upside breakout returns a measure of credence to the longer-term uptrend that began when silver bottomed at $11.703 in March 2020.

Silver has risen $20.954 (+179%) since that low was established. The $33.00 psychological barrier is the next upside target. Beyond that, there's a Fibonacci projection at $33.972.

An eventual violation of a key retracement level at $35.217 (61.8% of the entire decline from the March 2011 high at $49.752 to $11.703 low) would bolster a scenario that calls for a return to the $50 zone.

Keep in mind that the beta in the silver market is high and corrective action can be volatile. A pullback to the $30 zone can't be ruled out, although such a move is likely to attract additional buying interest.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

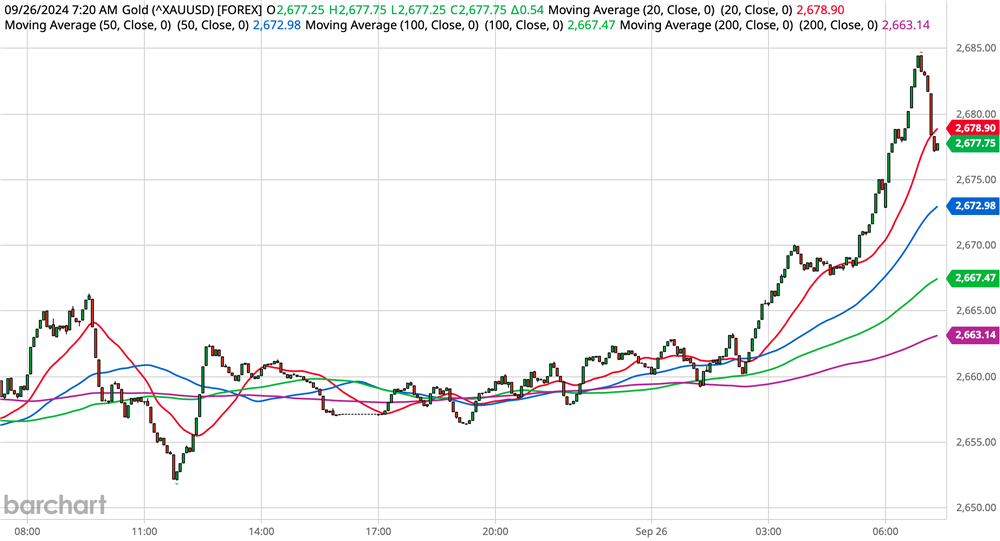

9/26/2024

Gold and silver extend higher in anticipation of Chinese fiscal stimulus

OUTSIDE MARKET DEVELOPMENTS: China's Politburo has pledged to deploy "necessary fiscal spending" to boost growth back to its 5% target. Citing sources, a Reuters article reports that the Ministry of Finance plans to issue CN¥2 trillion in sovereign bonds this year.

This comes on the heels of a surprise move by the PBoC earlier in the week that saw reserve requirements and key interest rates lowered. Bloomberg suggests the additional measures would "supercharge" China's stimulus.

"China’s policymakers are pulling out the stops," said David Qu of Bloomberg Economics. Qu noted that China is showing "an unusually high degree of urgency and determination to support the economy."

European stocks and bonds are rallying on mounting expectations that another ECB rate cut is in the offing. The latest ECB Bulletin sees scope for an uptick in inflation in Q4 before resuming the downward path to the 2.0% target in 2025. However, the central bank believes "risks to economic growth remain tilted to the downside."

U.S. durable orders for August were unchanged, better than the -2.6% market expectations, versus a revised +9.9% in July. The ex-transportation print was -0.5%.

The third report for U.S. Q2 GDP came in unrevised at 3.0%. Consumption was revised down to 2.8% from 2.9% in the second report. The price index was steady at 2.5%.

Initial jobless claims fell 4k to 218k in the week ended 21-Sep, below expectations of 225k, versus an upward revised 222k in the previous week. That's the lowest print since May. Continuing jobless claims rebounded 13k to 1,834k.

Today's U.S. data were generally positive, consequently, bets on another jumbo rate cut have moderated somewhat. The potential for a 50 bps rate cut in November stands at 52.1% currently, down from 57.4% yesterday.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$15.74 (+0.59%)

5-Day Change: +$76.87 (+2.97%)

YTD Range: $1,986.16 - $2,684.45

52-Week Range: $1,812.39 - $2,684.45

Weighted Alpha: +44.90

Gold has now set record highs in five consecutive sessions, nine of the last eleven. News that China will add CN¥2 trillion in fiscal stimulus on top of the monetary stimulus announced earlier in the week is the latest driving force.

While gold has retreated into the range after setting the latest ATH at $2,684.45, pullbacks are still seen as corrective and are expected to attract further buying interest. Initial support is marked by the overseas low at $2.656.34, which protects Wednesday's low at $2,652.08. More substantial supports are at $2,624.58 (24-Sep low) and $2,414.86 (23-Sep low).

With the latest Fibonacci objective at $2,674.84 satisfied and exceeded, focus shifts to $2,700.00/$2,709.14. Confidence in the longer-term target at $3,000 continues to grow.

Incrementum, the producers of the In Gold We Trust report, reminded us via X that their bullish projection from 2020 is "almost exactly on track." Incrementum sees potential to $4.821 by 2030!

The most recent In Gold We Trust report 2024 was released in May and is well worth a read if you haven't done so already. The yellow metal is up nearly 13% since the report came out.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.811 (+2.55%)

5-Day Change: +$1.240 (+4.03%)

YTD Range: $21.945 - $32.657

52-Week Range: $20.704 - $32.657

Weighted Alpha: +46.19

Silver clearly likes the idea of "supercharged" Chinese stimulus. The white metal established a new 12-year high of $32.657 before retreating into the intraday range. Silver has gained more than 37% year-to-date.

The violation of the May high at $32.379 reestablishes the 4-year uptrend off the $11.703 low from March 2020. The $33.00 psychological barrier is the next upside target. Beyond that, there's a Fibonacci projection at $33.972.

The next major level I'm watching is $35.217 which marks 61.8% retracement of the entire decline from $49.752 (April 2011 high) to $11.703.

The Asian low at $31.799 remains protected thus far, keeping yesterday's low at $31.642 at bay. Pullbacks are expected to be viewed as buying opportunities with Chinese stimulus and a global bias toward monetary easing expected to provide a persistent tailwind for the market.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

9/25/2024

Gold sets another new high as silver consolidates Tuesday's gains

OUTSIDE MARKET DEVELOPMENTS: The U.S. is sending an additional $375M in military supplies to Ukraine, including controversial cluster munitions. Ukraine is still trying to get clearance to use U.S. and UK long-range missiles to strike deep inside Russia.

President Biden said in his final speech before the UN General Assembly, "We will not let up on our support for Ukraine, not until Ukraine wins with a just, durable peace." Meanwhile, President Zelensky of Ukraine contends that "Russia can only be forced into peace." Biden is scheduled to meet with Zelenskiy on Thursday.

President Biden also urged Israel and Hamas to accept the ceasefire proposal that's on the table. "Full scale war is not in anyone's interest, even if situation has escalated, a diplomatic solution is still possible," said Biden.

These two wars are almost certain to outlast Biden's presidency and pose geopolitical challenges for the next administration. Countering growing regional influence by the likes of Russia, China, and Iran will also continue to test the next president.

The yuan reached a 16-month high against the dollar as markets digest China's largest stimulus since the COVID crisis. The market is broadly expecting additional PBoC stimulus.

The greenback has been under pressure since mid-year as markets initially looked forward to the Fed beginning its easing campaign. interest rate cuts and now anticipate further easing.

The dollar index set a new low for the year last week at 100.21 and this level remains under pressure. A challenge of last year's low at 99.58 is anticipated. If this level also gives way, focus will shift to a Fibonacci level at 78.6.

The Institute of International Finance (IIF) reports that global debt rose by $2.1 trillion to reach a record $312 trillion. Estimates for 2024 global GDP are around $108 trillion, resulting in a debt-to-GDP ratio approaching 300%. Most of the recent rise is global debt is attributable to the U.S. and China.

"With the Fed’s new easing cycle expected to accelerate the pace of global debt buildup, a significant concern is the apparent lack of political will to address rising sovereign debt levels in both mature and emerging market economies," the IIF report said.

As debt burdens continue to grow, countries must allocate an ever-greater share of revenue to servicing that debt. While lower interest rates may lighten the load, the risks to growth are considerable.

U.S. mortgage applications surged 11% in the week ended 20-Sep. Refinancings accounted for most of the gains as 30-year mortgage rates fell to 23-month lows.

New home sales fell 4.7% to 716k in August on expectations of 700k, versus a revised 751k in July. Home inventories rose 1.7% to 467k and the median price fell 2.0% as lower mortgage rates may finally be loosening up an extremely tight real estate market.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$1.42 (-0.05%)

5-Day Change: +$97.05 (+3.79%)

YTD Range: $1,986.16 - $2,667.22

52-Week Range: $1,812.39 - $2,667.22

Weighted Alpha: +44.32

Gold set another record high in overseas trading, pulling within striking distance of the $2,674.84 Fibonacci objective. While the yellow metal has retreated into the range, high geopolitical tensions, rising expectations for another jumbo Fed rate cut, and a weak dollar offer ongoing support.

Fed funds futures now show a 59.5% chance of a 50 bps cut at the November FOMC meeting. That's up modestly from 58.2% yesterday. However, the odds of another 50 bps cut were just 37% a week ago when the Fed announced its initial half-point move.

Initial support is marked by a minor intraday chart point at $2,652.08. More substantial supports are found at $2,614.86, $2,600.00/$2,597.42, and $2,585.74/$2,584.84. Dips that approach $2600 are likely to be viewed as buying opportunities.

The World Gold Council reports that Indian gold demand has normalized since the government significantly cut import duties. However, demand remains strong as we move deeper into the important festival and wedding season that extends through year-end.

The WGC sees potential for improved rural consumption due to a good monsoon season and expectations for higher crop yields. When farmers experience better economic conditions, they buy more gold. Record-high prices are not necessarily a deterrent, particularly if they anticipate the uptrend will continue.

The Reserve Bank of India has bought gold every month of this year through August. The RBI's YTD total stands at 50 tonnes.

While central bank buying is expected to remain a driving force in the gold market, the central bank of the Philippines acknowledged that they were a seller in H1. BSP selling was a strategic move that if anything reinforces the advantage of holding gold as a reserve asset.

"The BSP took advantage of the higher prices of gold in the market and generated additional income without compromising the primary objectives for holding gold, which are insurance and safety." according to a press release. I expect the BSP to be a buyer in the future as circumstances warrant.

Silver is consolidating at the upper end of yesterday's range. The white metal surged 4.6% on Tuesday to close above $32 for the first time since 28-May.

An eventual breach of the $32.379 high from 21-May would establish 12-year highs and signal that the longer-term uptrend is back underway. Such a move would shift focus to $33.972 initially based on a Fibonacci projection.

There's another Fibonacci level at $35.217, which marks 61.8% retracement of the entire decline from $49.752 (April 2011 high) to $11.703 (March 2020 low). This level also makes a logical secondary objective pending new highs for the year.

I continue to see the basic supply/demand dynamics for silver as broadly supportive. China's latest stimulus program, and expectations for additional accommodations, provide an additional tailwind.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

9/24/2024

Gold and silver continue to march higher

OUTSIDE MARKET DEVELOPMENTS: China's central bank initiated a sweeping stimulus program to halt disinflation and shore up flagging economic growth. The PBoC cut reserve requirements and key interest rates which could unleash up to ¥1 trillion in additional capital at lower borrowing costs.

New swap and funding facilities were announced, providing an initial ¥800 bln in liquidity to support the stock market. A stock stability fund is reportedly being considered as well.

Chinese stocks soared in response. Hong Kong's Hang Seng Index was up more than 4% and is back within 3% of its high for the year.

The PBoC also sought to address the ongoing property crisis by lowering downpayment requirements and cutting existing mortgage rates by 50 bps.

It is widely believed that additional stimulus will be forthcoming. Many see fiscal stimulus as necessary to revive China's economic recovery.

Israel and Hezbollah forces in Lebanon continue to trade cross-border strikes on Tuesday. Tensions remain extremely high with the risk of a broader regional conflict after Lebanon reported that more than 500 were killed on Monday.

Fed Governor Michelle Bowman (centrist-hawk) warns that inflation remains a threat. She worries that last week's 50 bps rate cut “could be interpreted as a premature declaration of victory on our price-stability mandate." Bowman was the lone dissenter in last week's Fed decision, favoring a more cautious 25 bps cut.

The Case-Shiller home price index and the FHFA home price index both reached new record highs in July. Lower mortgage rates driven by easier Fed policy will likely increase demand in a still-hot housing market. I think rates need to come down quite a bit more before homeowners consider rotating out of mortgages with 3 and 2 handles thereby increasing supply.

Consumer confidence tumbled 4.6 points to 98.7 in September, below expectations of 103.0, versus 103.3 in August. It was the largest decline since August 2021. The labor market diffusion index fell to a 42-month low of 12.6. “The deterioration across the Index’s main components likely reflected consumers concerns about the labor market and reactions to fewer hours, slower payroll increases, fewer job openings," said Dana M. Peterson, Chief Economist at The Conference Board.

The Richmond Fed Manufacturing Index fell two points to a post-COVID low of -21 in September, well below expectations of -12, versus -19 in August. The employment component tumbled seven points to −22, the lowest print since April 2009.

Median expectations for September nonfarm payrolls are +145k, but recent labor market readings make me think there's a risk once again for a downside surprise. Perhaps not surprisingly the prospects for another 50 bps rate cut in November are on the rise.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$5.04 (+0.19%)

5-Day Change: +73.96 (+2.88%)

YTD Range: $1,986.16 - $2,647.09

52-Week Range: $1,812.39 - $2,647.09

Weighted Alpha: +43.42

Gold continues to trend higher, buoyed by news of Chinese stimulus, high geopolitical tensions, political uncertainty in the U.S., expectations of more Fed rate cuts, and a soft dollar. The yellow metal is also being helped by surging silver. Gold's latest record high is $2,647.09.

Fed funds futures now favor a 50 bps rate cut in November. The probability for a cut to 4.25%-4.50% now stands at 58.1%, up from 53% yesterday, 29% a week ago, and 13.1% a month ago.

Short-term focus remains on the $2,674.84 Fibonacci objective. Beyond that, the next psychological barrier at $2,700 would be the attraction. Further out, the $3,000 level looks increasingly attractive.

Setbacks into the range are expected to attract additional buying interest. Initial support is marked by an intraday chart point at $2,641.27. Below that, additional supports are noted at $2,614.86, $2,600.00/$2,597.42, and $2,585.74/$2,584.84.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.226 (+0.74%)

5-Day Change: +$1.200 (+3.91%)

YTD Range: $21.945 - $32.379

52-Week Range: $20.704 - $32.379

Weighted Alpha: +45.33

Silver is surging, boosted by China's biggest stimulus package since COVID with more thought to be in the offing. The white metal is up more than 4% today.

Gains accelerated following the breach of important resistance at $31.652 (11-Jul high) which likely triggered longer-term stops and cleared the way for a challenge of the high for the year at $32.379 (21-May). An eventual breach of the latter would establish new 12-year highs and shift focus to $33.972 based on a Fibonacci projection.

China is the world's largest consumer of silver and many other commodities as well. Not surprisingly, the commodity sector is celebrating the Chinese stimulus.

Former resistance at $31.652 now marks first support. Secondary supports are noted at $31.413 and $31.249.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.