Morning Metals Call

Tuesday, November 26, 2024

11/25/2024

Gold and silver hit hard by revived risk-on sentiment

OUTSIDE MARKET DEVELOPMENTS: Markets have been cheered by President-elect Trump's broadly appealing choice of Scott Bessent for Treasury Secretary. This has boosted risk appetite offsetting some of the risk-off flows associated with hot geopolitical tensions between Russia and the West.

Bessent is known to be a fiscal hawk who will hopefully be keen to address America's surging debt burden, which is now more than $36 trillion. To accomplish that and keep the economy on an even keel, Bessent may seek to temper Trump's campaign promises for aggressive tax cuts and tariffs.

Stocks and Treasuries are higher. Lower yields have pulled the dollar index off last week's 13-month high.

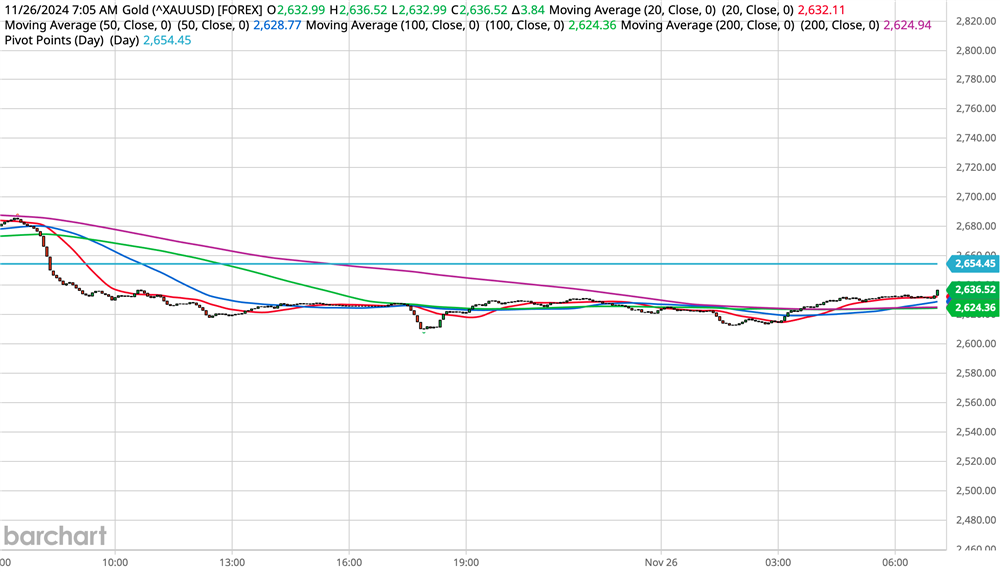

OVERNIGHT CHANGE THROUGH 6:00 AM CST: -$26.83 (-0.99%)

5-Day Change: +$20.32 (+0.78%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +26.60

Gold has come under significant selling pressure amid revived risk appetite, notching the biggest one-day drop since 07-Jun when we saw surprisingly strong May jobs data. The yellow metal has retraced about half of last week's solid gains.

President-elect Trump's nomination for Treasury Secretary and optimism about a possible ceasefire between Israel and Hezbollah have shifted market focus to riskier assets and away from havens like gold.

However, the conflict between Israel and Hamas continues and tensions between Russia and the West remain extremely high. Any escalation in either theater could quickly swing market sentiment back toward risk-off.

I still anticipate a 25 bps rate cut in December, but recent FedSpeak has taken on a more cautious tone heading into 2025, which also poses a bit of a headwind for gold. Prospects for a December hold continue to hover around 40% but became close to a 50-50 proposition on Friday.

Global ETFs saw a modest net inflow of 3.4 tonnes last week on heightened geopolitical risks, ending the string of weekly outflows at two. North American buying eclipsed outflows from Europe and Asia.

Futures traders were apparently less inclined to buy into last week's rally. The latest CFTC COT report showed net speculative long positions fell 2.1k to 234.4k contracts in the week ended 22-Nov from 236.5k contracts in the previous week. It was the fourth consecutive weekly decline.

Last week's gains back above $2,700 went a long way toward suggesting the corrective low is in place at $2,541.42. From there I was expecting choppy consolidative trading to prevail into year end. Today's price action reinforces that expectation with competing risk-on/risk-off forces competing for the attention of investors.

I suggest that such a consolidation phase would bode well for an eventual continuation of the long-term uptrend. A rebound above $2,668.84/$2,669.91 would ease pressure on the downside and suggest potential for further probes above $2,700.

With gold back below the 20- and 50-day moving averages, the short-term bias is back to the downside. Supports to watch are at $2,621.25 (20-Nov low) and $2,610.94/$2,609.54. The latter is marked by the low from 19-Nov and 61.8% of the rally off the $2,541.43 cycle low.

Silver plunged more than 3% in sympathy with gold. The much smaller, more thinly traded silver market has a higher beta that lends itself to amplified moves, particularly on the downside.

Despite the recent swings, the white metal remains confined to the range established in the week ended 15-Nov. However, today's breach of last week's low at $30.260 and the move back below the 100-day moving average suggests the $29.736 cycle low from 14-Nov remains vulnerable to a challenge.

Unlike gold, last week's gains in silver failed to signal that the corrective low was likely in place. I was watching the 20- and 50-day moving averages and the $32.294 Fibonacci level for that confirmation.

The CFTC COT report for last week showed net speculative long positions declined by 1.3k to 46.3k contracts, versus 47.6k in the previous week. While the decline was slight, it was the fourth consecutive weekly decline in net spec long positioning.

CFTC Silver speculative net positions

The 20- and 50-day MAs are at $31.551 and $31.787 respectively and are protected by solid chart resistance at $31.417/465. A rebound through this zone is needed to reinvigorate the bull camp.

I still think we could get a range form as long as gold holds its low. However, a fresh cycle low in silver below $29.736 would shift focus to the rising 200-day moving average at $28.970.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

Good morning. The precious metals are lower in early U.S. trading.

U.S. calendar features Chicago Fed National Activity Index, Dallas Fed Index.

11/22/2024

Gold and silver poised for first weekly gain in four as geopolitical risks mount

OUTSIDE MARKET DEVELOPMENTS: Russia fired a new advanced hypersonic ballistic missile at the Ukrainian city of Dnipro on Thursday in the latest escalation of the conflict. The Oreshnik missile system is nuclear-capable and carries multiple independently guided warheads. The missile is said to travel at ten times the speed of sound and is maneuverable in flight making it all but impossible to be intercepted.

The Kremlin confirmed that the use of the Oreshnik missile was retaliation for Ukraine’s use of U.S.- and UK-supplied missiles against targets inside Russia. "We consider ourselves entitled to use our weapons against the military facilities of those countries that allow their weapons to be used against our facilities," said Russian President Putin.

The stakes are extraordinarily high and continue to drive safe-haven flows. Gold is benefitting but so is the dollar. The dollar index has set a new two-year high at 108.07.

The greenback is also being boosted by euro and sterling weakness following dismal PMI data indicative of heightened recession risks. These risks also set the stage for accelerated easing from the ECB and BoE. The euro is trading at levels last seen in Nov'22 against the dollar, while cable reached a six-month low.

The comparatively resilient U.S. economy and higher yields make for an attractive investment environment. When foreign investors buy U.S. shares and Treasuries, the transaction starts with converting their local currency to dollars.

That being said, I still anticipate the Fed will cut rates by another 25 bps in December. However, Fed funds futures continue to suggest there is about a two in five chance of a hold.

U.S. S&P Flash Global Manufacturing PMI rose 0.3 points to a five-month high of 48.8 in November, below expectations of 48.9, versus 48.5 in October.

U.S. S&P Flash Global Services PMI surged 2.0 points to a 32-month high of 57.0 in November, well above expectations of 55.0, versus 55.0 in October.

Employment fell for a fourth straight month. Prices for goods and services "rose only very modestly in November."

"The prospect of lower interest rates and a more probusiness approach from the incoming administration has fueled greater optimism, in turn helping drive output and order book inflows higher in November," said S&P's Chris Williamson.

U.S. Michigan Sentiment Final was adjusted down to 71.8 for November, below expectations of 73.8, versus a preliminary read of 73.0 and 70.5 in October. The revised print is still a seven-month high. Inflation expectations ticked down to 2.6%.

The University of Michigan notes that the "stability of national sentiment this month obscures discordant partisan patterns." Not surprisingly, Republicans are more optimistic, while Democrats turned more pessimistic. This reflects "the two groups’ incongruous views of how Trump’s policies will influence the economy."

FedSpeak is due from Governor Michelle Bowman (centrist/hawk) this afternoon. Her topic is AI, and she may not comment on monetary policy.

GOLD

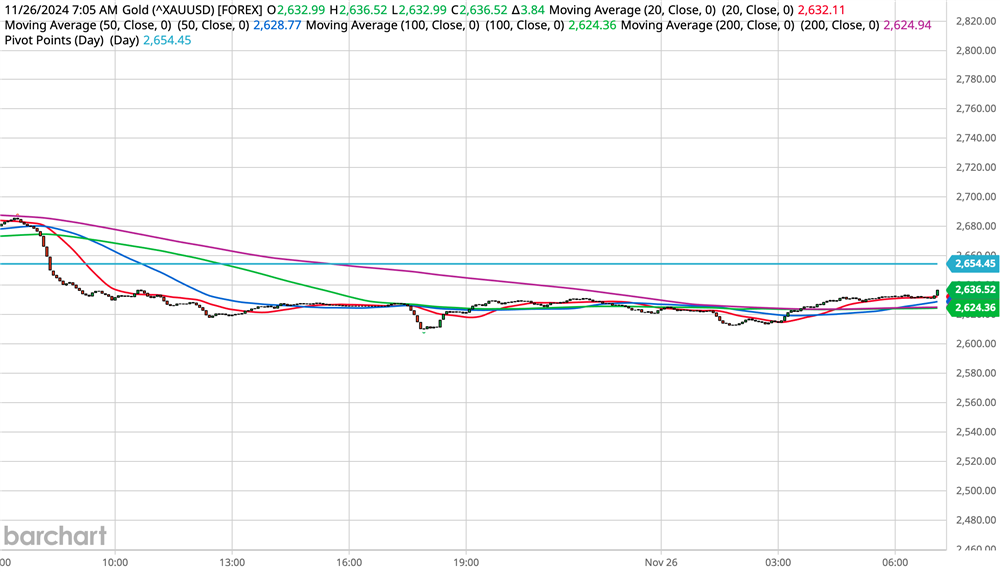

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +$29.10 (+1.09%)

5-Day Change: +$131.67 (+5.14%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +34.39

Gold continues to retrace recent losses driven by rising geopolitical tensions. The yellow metal is poised for its first higher weekly close in four.

Gold has now retraced more than 61.8% of the entire decline from $2,789.68 (30-Oct high) to $2,541.42 (14-Nov low). Gold is also back above all the major moving averages.

Considerable credence has been returned to the long-term uptrend. I still think a period of choppy consolidation is possible within the $2,789.68/ $2,541.42 range if calmer heads in both Russia and the West prevail. If tensions continue to escalate I expect gold to resume its trend toward $3,000 and beyond.

The next levels I'm watching on the upside are $2,736.55 (78.6% retrace) and a minor chart resistance at $2,745.93/$2,748.72. Beyond the latter, confidence would be high for a retest of the record peak at $2,789.68.

On the downside, the 20-day moving average at $2,675.20 protects today's overseas low $2,668.84.

Just as we noted that the historic inverse correlation between gold and the dollar was re-exerting itself, both are sharply higher today. Besides haven flows, the greenback is also being helped by euro and sterling weakness.

The strength of the dollar makes gold more expensive for buyers using other currencies. This could potentially reduce overseas demand unless they view the potential gains as outweighing their price sensitivity.

The Reserve Bank of India (RBI) added about 28 tonnes of gold to reserves in October, bringing YTD purchases to 78 tonnes. Total RBI gold holdings are now 882 tonnes, accounting for about 10% of total reserves.

Record high XAU-INR prices in October clearly didn't dissuade the RBI from adding to reserves. I suspect that will continue to be the case for many central banks.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CST: +0.460 (+1.49%)

5-Day Change: +$0.885 (+2.93%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +27.26

Silver is probing above $31.00 once again, but remains below Monday's high at $31.465 and within last week's range. Like gold, the white metal is positioned to notch its first higher weekly close in four.

Gold's strength is helping to underpin silver, but two-year highs in the dollar and mounting growth risks in Europe and the UK are a counterbalance for the largely industrial metal.

A report released by The Silver Institute earlier this week makes a pretty compelling case for silver as a safe-haven asset. In the wake of some key geopolitical events silver actually outperformed gold.

With gold approaching record territory once again, it might be worth considering at least a partial allocation to silver as a hedge against mounting geopolitical risks.

A breach of last week's high at $31.503 would clear the way for a challenge of the $31.718/$31.795 zone where the 20-day moving average has converged with the 50-day. Penetration of the letter would shift focus to the more important $32.048/294 zone where good chart resistance corresponds with the halfway back point of the four-week decline.

A move above $32.294 would strongly suggest that the corrective low is in place at $29.736 (14-Nov).

An intraday chart point at $31.032 marks first support. More substantial support is found at $30.750/680

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

11/20/2024

Gold remains underpinned by geopolitical risks but revived dollar strength limits

OUTSIDE MARKET DEVELOPMENTS: Russia has pledged to retaliate for President Biden’s decision to allow Ukraine to strike targets within Russia with U.S.-made missiles. The U.S. embassy in Kyiv closed today in anticipation of significant Russian missile and drone attacks.

Sky News is reporting that Ukraine has fired British Storm Shadow missiles into Russia. Russia's recently revised nuclear doctrine views aggression from any non-nuclear state – but with the participation of a nuclear power – a joint attack on Russia.

Does Russia now view itself at war with the U.S. and UK, and perhaps NATO as a whole? While doctrine now suggests a nuclear response is possible, Russian nuclear saber-rattling is nothing new.

Markets are nervously awaiting a response from Putin. Events this week are most certainly escalations of the conflict and markets have shifted to more risk-off positioning.

The U.S. vetoed a UN Security Council resolution that demanded an "immediate, unconditional and permanent cease-fire" in Gaza. The U.S. objected because the resolution did not call on Hamas to release the remaining hostages.

While geopolitical tensions are at the fore of the market's consciousness, speculation about the Fed's policy intentions for the December FOMC meeting persists. Fed funds futures now suggest a 41% probability of rates being held at 4.50%-4.75%. That's up from 17.5% a week ago and 21.8% a month ago.

The prospect of a less-dovish Fed heading into the new year provides an additional tailwind for the dollar. The dollar index set a 13-month high last week largely on post-election investment flows driven by expectations of more market-friendly policies from the incoming President and Congress.

The recent setback in the greenback was limited and had the characteristics of a bull flag formation. This chart pattern favors additional near-term gains. Most of the setback from last week's high has already been retraced.

Scope is seen for a challenge of last year's high in the DX at 107.35. This level is bolstered by the 50% retracement level of the entire decline from the 2022 high at 114.78 to the 2023 low at 99.58.

MBA Mortgage Applications rose 1.7% in the week ended 15-Nov. It was the second consecutive week of improvement but with 30-year mortgage rates reaching a 19-week high of 6.90% headwinds for the housing market persist.

GOLD

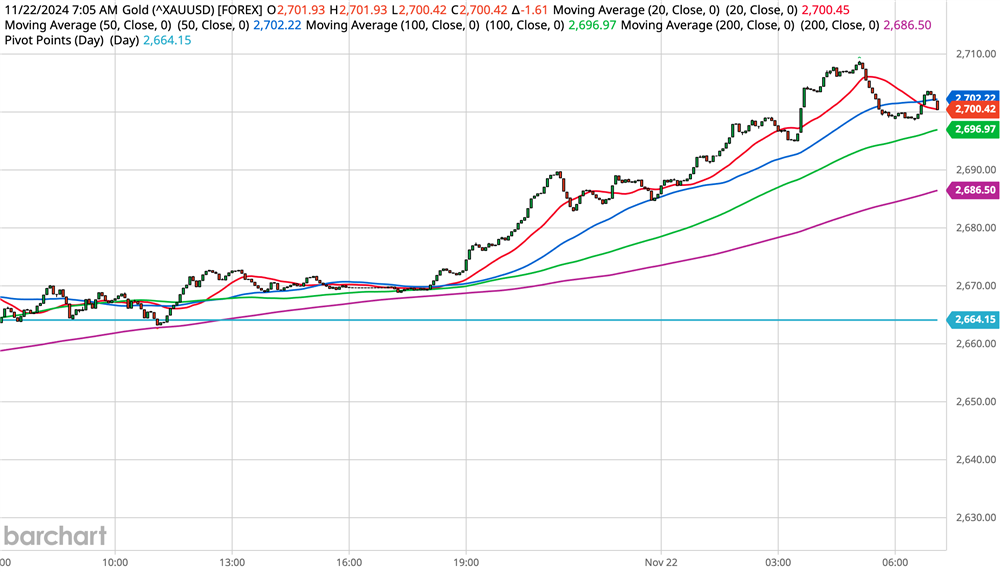

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: -$4.51 (-0.17%)

5-Day Change: +$76.23 (+2.96%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +31.37

Gold remains underpinned by heightened geopolitical tensions. However, dollar strength and rising expectations of a December hold by the Fed are seen as limiting factors.

Nonetheless, the yellow metal is edging toward an important resistance level at $2,659.09/$2,665.55 where the 50-day moving average corresponds closely with the halfway back point of the recent decline. A push through this zone would suggest to me that the corrective low is in place at $2,541.42.

My initial expectation was that gold would meet resistance shy of the all-time high at $2,789.68 and choppy consolidative trading would prevail into year-end. Such price action would be a continuation pattern within the long-term uptrend. I do believe that trend ultimately resumes.

However, if tensions associated with the war in Ukraine continue to escalate, the uptrend could re-exert itself much faster. If Russia were to use a tactical nuclear weapon or if there is direct fighting between Russian and NATO forces, gold could surge to $3,000 and beyond.

The World Gold Council noted healthy gold jewelry, coin, and bar buying in India during Diwali, despite record-high prices. According to the WGC, "Volatility in domestic equity markets, coupled with rising international prices, has added to gold’s investment appeal." This has also contributed to robust ETF inflows.

Swiss gold exports jumped to 101 tonnes in October, helped by Indian seasonal demand. That's an 8% increase versus September. However, exports are still down about 38% y/y due to slack demand from China and Hong Kong stemming from record-high prices.

If gold is unable to move convincingly above $2,665.55 a move back below $2,600 would have to be considered. Today's overseas low at $2,621.25 and yesterday's low at $2,610.94 provide intervening barriers.

Silver is trading lower today, unable to build on gains notched earlier in the week. The white metal typically does not have the same haven appeal as gold, so there is less of a buffer against today's resurgent dollar.

That being said, the Silver Institute report I cited yesterday notes that Russia's initial invasion of Ukraine and the resulting sanctions corresponded closely with a significant turning point in silver. In times of geopolitical unrest, investors turn to alternative assets, including silver, as an investment.

"During times of safe haven demand due to flare-ups in geopolitical tensions many of the relationships with the fundamental drivers for silver are interrupted," according to the report.

Last week's high at $31.503 successfully contained the upside yesterday, leaving the 50-day moving average at $31.769 protected. Penetration of these levels is needed to shift focus to the more important $32.048/294 zone where good chart resistance corresponds with the halfway back point of the four-week decline.

A move above $32.294 is needed to suggest that the corrective low is in place at $29.736 (14-Nov).

Today's European low at $30.827 marks initial support. Penetration would bode well for another run at the 100-day moving average, which is at $30.394 today.

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.

11/19/2024

Gold extends gains on haven bid after Ukraine fires U.S.-made weapons into Russia

OUTSIDE MARKET DEVELOPMENTS: Ukraine reportedly fired six U.S.-made ATACMS missiles at a Russian military installation in the Bryansk region of Russia. Moscow reports that five missiles were shot down, the sixth was damaged, and there were no casualties.

The attack occurred just days after President Biden gave the green light for Ukraine to use U.S. weapons to hit targets on Russian soil. President Putin warned in September that “This will mean that NATO countries – the United States and European countries – are at war with Russia."

Putin lowered the threshold for the use of nuclear weapons in response to Biden's decision. "The Russian Federation reserves the right to use nuclear weapons in the event of aggression with the use of conventional weapons against it," said a Kremlin spokesman.

The escalation of the conflict has put markets on edge awaiting Putin's response. Post-election risk-on flows that have dominated the past two weeks have been tempered and perhaps reversed. President-elect Trump has pledged a negotiated peace deal even before he moves into the White House. Uncertainty and risks abound.

The haven bid has buoyed Treasuries and gold. The dollar index remains off the 13-month high set last week, but the downside is seen as limited from here.

U.S. Housing Starts contracted to a 1.311M pace in October, below expectations of 1.330M, versus a revised 1.353M in September (was 1.354M). Building Permits slid to a 1.416M pace from 1.425M in September. Housing Completions tumbled to 1.614M versus 1.688M.

FedSpeak is due from KC Fed President Jeffrey Schmid (centrist) this afternoon.

GOLD

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +$17.05 (+0.65%)

5-Day Change: +$39.37 (+1.52%)

YTD Range: $1,986.16 - $2,789.68

52-Week Range: $1,812.39 - $2,789.68

Weighted Alpha: +30.57

Gold has extended to the upside lifted by safe-haven demand after Ukraine wasted no time in using U.S. weapons after receiving permission to do so from President Biden. Just over 38.2% of the two-week decline has now been retraced.

Further escalation in Ukraine should lead to further upside retracement. Russia's use of tactical nuclear weapons or the direct involvement of NATO forces could almost certainly send gold soaring to new record highs and beyond.

My position has been that the decline off the $2,789.68 record high (30-Oct) is a correction within the long-term uptrend. The high-to-low magnitude of the drop has been just shy of 9% thus far. I was also heartened by the fact that the 100-day moving average survived last week's challenge.

Nonetheless, it's premature to suggest the corrective low is in. My preferred scenario was that a range would develop and choppy consolidative trading would prevail into year-end.

Heightened risks associated with the war in Ukraine could absolutely reignite the dominant uptrend. Markets are nervously awaiting Putin's response to today's missile attack.

The next resistances I'm watching are $2,656.21 (50-day moving average) and $2,665.55 (50% retracement). Penetration of the latter would go a long way toward confirming that the corrective low is in place at $2,541.42.

If President-elect Trump, or some other party, can get Russia and Ukraine to the negotiating table geopolitical tensions could moderate pretty quickly. That would likely put gold back on the defensive.

A negotiated peace would almost certainly require Ukraine to cede territory to Russia, something they appear loathe to agree to. After 1,000 days of Russian aggression within Europe, is it even possible for the U.S. and its allies to put NATO expansion back on the table?

Failure to sustain the recent gains back above $2,600 would favor a test of the halfway back point of the rally at $2,589.86. A breach of the latter would leave the 100-day moving average and last week's low vulnerable to further tests.

SILVER

OVERNIGHT CHANGE THROUGH 6:00 AM CDT: +0.115 (+0.37%)

5-Day Change: +$0.671 (+2.18%)

YTD Range: $21.945 - $34.853

52-Week Range: $20.704 - $34.853

Weighted Alpha: +28.73

Silver extended to new highs for the week in early U.S. trading, buoyed by strength in gold and helped by a generally neutral dollar. However, the white metal has since slipped back into negative territory leaving the price confined to last week's range.

With last week's high at $31.503 intact, the 50-day moving average at $31.722 is protected. Penetration of these levels is needed to shift focus to the more important $32.048/294 zone where good chart resistance corresponds with the halfway back point of the four-week decline.

A move above $32.294 would strongly suggest that the corrective low is in place at $29.736 (14-Nov).

The Silver Institute released a report today highlighting the benefits of a silver allocation for diversification and risk reduction. "Historically, silver has proven its value during economic and geopolitical crises, serving as a reliable hedge against inflation, currency devaluation, and systemic financial instability," according to the report.

New intraday lows below $31.099 would return focus to a pivot point at $30.890 with potential back to $30.600 (50% retrace of the rally from last week's low).

Peter A. Grant

Vice President, Senior Metals Strategist

Zaner Metals LLC

Tornado Precious Metals Solutions by Zaner

312-549-9986 Direct/Text

[email protected]

www.ZanerPreciousMetals.com

www.TornadoBullion.com

X: @GrantOnGold

X: @ZanerMetals

Facebook: @ZanerPreciousMetals

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.