Gold hits 6-month high on Fed pause expectation, softer dollar

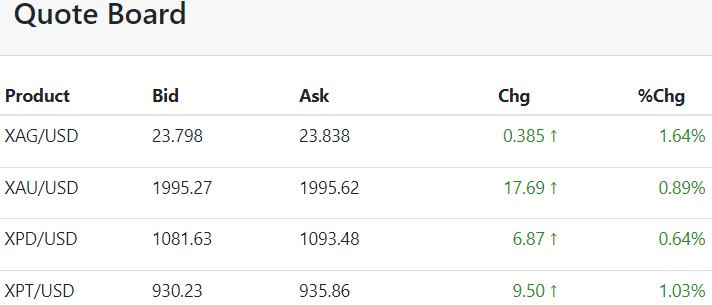

Monday, November 27, 2023Nov 27 (Reuters) - Gold prices hit a more than six-month high on Monday, firming above the $2,000 per ounce level, as a weaker dollar and expectations of an end to U.S. interest rate hikes lifted demand.

Spot gold was up 0.5% at $2,012.33 per ounce by 1147 GMT, after reaching its highest since May 16 at $2,017.82. U.S. gold futures also rose 0.5% to $2,013.10...[LINK]