Morning Call

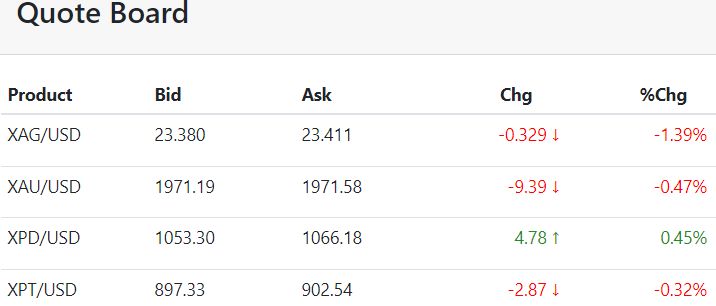

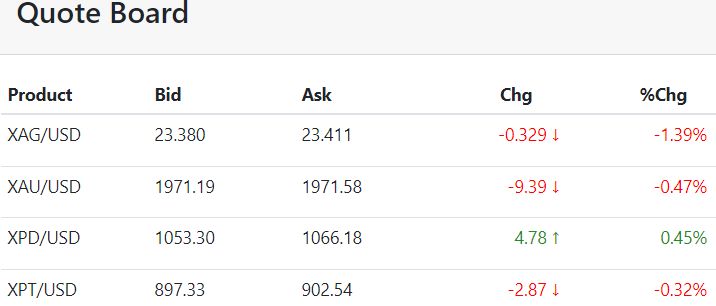

Monday, November 20, 2023Good morning. The precious metals are mostly lower in early U.S. trading.

U.S. calendar features Leading Indicators.

Good morning. The precious metals are mostly lower in early U.S. trading.

U.S. calendar features Leading Indicators.

Gold and silver face a critical "focus" junction today with action in the dollar likely to support, while US data and misguided/overstated disinflation predictions undermine sentiment.

However, we favor the downward tilt with the euphoria from the end of the historic US interest rate hike cycle fully injected into gold and silver prices with the rallies earlier this week.

We think the focus will be primarily on US continuing claims this morning which will be followed by what is expected to be soft US heavy industry/manufacturing data...[MORE]

Please subscribe to receive the full report via email by clicking here.

Nov 16 (Reuters) -Gold prices rose on Thursday as the U.S. Treasury yields edged lower, amid prospects that the Federal Reserve is done with its rate hike cycle.

Spot gold gained 0.3% to $1,965.08 per ounce, as of 1056 GMT. U.S. gold futures rose 0.2% to $1,967.70...[LINK]

Good morning. The precious metals are higher in early U.S. trading.

U.S. calendar features Philly Fed Index, Import/Export Price Indexes, Initial Jobless Claims, Industrial Production, NAHB Housing Mkt Index, TIC Data.

FedSpeak due from Barr, Mester, Waller, Williams, & Cook.

Nov 15 (Reuters) - Gold prices rose to a more than one-week high on Wednesday as the U.S. dollar and Treasury yields weakened after cooler inflation data boosted bets that a U.S rate cut might come sooner than earlier priced in by investors.

Spot gold rose 0.4% to $1,970.45 per ounce at 1224 GMT, after earlier touching its highest since Nov. 7. U.S. gold futures also gained 0.4% to $1,974.70...[LINK]

The technical path of least resistance is down in gold with a series of lower highs and lower lows presenting bearish charts.

We also see the fundamental bias pointing down in gold and silver as a muted US CPI reading fosters a thin measure of long liquidation from long-suffering gold inflation bulls.

However, the bull camp hopes that muted inflation will spark talk of the end of the rate hike cycle and potentially provide a measure of misguided buying off talk of rate "cuts" next year...[MORE]

Please subscribe to receive the full report via email by clicking here.

Nov 14 (Reuters) -Gold prices were flat on Tuesday as traders maintained caution ahead of the U.S. inflation print due later in the day for further cues on the interest rate path in the world’s largest economy.

Spot gold was little changed at $1,947.39 per ounce, as of 1021 GMT, trading in a narrow range of $6, after hitting its lowest in more than three weeks on Monday. U.S. gold futures rose 0.1% to $1,951.30...[LINK]

Unfortunately for the bull camp, the gold trade continues to embrace the bearish bias from last week with expectations the dollar will continue to climb, and the charts remain bearish.

With the last day of Diwali tomorrow the opportunity for Indian festival demand is past.

While there will be an avalanche of global inflation readings this week, we do not see that information playing a determining role for gold and silver prices, and most readings are expected to show only incremental changes it is unlikely there will be a definitive opinion on the direction of upcoming central bank policy changes.

Please subscribe to receive the full report via email by clicking here.