Blog posts of '2023' 'June'

Gold faces quarterly decline as rate hike bets grow

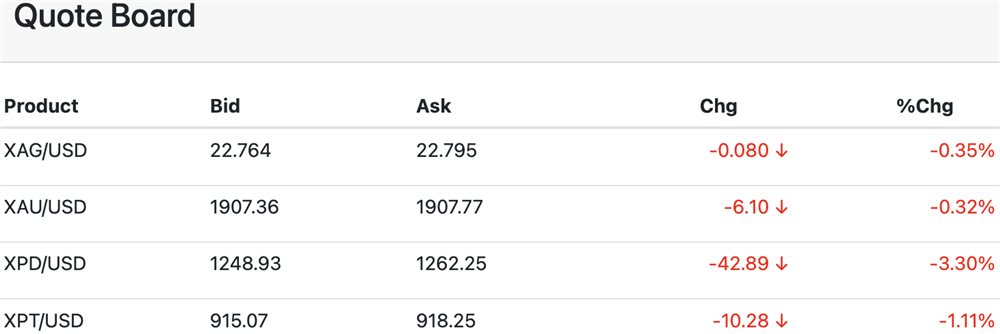

Friday, June 30, 2023June 30 (Reuters) - Gold prices are set for their first quarterly decline in three on Friday as expectations of more interest rate hikes by the U.S. Federal Reserve and its global peers dimmed the outlook for bullion.

Spot gold fell 0.2% to $1,904.94 per ounce by 1203 GMT, down 3.2% for the quarter ending June 30...[LINK]

Morning Call

Friday, June 30, 2023

Zaner Daily Precious Metals Commentary

Thursday, June 29, 2023Gold edges higher ahead of key US economic data

Thursday, June 29, 2023June 29 (Reuters) - Gold firmed into a tight range on Thursday, trading near a major support level of $1,900 as Federal Reserve officials reaffirmed their hawkish policy message ahead of key U.S. economic data.

Spot gold edged up 0.2% to $1,910.34 per ounce by 12:05 GMT, after hitting a fresh low since mid-March. U.S. gold futures fell 0.2% to $1,918.40...[LINK]

Morning Call

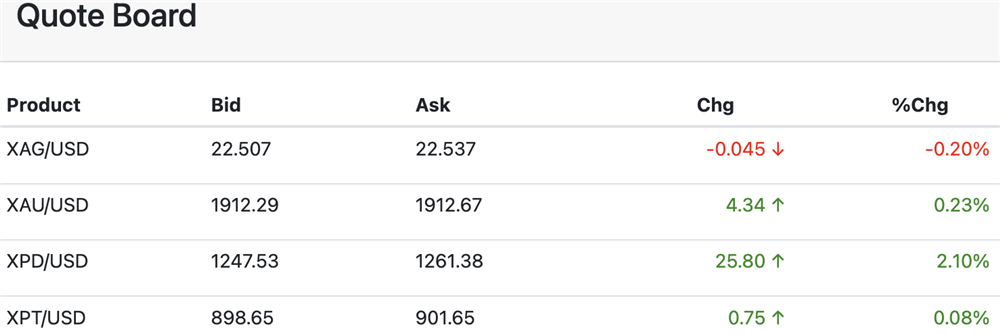

Thursday, June 29, 2023Good morning. The #preciousmetals are mixed in early U.S. trading.

U.S. calendar features Q1 GDP Final (1.4% exp), Initial Jobless Claims, Pending Home Sales Index.

Zaner Daily Precious Metals Commentary

Wednesday, June 28, 2023In addition to a lack of classic bullish fundamental themes, gold, and silver have seen sellers emerge off a rekindling of US rate hike prospects given yesterday's very positive sweep of US scheduled data in the form of durable goods and new-home sales.

Adding to the bearish tilt this morning is a wave of hawkish commentary from a European Central Bank forum in Portugal where a long list of central bank leaders have echoed the need to "fight inflation" with further rate hikes...[MORE]

Please subscribe to receive the full report via email by clicking here.

Gold drops to more than 3-month low as traders await Powell

Wednesday, June 28, 2023June 28 (Reuters) - Gold prices slipped to a more than three-month low on Wednesday after upbeat U.S. economic data cemented expectations of more rate hikes this year as investors positioned for a speech by Federal Reserve Chair Jerome Powell’s later in the day.

Spot gold fell 0.4% to $1,906.49 per ounce by 1148 GMT, hitting its lowest since mid-March earlier in the session. U.S. gold futures shed 0.4% to $1,915.50...[LINK]

Morning Call

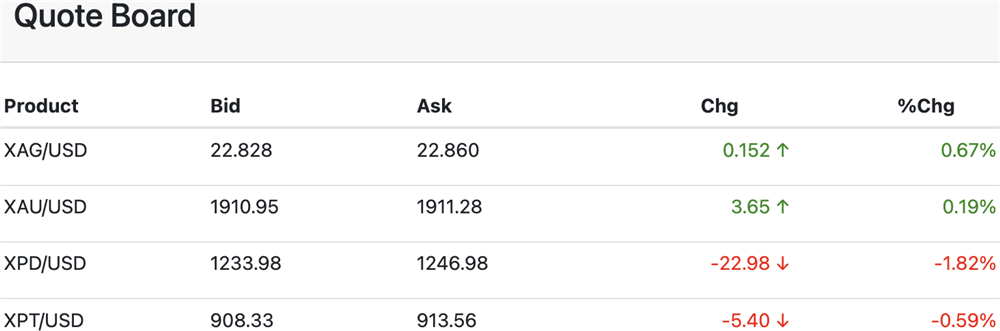

Wednesday, June 28, 2023Good morning. The #preciousmetals are lower in early U.S. trading.

U.S. calendar features Advance Economic Indicators, EIA Data, & FedSpeak from Powell.

Zaner Daily Precious Metals Commentary

Tuesday, June 27, 2023With promises of Chinese stimulus from the Chinese premier overnight gold and silver prices are showing little in the way of positive action.

While gold, silver, platinum, and palladium appeared to see flight to quality lift yesterday from the uncertainty of the military turmoil in Russia, that potential has dissipated quickly.

Certainly, if the coup attempt had gained traction and not ended so quickly, there might have been destabilization in Russia...[MORE]

Please subscribe to receive the full report via email by clicking here.