Grant on Gold – July 31, 2023

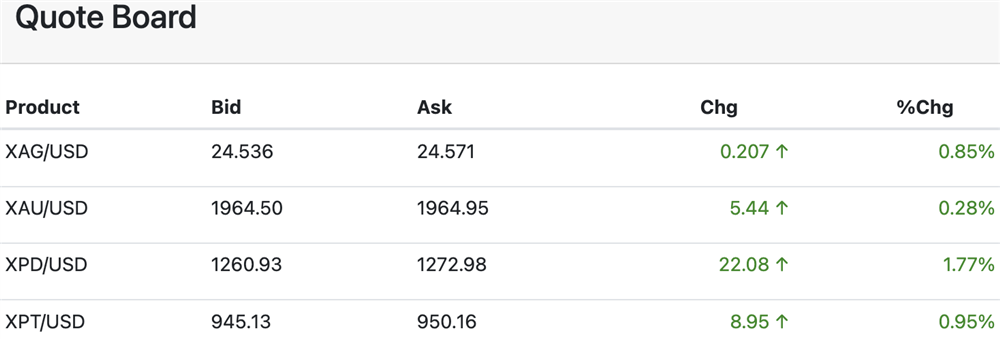

Monday, July 31, 2023Gold is consolidative just below the midpoint of the May-June range as the market assesses the implications of last week’s Fed rate hike and better-than-expected economic data. The yellow metal ends July with a gain of 2.4%, breaking a 2-month losing streak.

Last week the Fed hiked rates by 25 bps, and it was widely accepted it would be the last one for some time. However, on Thursday Q2 advance GDP came in at 2.4%, above expectations of 1.9%. In addition, durable goods orders surged 4.7% in June, well above market expectations of 1.8%.

These robust data are evidence that the U.S. economy continues to hum along at a respectable pace, despite the marked rise in interest rates over the past 16 months. More hawkish members of the Fed could now conceivably argue there is room for another rate hike. Fed funds futures are currently showing a 20% probability for a 25-bps hike in September.

While the Fed’s favored measure of inflation cooled to 4.1% in June, versus 4.6% in May, there are lingering worries in the market that a second wave of inflation could be in the offing. The national average for a gallon of regular gas jumped 13¢ last week reaching an 8-month high.

I’m often asked why gold didn’t fare better during this inflationary period. The answer lies in the Fed’s aggressive response in raising the Fed funds rate by 525 bps in just over a 1-year period. During that time, gold only corrected 22%, from $2070.63 (just shy of the all-time high) to $1614.92.

Most of those corrective losses have already been retraced, so I would argue that gold held up remarkably well in the face of the most aggressive tightening campaigns in recent history.

The long-term trend remains bullish with the market trading less than $110 off the all-time high. Setbacks into the range are likely to be viewed as buying opportunities.

Silver

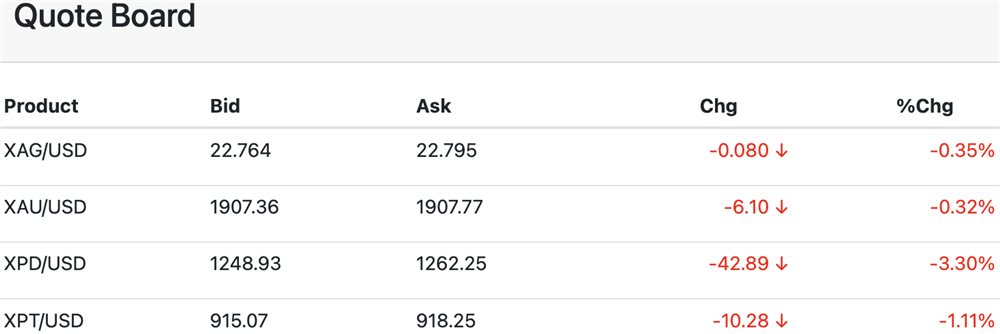

Silver closed down more than 1% last week, weighed by persistent concerns that the health of the Chinese economy, and an uptick in the probability of another Fed rate hike in September.

A firmer tone emerged over the past two sessions on the heels of strong U.S. and Japanese data. While the Chinese economy continues to show signs of weakness, the government announced supports for light industry on Friday and then measures to boost consumer spending on Monday.

Such stimulus offers support for both precious and industrial metals. If the Chinese economy continues to struggle, additional (and larger) stimulus would be likely, providing underpinning for the metals.

I like that the 20-day SMA successfully contained the downside last week. Renewed tests above $25 would bode well for a retest of the high from July 20 at $25.27. Penetration of the latter would clear the way for a challenge of the highs for the year at $26.09/14.

PGMs

Platinum fell 2.8% last week, notching a second consecutive lower weekly close. A fresh 2-week low was set on Monday before the market snapped back to close nearly 2% higher on the day.

The outside day with a higher close bodes well for upside follow-through on Tuesday. Strong economic data from the U.S. and Japan, along with Chinese stimulus are supportive factors.

The longer-term supply and demand dynamics remain broadly supportive. Dips into the range are likely to be viewed as buying opportunities.

Palladium has been corrective to consolidative over the past several weeks. While a short-term bottom may be in place at $1185.18, the trend remains bearish.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.