Blog posts of '2023' 'September'

Gold slides as Fed reinforces higher-for-longer rates outlook

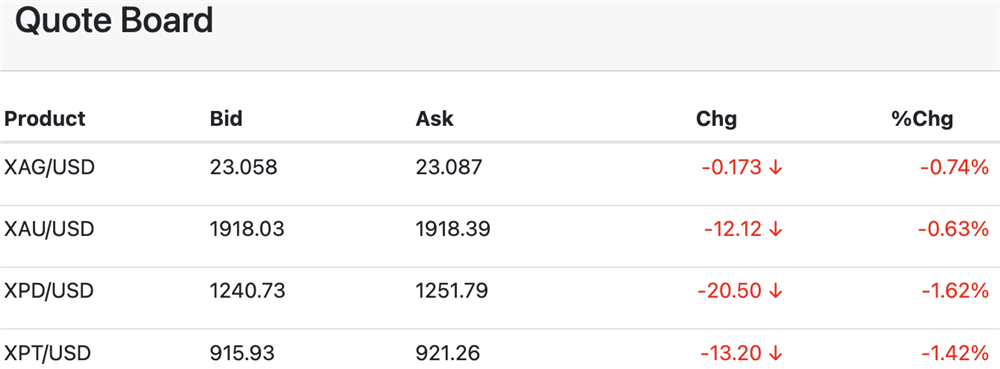

Thursday, September 21, 2023Sep 21 (Reuters) - Gold extended its decline on Thursday, weighed by the surge in the U.S. dollar and U.S. bond yields after the Federal Reserve hardened its hawkish posture on interest rates.

Spot gold shed 0.4% to $1,922.30 per ounce by 0907 GMT, having briefly touched its highest since Sept. 1 before closing lower in the previous session...[LINK]

Morning Call

Thursday, September 21, 2023

Zaner Daily Precious Metals Commentary

Wednesday, September 20, 2023Surprisingly, the #gold market has remained lower this morning despite a softer-than-expected set of inflation readings from the UK. In our opinion, the data was not enough to discourage the Bank of England from hiking rates tomorrow, but the UK economy has created some doubt.

However, recently the gold market has been very sensitive to action in the #dollar, and with gold trading lower today with a setback in the dollar, the bull camp has stepped back.

Certainly, the aggressive recovery in the dollar yesterday has rattled some would-be buyers, especially if the US #Fed surprises and decides to hike today...[MORE]

Please subscribe to receive the full report via email by clicking here.

Gold listless with eyes on Fed's interest rate outlook

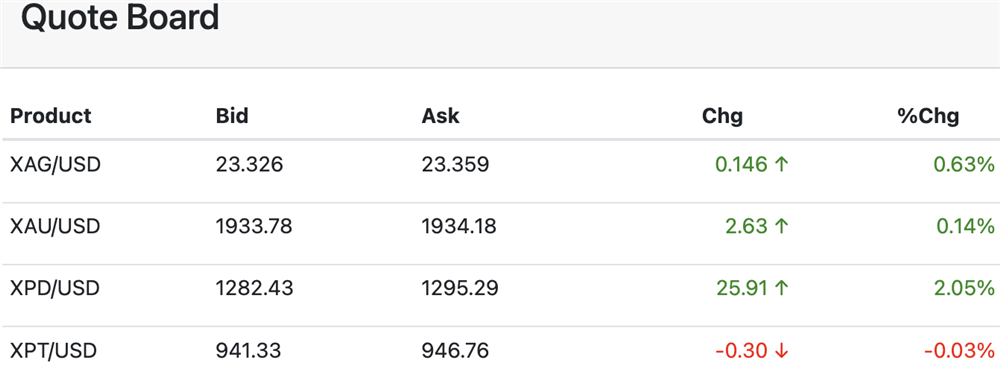

Wednesday, September 20, 2023Sep 20 (Reuters) - Gold was little changed on Wednesday as investors braced for updated interest rate projections and remarks from Chair Jerome Powell following the Federal Reserve’s monetary policy meeting.

Spot gold was steady at $1,931.20 per ounce at 1127 GMT, holding below its highest level since Sept. 5 reached on Tuesday. U.S. gold futures eased 0.1% to $1,952.50...[LINK]

Morning Call

Wednesday, September 20, 2023

Zaner Daily Precious Metals Commentary

Tuesday, September 19, 2023With the dollar showing signs of eroding the charts in both gold and silver continue to show signs of a slight revival.

Unfortunately for the bull camp investment interest in gold continues to wane with ETF holdings reduced for the 12th straight session, while silver investors bucked the trend with a purchase of 1.2 million ounces!

Apparently, the gold and silver trade is looking beyond the probable Bank of England rate hike tomorrow to the highly likely US Federal Reserve rate hike pause on Thursday...[MORE]

Please subscribe to receive the full report via email by clicking here.

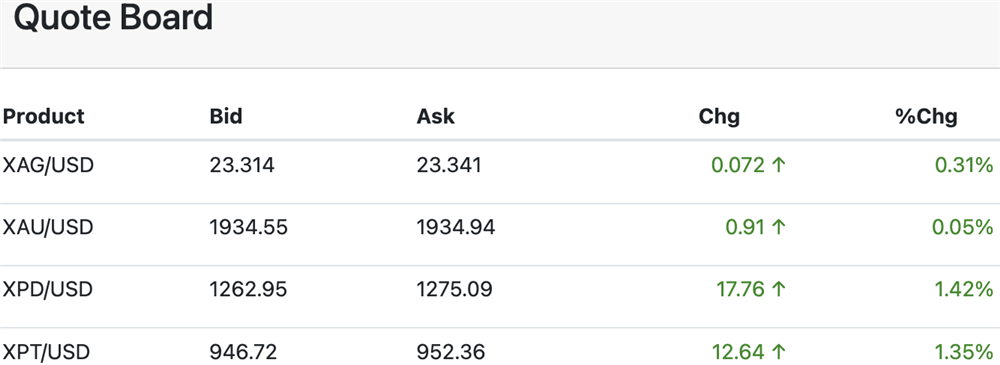

Gold at two-week high ahead of US Fed rate meeting

Tuesday, September 19, 2023Sep 19 (Reuters) - Gold prices hit a two-week high on Tuesday as the U.S. dollar eased from a six-month peak ahead of the start of the Federal Reserve’s policy meeting later in the day, with markets braced for a new set of economic forecasts from the central bank.

Spot gold was up 0.1% at $1,934.40 per ounce after hitting its highest since Sept. 5 earlier in the session. U.S. gold futures gained 0.2% to $1,957...[LINK]

Morning Call

Tuesday, September 19, 2023

Grant on Gold – September 18, 2023

Monday, September 18, 2023Gold has been unable to sustain tests below $1900 in recent weeks. While it’s premature to suggest the corrective low is in place at $1884.88 (21-Aug), support is now clearly defined. The yellow metal traded as low as $1901.05 last week which now marks a good intervening support level.

Gold has garnered some lift from revived inflationary pressures, uncertainty associated with the UAW strike, and the latest risk of a government shutdown.

Annualized CPI rose to 3.7% in August, versus 3.2% in July. PPI jumped to 1.6% y/y from 0.8% in July. Gas prices have reached new highs for the year at a time when ebbing seasonal demand should be tamping the price.

Production cuts by Saudi Arabia and Russia, along with severe flooding in Libya have squeezed supply and pushed crude to 10-month highs, approaching $100 per barrel. The price has risen at the fastest pace since Russia invaded Ukraine last year.

Gold is pressuring the upper reaches of the broad corrective channel. A move back above the 100-day MA at $1945.59, and perhaps more importantly the $1953.06 high from 01-Sep would set a more favorable tone within the range.

Despite resurgent inflation, Fed funds futures indicate that the central bank will hold steady when they announce policy this week. The probability of steady policy is currently at 99%.

Heightened growth risks, seem to be offsetting inflationary pressures. If Fed funds remain at 5.25-5.50%, market participants will turn to the policy statement and the projections for clues as to the Fed’s next move.

Not surprisingly, risks to growth along with stubborn inflation have led to heightened talk about stagflation. During the last bout of stagflation, which occurred in the 1970s, gold was one of the best-performing assets.

It is reasonable to assume that gold will once again serve as a hedge, should stagflation rear its ugly head once again. With gold less than 7% off its all-time high ($2075.28), the last several months of corrective to consolidative price action seem to present a favorable buying opportunity.

Silver

Silver unsuccessfully challenged important support at $22.22/11 last week before rebounding into the range. With this level intact, downside risk is clearly defined.

Worries about an economic slowdown are further exacerbated by the U.S. autoworker’s strike. While the auto industry will remain a huge source of demand for silver, the strike may sap demand in the short term.

According to the Silver Institute, the auto industry consumes 60 Moz of silver annually. That figure is expected to grow to 90 Moz by 2025, driven largely by the rising demand for electric vehicles (EVs).

Conventional vehicles with internal combustion engines contain 15 to 28 grams of silver. On the other hand, the silver load in EVs can be as high as 50 grams.

Some more upbeat economic data out of China in August suggests the demand picture may be improving. That would bode well for silver and other industrial metals, but many analysts worry that the property slump is likely to persist, leading to an ongoing drag on the economy.

A rebound above $24 would put silver back above all the major moving averages, setting a more positive technical tone within the large developing triangle pattern. Given the long-term supply and demand fundamentals, an eventual upside breakout of this pattern is still preferred.

PGMs

Platinum rebounded nearly 4% last week, leaving a potential inverse head-and-shoulders pattern. A breach of the neckline around $990 is needed to confirm the formation, which would have bullish implications. Upside potential would be $1107.68 based on a measuring objective.

A soft landing in the U.S. along with an end to the autoworkers strike would provide fundamental support to this scenario, as would a sustained recovery in China.

Palladium remains defensive after falling to nearly a 5-year low early in September. The autoworkers’ strike adds additional pressure to an already bleak demand environment.

Non-Reliance and Risk Disclosure: The opinions expressed here are for general information purposes only and should not be construed as trade recommendations, nor a solicitation of an offer to buy or sell any precious metals product. The material presented is based on information that we consider reliable, but we do not represent that it is accurate, complete, and/or up-to-date, and it should not be relied on as such. Opinions expressed are current as of the time of posting and only represent the views of the author and not those of Zaner Metals LLC unless otherwise expressly noted.