Zaner Daily Precious Metals Commentary

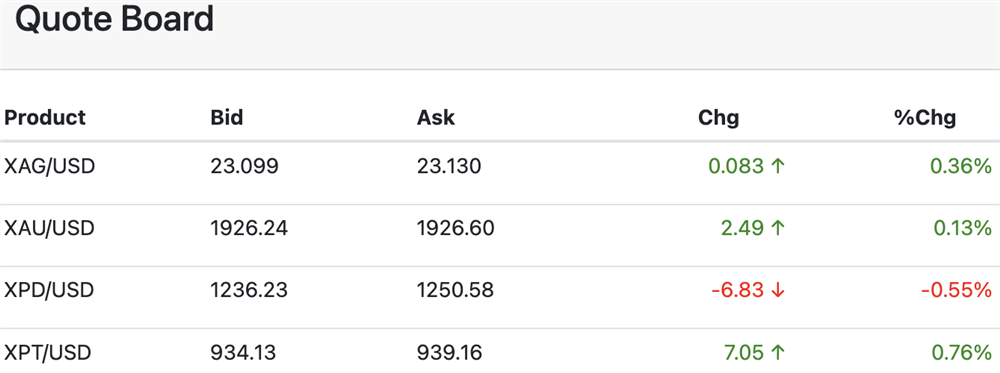

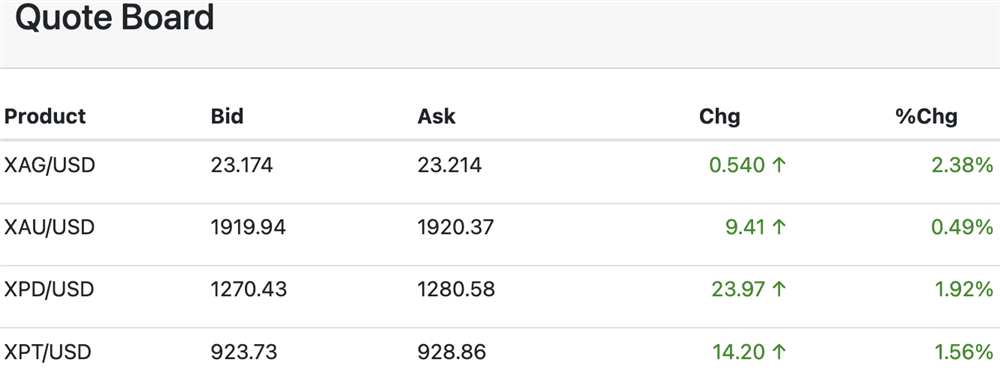

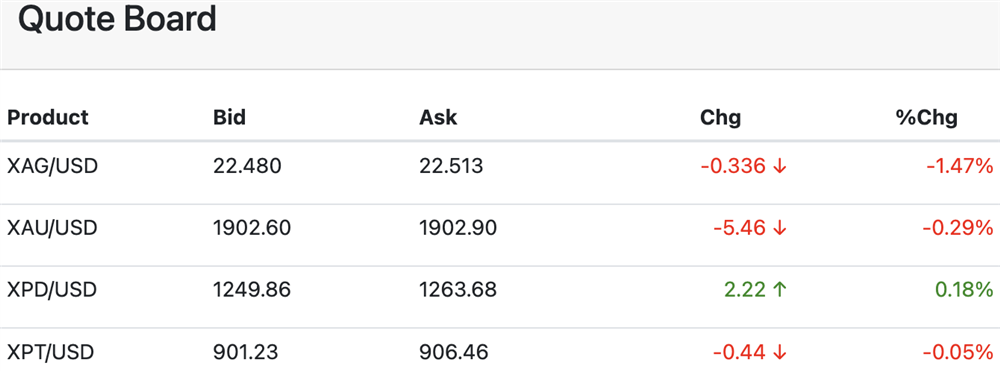

Monday, September 18, 2023While the dollar has not made a fresh high for the move since last Thursday (6-month high), the currency index remains near upside breakout territory, suggesting potential for a resumption of upside follow-through today.

With treasury yields also breaking out to the highest level since August 22nd overnight and sitting within one point of contract lows, renewed strength in the dollar should not be discounted.

In short, outside market forces continue to favor the bear camp in gold and silver with internal bullish fundamentals incapable of supporting prices or are simply completely absent...[MORE]

Please subscribe to receive the full report via email by clicking here.