Morning Call

Friday, September 8, 2023

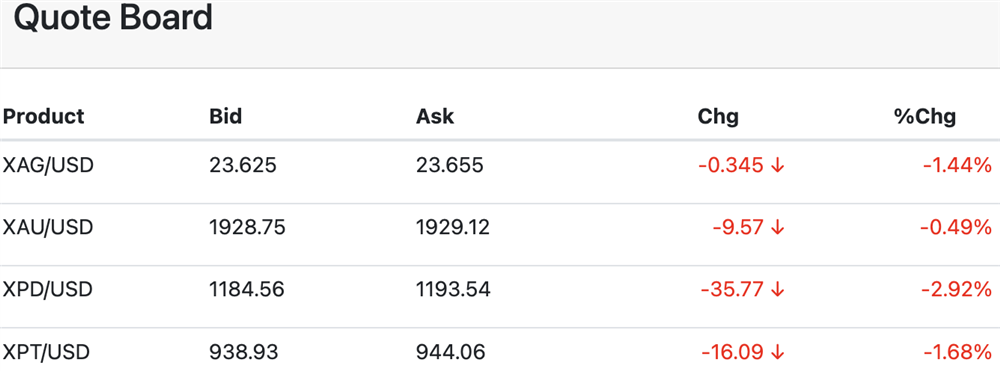

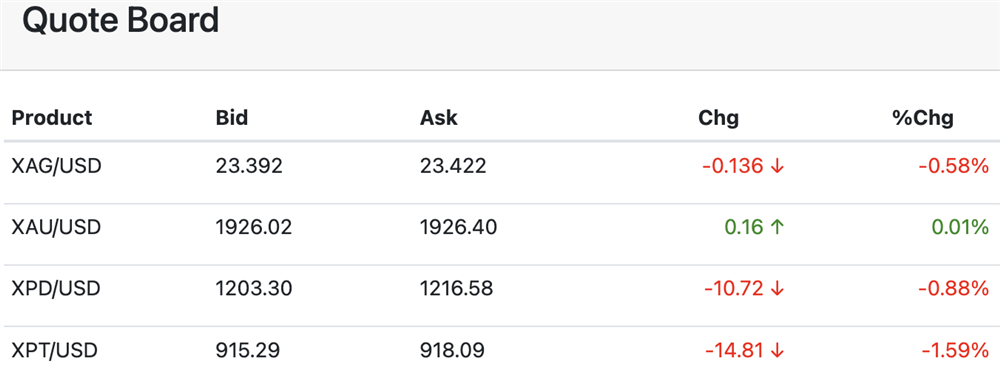

While bearish outside market forces are not presenting significant pressure on gold and silver prices, early on those forces remain and are likely to expand their impact directly ahead.

Unfortunately for the bull camp in gold and silver treasury prices are just above new lows for the move and the dollar index in the early trade matched the multi-month high posted yesterday in the overnight trade.

Internal market forces like demand are mixed with gold and silver ETF holdings falling significantly (especially in silver) and Chinese gold reserves at the end of August increasing from 68.6 million ounces to 69.6 million ounces...[MORE]

Please subscribe to receive the full report via email by clicking here.

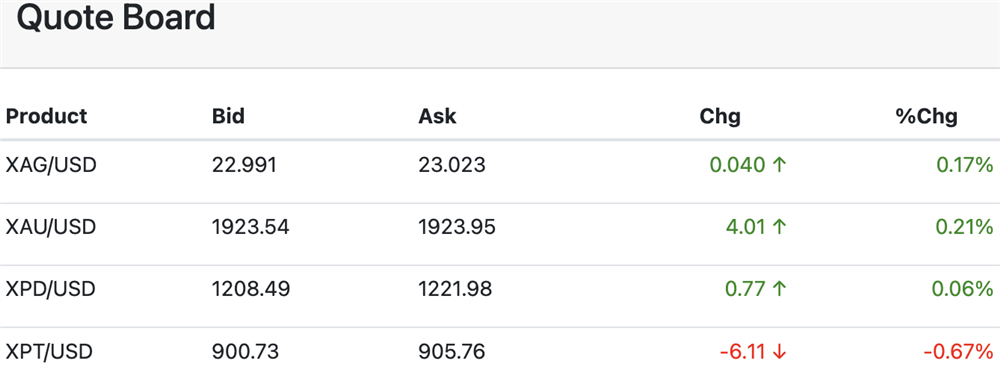

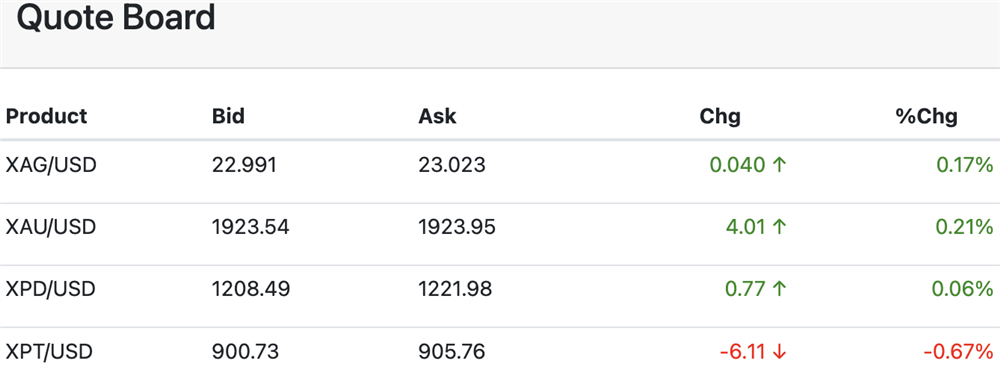

Sep 7 (Reuters) -Gold prices inched higher on Thursday, as a slight pullback in Treasury yields offered some respite from a robust dollar, while investors looked forward to more U.S. economic data to gauge the outlook for interest rates.

Spot gold was up 0.1% at $1,918.64 per ounce by 0906 GMT, after hitting a one-week low on Wednesday. U.S. gold futures were little changed at $1,943...[LINK]

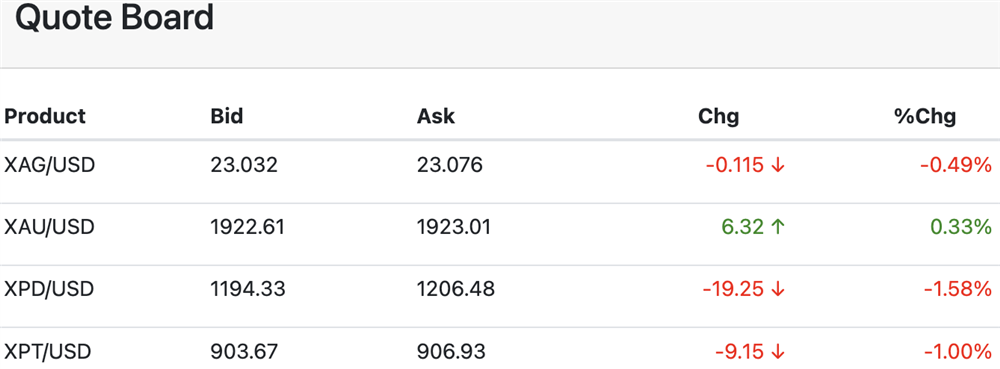

Sep 6 (Reuters) - Gold languished near one-week lows on Wednesday on strength in the dollar and Treasury yields, driven by expectations for U.S. interest rates to stay elevated for longer and worries about China’s economy.

Spot gold was flat at $1,926.30 per ounce by 1209 GMT, after hitting its lowest since Aug. 29 earlier in the session. U.S. gold futures were little changed at $1,952.40...[LINK]

Sept 5 (Reuters) - Gold slipped to a one-week low on Tuesday as investors sought the U.S. dollar after weak data in China, although rising expectations for a pause in interest rate increases by the U.S. Federal Reserve limited losses.

Spot gold declined 0.4% to $1,930.33 per ounce by 1126 GMT, eyeing its biggest daily drop since mid-August. U.S. gold futures fell 0.6% to $1,955.80...[LINK]